Share the post "Let’s Talk About Shrinkage (Again)"I’ve got shrinkage on the mind again. Maybe I’ve spent too much time in cold water this summer or maybe it’s just me getting old? I don’t know, but I do know that it’s becoming an increasingly important discussion as the Fed discusses its future policy options. I’ve talked about how the Fed will unwind its balance sheet in the past and how this isn’t a big deal. I was one of a handful of people at the time of QE’s initiation explaining that this policy was not nearly as important as many expected and that it would not cause hyperinflation, high growth and in fact might cause rates to decline. This was not just a contrarian view, but it was a very accurate contrarian view. So I think I’ve earned some credibility assessing these things over

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Share the post "Let’s Talk About Shrinkage (Again)"

I’ve got shrinkage on the mind again. Maybe I’ve spent too much time in cold water this summer or maybe it’s just me getting old? I don’t know, but I do know that it’s becoming an increasingly important discussion as the Fed discusses its future policy options. I’ve talked about how the Fed will unwind its balance sheet in the past and how this isn’t a big deal. I was one of a handful of people at the time of QE’s initiation explaining that this policy was not nearly as important as many expected and that it would not cause hyperinflation, high growth and in fact might cause rates to decline. This was not just a contrarian view, but it was a very accurate contrarian view. So I think I’ve earned some credibility assessing these things over the years, but shrinkage can make a man feel insecure even when he’s confronted with things that he understands well. So let’s explore this a bit more.

The shrinkage of the Fed’s balance sheet works in the exact reverse manner that the expansion works. Reserve additions expand the balance sheet by buying assets and reserve deletions expand the balance sheet when assets are sold or mature. It’s worth noting that the contraction will very likely occur naturally via the maturation of existing bonds. This means that the bonds will mature and simply poof, disappear, from their balance sheet (see here for a more thorough explanation).

Okay, but how will all of this actually play out? Let’s put this in perspective because there will no doubt be a mountain of articles written about this in the coming years if it transpires. And much like I downplayed the impact of the Fed’s expansion of the balance sheet I am afraid I have to throw cold water on the shrinkage as well.¹

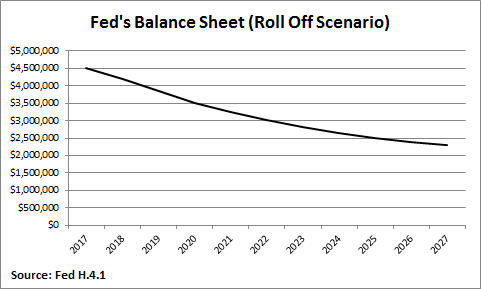

If we look at the existing securities and their maturities we can construct a general idea of the roll-off shrinkage that will occur over the next 10 years. Here’s the general perspective:

53% of the Fed’s existing balance sheet is 10+ years in maturity. So even if they let the existing portion mature the Fed will still be sitting on about $2.5T in assets in 2027. This is a substantial portfolio. But here’s the thing – we’re very likely to encounter a recession in the next 10 years. This is already one of the longest recoveries on record. And the Fed’s interest rate tool appears to have lost its impact to some degree. So this means that the balance sheet will play an increasingly important role in future recession fighting.

The long story short is this – shrinkage isn’t a big deal. If we don’t get a recession then the Fed will let this occur over a very long period. So, not only will this occur over a very long time horizon, but there’s a likelihood that the balance sheet gets bigger if we run into economic turbulence in the coming 10 years.² If I had to put money on the Fed’s balance sheet size in a decade my guess is that we will still be talking about trillions in assets on their balance sheet….Perhaps even more trillions than they already own.

¹ – Throwing cold water on a case of shrinkage will very likely exacerbate the existing case of shrinkage.

² – I assumed that shrinkage would be “natural” and not forced via market sales of assets. Forced shrinkage is not recommended in my opinion as it can create disruptions that could cause laughter and unfair judgement.

Share the post "Let’s Talk About Shrinkage (Again)"