Seems there’s no wisdom on the topic of ‘money’ anywhere of consequence: No ‘plan B’ for ECB despite still low inflation: Praet Jan 6 (Reuters) — Executive Board member Peter Praet said various factors, notably low oil prices and less buoyant emerging economies, meant it was taking longer to reach the goal of inflation of close to but below 2 percent. “We need to be attentive that this shifting horizon does not damage the credibility of the ECB,” he added. “There is no plan B, there is just one plan. The ECB is ready to take all measures necessary to bring inflation up to 2 percent. If you print enough money, you get inflation. Always. If, as is happening now, the prices of oil and commodities are tumbling, then it’s more difficult to drive up inflation,” he said. From Morgan Stanley: Up to 1% for Q4 on the trade number, which is subject to revision. And DB is forecasting +.5%.The still don’t seem to understand it’s only about pricing, not quantity: Brent Crude Oil Drops Below World’s benchmark oil fell by more than 4.8% to below a barrel around 9:30 AM NY time, extending a third consecutive day of losses. It is the lowest price since 2004 as oversupply worries increased as tensions between Saudi Arabia and Iran diminish chances of major producers cooperating to cut production.

Topics:

WARREN MOSLER considers the following as important: ECB, GDP, Oil

This could be interesting, too:

Angry Bear writes GDP Grows 2.3 Percent

Merijn T. Knibbe writes Monetary developments in the Euro Area, september 2024. Quiet.

NewDealdemocrat writes Real GDP for Q3 nicely positive, but long leading components mediocre to negative for the second quarter in a row

Mike Norman writes Atlanta Fed reduces Q2 GDP forecast once again, as I said they would

Seems there’s no wisdom on the topic of ‘money’ anywhere of consequence:

No ‘plan B’ for ECB despite still low inflation: Praet

Jan 6 (Reuters) — Executive Board member Peter Praet said various factors, notably low oil prices and less buoyant emerging economies, meant it was taking longer to reach the goal of inflation of close to but below 2 percent. “We need to be attentive that this shifting horizon does not damage the credibility of the ECB,” he added. “There is no plan B, there is just one plan. The ECB is ready to take all measures necessary to bring inflation up to 2 percent. If you print enough money, you get inflation. Always. If, as is happening now, the prices of oil and commodities are tumbling, then it’s more difficult to drive up inflation,” he said.

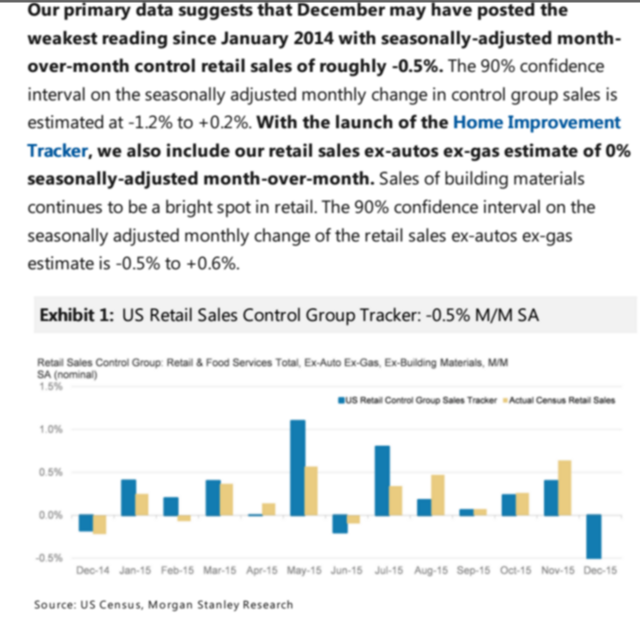

From Morgan Stanley:

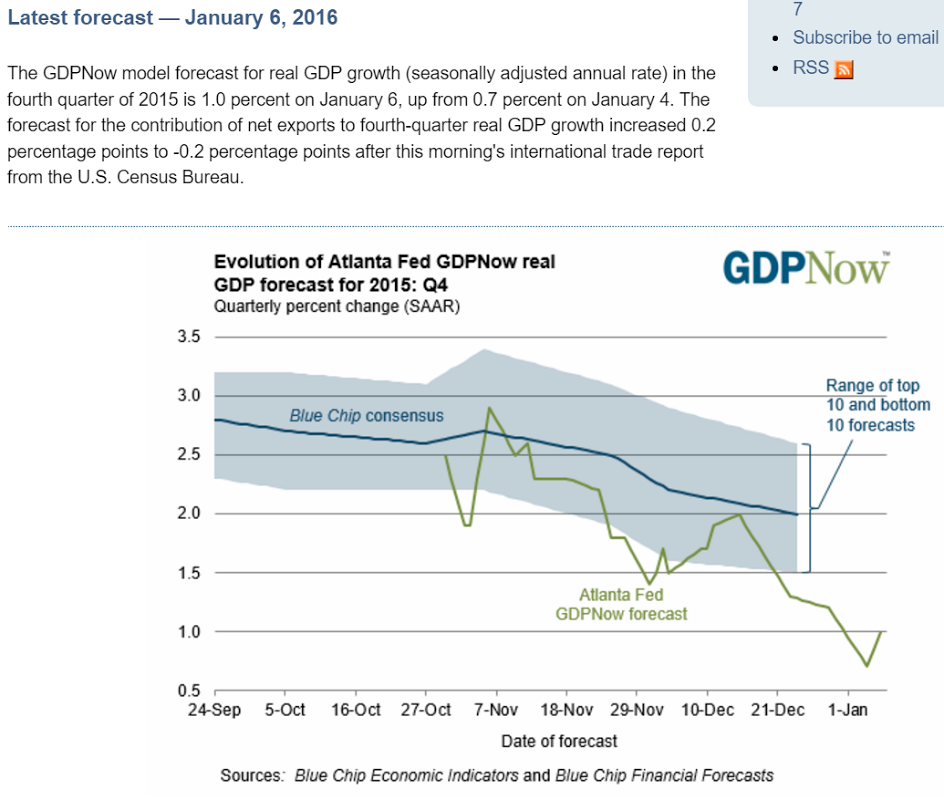

Up to 1% for Q4 on the trade number, which is subject to revision.

And DB is forecasting +.5%.

The still don’t seem to understand it’s only about pricing, not quantity:

Brent Crude Oil Drops Below $35

World’s benchmark oil fell by more than 4.8% to below $35 a barrel around 9:30 AM NY time, extending a third consecutive day of losses. It is the lowest price since 2004 as oversupply worries increased as tensions between Saudi Arabia and Iran diminish chances of major producers cooperating to cut production.

Not to forget their models use the oil futures prices, which express storage charges, as indications of future spot prices, and that this ‘rookie error’ tends to inflate their inflation forecasts:

A number of members commented that it was appropriate to begin policy normalization in response to the substantial progress in the labor market toward achieving the Committee’s objective of maximum employment and their reasonable confidence that inflation would move to 2 percent over the medium term.

However, some members said that their decision to raise the target range was a close call, particularly given the uncertainty about inflation dynamics, and emphasized the need to monitor the progress of inflation closely.