The ultimate dream of the crypto currency enthusiasts is for money to become decentralized and essentially removed from the hands of banks and Central Banks who can “manipulate” it for their own benefit. This is a nice thought, but most of it is based on misunderstandings about what “money” is. Let me explain. I was browsing Twitter this weekend when I ran across this post that was being retweeted by a bunch of the top crypto enthusiasts: When banks stored all our money, the bankers became the most powerful people in the world. When the protocols store all our money, the programmers will become the most powerful people in the world. Fun times ahead if you’re a nerd. — Richard Burton (@ricburton) April 8, 2018 And then there was this presentation going around showing that the

Topics:

Cullen Roche considers the following as important: Myth Busting

This could be interesting, too:

Cullen Roche writes How Does the Fed “Manipulate” Interest Rates?

Cullen Roche writes Everything Wrong with the “Money Printer Go Brrrr” Meme

Cullen Roche writes The Scarcity of Money Myth

Cullen Roche writes Is Inflation Really 10%?

The ultimate dream of the crypto currency enthusiasts is for money to become decentralized and essentially removed from the hands of banks and Central Banks who can “manipulate” it for their own benefit. This is a nice thought, but most of it is based on misunderstandings about what “money” is. Let me explain.

I was browsing Twitter this weekend when I ran across this post that was being retweeted by a bunch of the top crypto enthusiasts:

When banks stored all our money, the bankers became the most powerful people in the world.

When the protocols store all our money, the programmers will become the most powerful people in the world.

Fun times ahead if you’re a nerd.

— Richard Burton (@ricburton) April 8, 2018

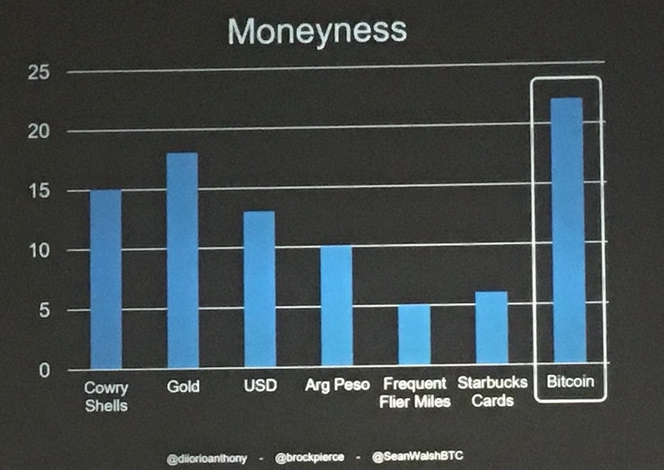

And then there was this presentation going around showing that the “moneyness” of cryptocurrencies is off the charts when compared to other forms of money:

I’d argue that technologists are already the most powerful people in the world (see any recent news about Facebook, Google, Amazon, etc), but that’s a different point. The idea that money can become entirely decentralized is fundamentally at odds with the way our economy works because consumers require purchasing power optionality.

Most of the money in today’s world is comprised of bank deposits. Bank deposits are just bank liabilities (customer assets) that exist because a bank made a loan. Importantly, the Central Bank doesn’t control the issuance of these deposits. The money multiplier is a myth and the quantity of reserves in the banking system has little to no bearing on the quantity of loans that can be made by private banks. This is important to understand because our money supply is largely market based and driven by the creditworthiness of those who seek the optionality of purchasing power by taking out credit. Libertarians and free market advocates should love this arrangement as the money supply is based almost entirely on people with credit being able to get approved for loans by private profit seeking entities.¹

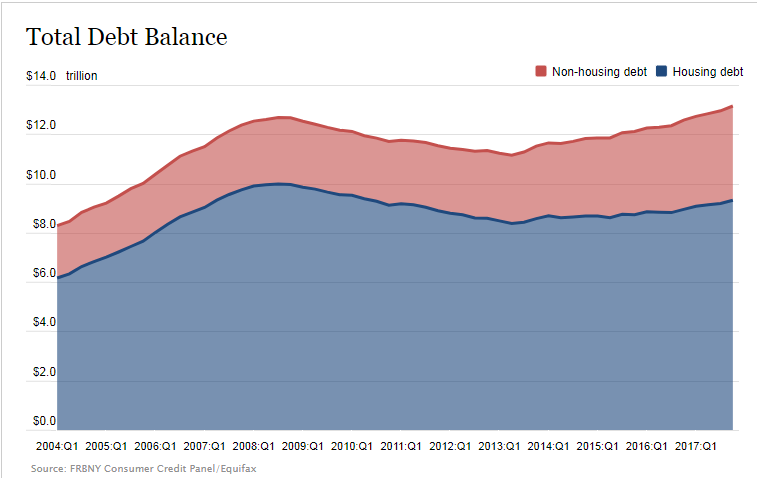

Most of those deposits exist because people wanted to buy a home and a bank issued deposits to fund the loan. The remaining 25% or so exist because people buy cars and have revolving credit lines on their credit cards:

Importantly, loans (and hence deposits) are an elastic form of money. They can be destroyed on demand (when loans are repaid) and they can be created on demand when loans are made. This creates flexibility across our economy and allows people to buy things they otherwise couldn’t with a fixed money supply.

It’s important to understand that accounting is at the center of all of this. Our monetary economy is made up of centralized entities that are counter-parties in every transaction. In fact, the entire economy is basically one big electronic spreadsheet that shows the current balance sheets of everyone involved. So, your deposits are your asset and a bank’s liability. Your loan is your liability and the bank’s asset. Your stocks are your asset and a contra-asset for the corporation. Your Treasury Bonds are your asset and the US Government’s liability. There’s two sides to every transaction and the assets and liabilities that we exchange are issued by centralized entities that are trying to finance certain needs.

The main problem with Bitcoin is that it’s inelastic.² Its supply is set to be fixed. This means it cannot be the dominant form of money because it cannot be issued as credit to debtors who need money they don’t presently have. This doesn’t mean that Bitcoin can’t serve as a form of money in much the same way that gold does, but Bitcoin’s biggest weakness is that its supply is fixed. This renders it a relatively inferior form of money because it cannot be used as credit. And as I’ve explained above and before, CREDIT IS MONEY. Nothing has more moneyness than credit because credit is optionality of purchasing power.³

Now, in theory, there could be crypto currencies that have credit-like qualities. You could create some sort of blockchain based lender that makes the entire banking process more seamless in various ways. But make no mistake – this is a centralized counter-party using blockchain technology. It can be no other way because credit is constrained by the laws of accounting which require a counterparty. A decentralized lender is antithetical to double-entry bookkeeping and the essential qualities of credit.

Based on my reading of the cryptocurrency enthusiasts I think it’s safe to say that there’s a lot more ideology than fact going into the future expectations here. This doesn’t mean that cryptocurrencies can’t play a meaningful role in our future economy, but the one thing technologists can’t change is the fact that accounting adheres to strict rules that cannot be “disrupted” out of existence.

¹ – The anti bank arguments are especially painful to read coming from Silicon Valley’s venture capitalists. These venture capitalists are literally structured as non-bank financial firms. They are basically banks who charge hedge fund style fees for giving firms access to credit. They take the very most valuable asset an entrepreneur has (their equity in the firm) and charge their investors fees all along the way. The term “vulture capitalist” is not a mistake – these firms are modern day banks providing a necessary good, but also doing so by charging their investors huge sums. You don’t get to act like a really, really expensive bank and then turn around and attack banks.

² – William on Twitter asks a very good question: “Why can’t banks make bitcoin-denominated loans?”

The answer is that they could, but why would they want to? Bitcoin is so volatile that it exposes the lender to huge amounts if principal risk. This is why I’ve said that a stable coin of some sort is essential to the entire crypto network. But this brings us to another interesting topic – who or what entity in the economy has the income and low credit risk to be able to support a coin that trades permanently at par? The answer is the entity that sets the rules of the game and has huge income sources which is, you guessed it, the government. In either case, all of this involves centralization and credit risk so whether it’s a stable coin or someone creating Bitcoin denominated loans you’ve still created a centralized counter-party so the basic point being made above is still essential to this whole topic.

³ – We should be clear that moneyness refers to how well a form of money serves as a medium of exchange. Gold, for instance, has a relatively low level of moneyness because it is not widely accepted as a medium of exchange. Bitcoin is similar in that you can’t walk into most retail stores and make purchases with it. The above chart is misleading and I am not sure how they’re claiming that Bitcoin has a higher degree of moneyness than something like USD denominated deposits.