Share the post "(Another View on) The Slowdown in Lending: A Rorschach Test"A lot of ink has been spilled about the “decline” and even “collapse” in bank lending in recent months. Let’s take a closer look and see if we can’t find some pragmatic conclusions here.¹The Big Picture: Aggregate lending data tends to be noisy and it’s not at all uncommon to see sharp slowdowns in lending during expansions. That said, Total Lending is growing at 3.8% per year vs a ten year average of 4.4% so the current slowdown should not be exaggerated and in my opinion remains perfectly consistent with the slow rate of loan expansion during the recovery from the credit bust.Whether this is the beginning of a trend of a normal late cycle slowdown remains to be seen, but let’s explore some of the possible explanations here:The Trump Uncertainty Effect: As the Wall Street Journal recently noted, the election created significant tax uncertainty so a lot of lending decisions are on the backburner until further clarity is seen moving forward.The Giveback Effect: A lot of what we’re seeing is a slowdown in year over year rates thanks in large part to strong years of lending in the past. In other words, the decline isn’t so much a “decline” as it’s just a higher hurdle for current trends to jump. But make no mistake, we are still jumping that higher hurdle even if it’s by a smaller margin than before.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Share the post "(Another View on) The Slowdown in Lending: A Rorschach Test"

A lot of ink has been spilled about the “decline” and even “collapse” in bank lending in recent months. Let’s take a closer look and see if we can’t find some pragmatic conclusions here.¹

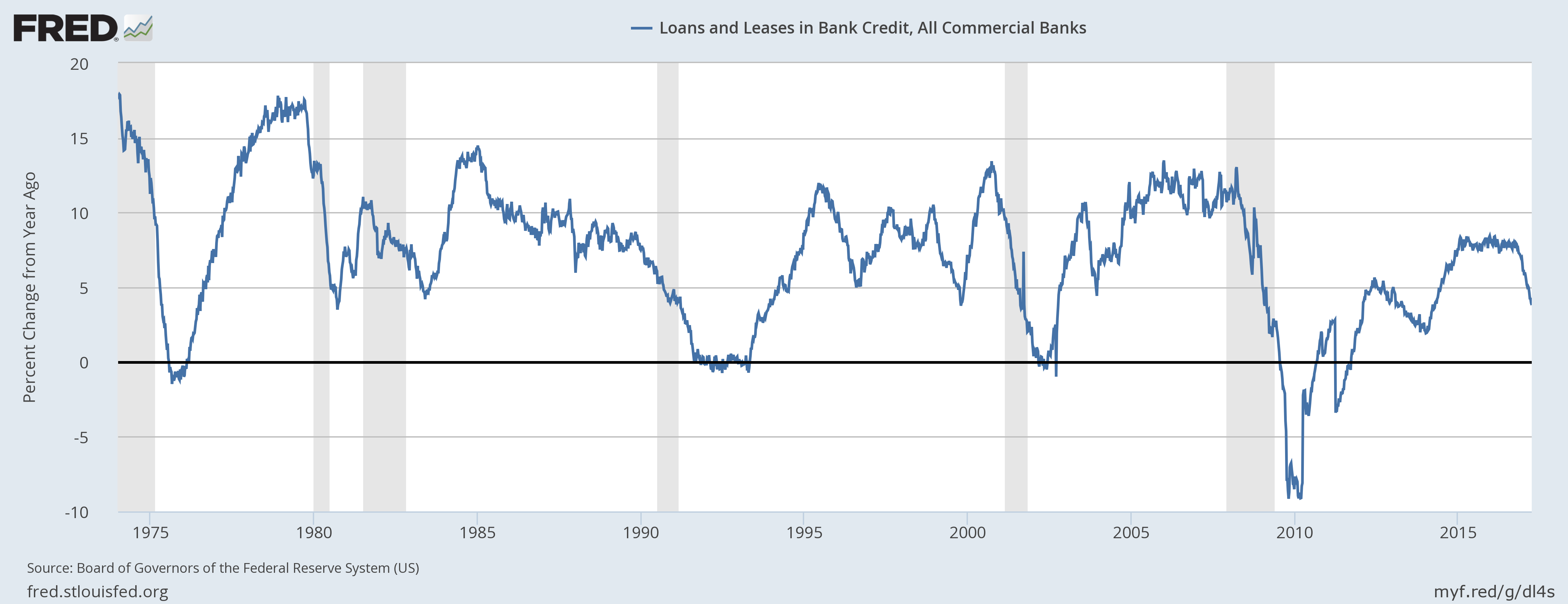

- The Big Picture: Aggregate lending data tends to be noisy and it’s not at all uncommon to see sharp slowdowns in lending during expansions. That said, Total Lending is growing at 3.8% per year vs a ten year average of 4.4% so the current slowdown should not be exaggerated and in my opinion remains perfectly consistent with the slow rate of loan expansion during the recovery from the credit bust.

Whether this is the beginning of a trend of a normal late cycle slowdown remains to be seen, but let’s explore some of the possible explanations here:

- The Trump Uncertainty Effect: As the Wall Street Journal recently noted, the election created significant tax uncertainty so a lot of lending decisions are on the backburner until further clarity is seen moving forward.

- The Giveback Effect: A lot of what we’re seeing is a slowdown in year over year rates thanks in large part to strong years of lending in the past. In other words, the decline isn’t so much a “decline” as it’s just a higher hurdle for current trends to jump. But make no mistake, we are still jumping that higher hurdle even if it’s by a smaller margin than before.

- As Goldman Sachs has noted, there’s significant downward pressure from the oil and materials sectors. This data, as Tim Duy has shown, is a lagging indicator and is more indicative of past sectoral weakness rather than future trends.

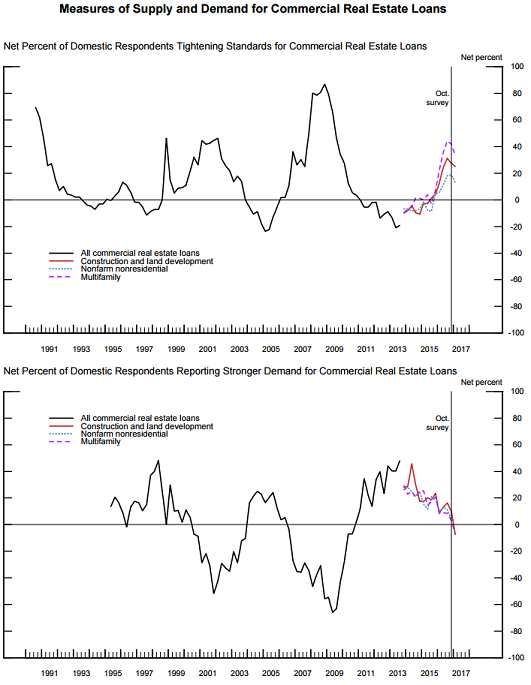

- At the same time, there is clear evidence of a slowdown in demand and tightening lending standards in some segments such as Commercial Real Estate Loans. As the Q4 Senior Loan Survey highlights the demand is down across the board and the tightening is up across the board:

In my opinion there are too many positive signs in the macro data to get too worked up over the slowdown in the rate of bank lending. But the corporate space is worth keeping an eye on here. In my opinion, the next recession is very likely to resemble the 2000 recession in that it will derive from excesses in the corporate space. The nonfinancial credit space is one of the few areas of the economy where we’ve seen legitimately strong and sustained growth since 2010. A reversal here could be a sign that a corporate led recession is on the horizon.

At this stage all of this amounts to little more than a Rorschach Test – the conclusion is in the eye of the beholder and is certainly unclear. There is enough positive data out there to corroborate the theory that this is a normal late cycle slowdown and not a precursor for a recession. But the trend is obviously not good. So, it’s worth keeping an eye on these trends in the coming quarters as further deterioration could be a legitimate signal that some of the excesses of the last few years are unwinding. I am inclined to argue that the worry is overdone at this stage, but given the many late cycle trends we’re seeing here I think all of this remains consistent with a stance that warrants some mild caution, but not overreaction.

¹ You’ll notice what I did here by using the word “pragmatic” on the Pragmatic Capitalism website. Genius, eh?

Share the post "(Another View on) The Slowdown in Lending: A Rorschach Test"