Share the post "Three Things I Think I Think – Disaster Edition"Here are some things I think I am thinking about:1. Floyd Mayweather – Maybe not such a financial disaster? Floyd Mayweather didn’t follow my financial advice. He was, predictably, MUCH better than Conor McGregor at boxing. Actually, I’d say Conor surpassed expectations. But Floyd is Floyd. He’s the best ever. And he proved it again on Saturday night when he beat a much younger and bigger man.What was most interesting to me about the fight was that Floyd really showed no signs of quit. He did what he always does – he tired his opponent out and guaranteed he’d win on points while doing enough to stop the fight in the meantime. But this means one of two things financially – either Floyd is in much better shape than I think.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Share the post "Three Things I Think I Think – Disaster Edition"

Here are some things I think I am thinking about:

1. Floyd Mayweather – Maybe not such a financial disaster? Floyd Mayweather didn’t follow my financial advice. He was, predictably, MUCH better than Conor McGregor at boxing. Actually, I’d say Conor surpassed expectations. But Floyd is Floyd. He’s the best ever. And he proved it again on Saturday night when he beat a much younger and bigger man.

What was most interesting to me about the fight was that Floyd really showed no signs of quit. He did what he always does – he tired his opponent out and guaranteed he’d win on points while doing enough to stop the fight in the meantime. But this means one of two things financially – either Floyd is in much better shape than I think. Or he is worse off than he thinks. I guess we’ll find out over the course of time. But if anyone is interested in a betting pool here it is:

Who Will go Bankrupt First?

A. Floyd Mayweather

B. The $750MM Powerball winner.

2. Free Markets and Disaster Relief. Here’s an article criticizing the free market’s response to Harvey. There have been some reports of price gouging and companies taking advantage of the situation. This is obviously bad. People should show nothing but compassion in the face of such a terrible tragedy. But I suspect that this article is cherry picking some micro cases of malfeasance inside of what is clearly a much bigger aid effort. The response to Harvey from around the rest of the country has been overwhelmingly positive and I suspect that the net effect for Harvey is that the cost of goods and services to those who need them, have gone down substantially thanks to what is an overwhelming amount of charitable giving.

Here’s the thing a lot of people overlook in the course of criticizing capitalism. The simple fact of the matter is that the USA gives more money to charity than any country in the world (see here and here). The USA is consistently listed in the top 2 of the World Giving Index (behind Myanmar, which, to be honest, is a small enough economy that this could be a statistical error). The reason for this incredible generosity is that the USA is unusually wealthy. And the USA is unusually wealthy because of its capitalist system. As I’ve said before, capitalism allows us to be more socialist. I don’t mean that in a pejorative sense. I mean that capitalism allows us to be more socially conscious. Of course, capitalism has its weaknesses and capitalism is really only as good as the capitalists in that system, but we should not lose sight of the forest while we assess the damage of the trees within that forest (or, now lake).

By the way, here’s a list of ways to help Houston. If you’re reading this piece I suspect you’re one of the good capitalists who uses his/her great wealth to, at times, be a good socialist. ?

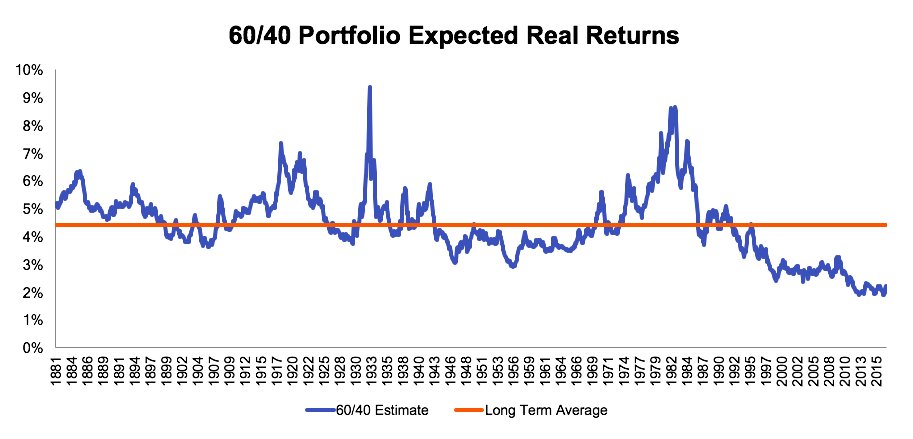

3. 60/40 Disastrous Future Performance? Here’s a thoughtful piece by Corey Hoffstein about the future of asset returns and the 60/40 portfolio. Here’s the money shot:

Now, I suspect Corey’s estimates are a little low. He’s using CAPE Shiller to guesstimate prices and I don’t find that terribly reliable. But his point is still valid – buying the 60/40 index today is nothing like buying the 60/40 index of 30 years ago. For instance, bonds generated an average 30 year return of 7.35% and stocks averaged 12.5%. Your 60/40 did about 10.5%. Now, let’s be super generous to the stock estimate and just guess that stocks repeat this performance (they very likely won’t). If the bonds just generate the current yield of 2.25% then your 60/40 does just 8.4% (maybe 6.4% real). And it does so with far worse risk adjusted returns because it’s not getting the principal protection it got from the bond component. In other words, you’re more overweight stock risk today than you were when you put together a 60/40 30 years ago.

The math there is pretty cut and dry. It’s not as dire as some people like to proclaim, but it’s not a real fun time to be an asset allocator.

Share the post "Three Things I Think I Think – Disaster Edition"