The main goal of this website over the years has been to search for an operationally sound and empirically supported perspective of how the monetary system works. I’ve debunked tons of myths in the process of this search, but the inflation truthers have been hard to convince for some reason. Strangely, there are still people out there who believe that the BLS lies about inflation stats and that all the data is manipulated. But I have some hard truths for the inflation truthers. Hard truth #1 – Millions of traders are not wrong. When someone says that low inflation data is wrong they are essentially saying that millions of free markets are also wrong. For instance, commodity traders have priced in near record low commodity prices. Are all of these commodity markets wrong? Or what about

Topics:

Cullen Roche considers the following as important: Myth Busting

This could be interesting, too:

Cullen Roche writes How Does the Fed “Manipulate” Interest Rates?

Cullen Roche writes Everything Wrong with the “Money Printer Go Brrrr” Meme

Cullen Roche writes The Scarcity of Money Myth

Cullen Roche writes Is Inflation Really 10%?

The main goal of this website over the years has been to search for an operationally sound and empirically supported perspective of how the monetary system works. I’ve debunked tons of myths in the process of this search, but the inflation truthers have been hard to convince for some reason. Strangely, there are still people out there who believe that the BLS lies about inflation stats and that all the data is manipulated. But I have some hard truths for the inflation truthers.

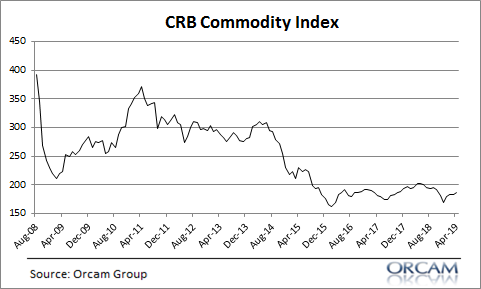

Hard truth #1 – Millions of traders are not wrong. When someone says that low inflation data is wrong they are essentially saying that millions of free markets are also wrong. For instance, commodity traders have priced in near record low commodity prices. Are all of these commodity markets wrong?

Or what about the bond markets? Bond yields have collapsed in the last decade which is consistent with very low inflation. Are millions of bond traders and corporations just pricing their assets wrong for 10 years running? I find that very hard to believe. In fact, while I am no believer in efficient markets, I find it impossible to believe that they could be this wrong for this long.

Hard Truth #2 – GDP isn’t Negative. Nominal GDP has been very low for the last 10 years at an average annual rate of just 3.2%. If inflation has been high (for instance, the average Shadow Stats rate of 4.5%) then that means that Real GDP has been negative EVERY YEAR since the financial crisis. Said differently, that would mean that our economy has shrunk by 14% since 2008.¹

This is literally impossible. It doesn’t match up with any of the empirical evidence we have from other sources such as ISM, PMI, retail sales, corporate profits, foreign governments, trade data, factory orders, durable goods orders, NFIB data, etc. The economy might not be booming, but it’s patently wrong and unsubstantiated to argue that it has been shrinking.

I don’t think it’s controversial to say that the BLS data is imperfect. But that doesn’t mean it’s all a big conspiracy theory. Luckily, some common sense and some hard truths make that perfectly clear.

¹ – Funny story – At $175 ShadowStats shows that there is STILL deflation in hyperinflation newsletter costs.