Share the post "Obama’s Great Economic Blunder"President Obama inherited an economic disaster. And since then the US economy has made a huge rebound. Yeah, it has been a bit underwhelming as growth has been somewhat sluggish, but we’ve been growing and we’ve recovered all of the jobs we lost during the crisis. The stock market has more than tripled and Americans are better off than they’ve ever been. A lot of great things have happened in the last 8 years, but it still feels like we’re not doing well enough. And that’s because we’re not.Longtime readers will remember that I was very vocal about the “balance sheet recession” back in the early post-crisis years. Basically, consumers had gone through a balance sheet implosion where the housing bubble (really a consumer debt bubble) turned their balance sheets upside down. With weak balance sheets consumers were de-leveraging which led to deflation and low inflation for years. To this day, households are borrowing at a rate that is consistent with past recessionary periods.The only reason this weak household borrowing has been offset is thanks to a huge debt binge by corporations and the US government.¹ But the US government could have and should have done more.Back in 2009 the primary argument against more fiscal policy was that it would cause high inflation, crash the dollar or bankrupt the USA.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Share the post "Obama’s Great Economic Blunder"

President Obama inherited an economic disaster. And since then the US economy has made a huge rebound. Yeah, it has been a bit underwhelming as growth has been somewhat sluggish, but we’ve been growing and we’ve recovered all of the jobs we lost during the crisis. The stock market has more than tripled and Americans are better off than they’ve ever been. A lot of great things have happened in the last 8 years, but it still feels like we’re not doing well enough. And that’s because we’re not.

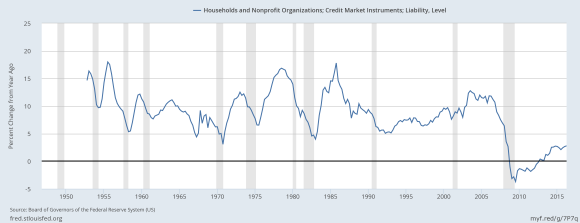

Longtime readers will remember that I was very vocal about the “balance sheet recession” back in the early post-crisis years. Basically, consumers had gone through a balance sheet implosion where the housing bubble (really a consumer debt bubble) turned their balance sheets upside down. With weak balance sheets consumers were de-leveraging which led to deflation and low inflation for years. To this day, households are borrowing at a rate that is consistent with past recessionary periods.

The only reason this weak household borrowing has been offset is thanks to a huge debt binge by corporations and the US government.¹ But the US government could have and should have done more.

Back in 2009 the primary argument against more fiscal policy was that it would cause high inflation, crash the dollar or bankrupt the USA. I looked at all of these arguments from an operational perspective and concluded that they were all wrong. I debunked all of them over the years. But there was a bigger blunder in here. While the government did a lot to bolster the private sector I would argue that we actually didn’t do enough. Over the years I’ve shown how much larger the budget deficit could have been. But we never got that extra stimulus and one of the main reasons we never got the stimulus we needed was because of the Affordable Care Act. President Obama could have passed a much larger stimulus plan in the early days of the crisis (or a subsequent one in 2010), but instead chose to pursue the ACA. I said, in real-time, that this was no time to be thinking about universal healthcare. We needed jobs! And the government could help bolster the economy by running the deficit that would offset and help households deleverage their balance sheets.

It’s unfortunate really. I think President Obama has been a very good President. The USA has come a long way from the depths of 2009. But it’s the ACA that President Obama will be remembered for. And if we’d diagnosed the balance sheet recession accurately and gotten better economic advice back in the early days of the crisis I suspect we would have focused a lot less on monetary policy and much more on fiscal policy. But we’re worse off than we should be because we misdiagnosed the disease and made a huge bet on monetary policy and passed a flawed healthcare plan. Both of these focuses have directly contributed to the weak state of the economy and much of the angst that we’re now experiencing.

¹ – An interesting sidenote here is that corporations have binged on debt in large part because the government did a good deal to directly stimulate US corporations during the crisis. So, in a sense, you could argue that the government laid the foundation for the next debt crisis in corporate debt as well intentioned policies trickled to the wrong parts of the economy.

Share the post "Obama’s Great Economic Blunder"