Here are some things I think I am thinking about: 1) Stocks are more like bonds than we want to admit. Eddy Elfenbein had a great post titled “What if the stock market were a bond?” I’ve talked about this concept in the past. This is by no means a new concept. Warren Buffett has described stocks as perpetual bonds. And William Bernstein has described stocks as having duration-like properties that make them similar to super long duration bonds. Now, you have to be careful with this topic because some people freak out when you compare stocks and bonds. And they’re not wrong. Stocks are very different from bonds in specific ways. But they’re also more similar than some people want to admit in that they’re corporate liabilities that pay out some portion of available cash flow over time. And

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here are some things I think I am thinking about:

1) Stocks are more like bonds than we want to admit. Eddy Elfenbein had a great post titled “What if the stock market were a bond?” I’ve talked about this concept in the past. This is by no means a new concept. Warren Buffett has described stocks as perpetual bonds. And William Bernstein has described stocks as having duration-like properties that make them similar to super long duration bonds. Now, you have to be careful with this topic because some people freak out when you compare stocks and bonds. And they’re not wrong. Stocks are very different from bonds in specific ways. But they’re also more similar than some people want to admit in that they’re corporate liabilities that pay out some portion of available cash flow over time. And while equities don’t have defined time horizons or defined coupons they are instruments that give shareholders a claim on cash flow over the long-term.

As Buffett notes, it turns out that those cash flows are a lot more stable over long periods of time than many people assume. But this is the kicker – LONG PERIODS. And that’s what I find useful about this concept. As Bernstein alludes to – stocks are properly thought of as long-term instruments. We don’t know what they’ll yield or even when. And it’s reasonable to expect that they’ll yield lower average returns when they’re purchased at very high prices. But in terms of compartmentalizing stocks for the purpose of something like asset-liability matching, they are best thought of as super long duration instruments.

The reason this is a useful heuristic is because it gets us away from the urge to think of stocks as get rich quick vehicles. No. Stocks are super long duration instruments and they can only pay out their cash flows over long periods of time. So it makes no sense to trade these instruments and treat them like short-term instruments when they’re best thought of as long-term instruments.

Anyhow, when I say this some people assume I am making a value judgment about stocks as bonds (as if they’ll pay out some sort of fixed, predictable short-term coupon). NO. I am specifically saying the opposite. We should think of stocks as long-term instruments specifically because their short-term coupons are totally unpredictable, volatile and likely to be negative at times.

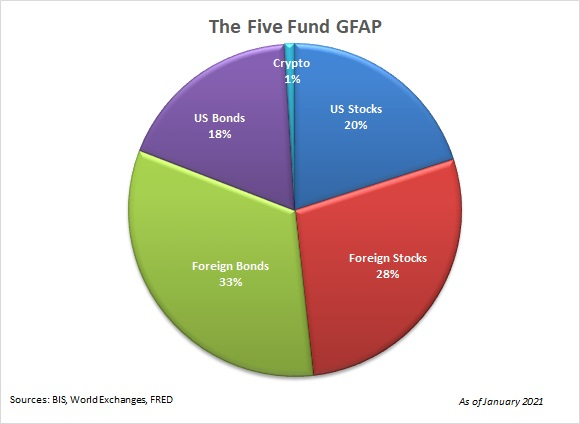

2) Is Bitcoin “Worthless”? Jamie Dimon was on Bloomberg yesterday saying that Bitcoin is worthless. I’ve tried to stay relatively balanced about Bitcoin over the years. I definitely don’t think it’s worthless. But I also think the Bitcoin Maximalist argument is too far in the other direction. In truth, nobody knows. But one thing I would certainly argue is that it’s irrational to say it’s “worthless” at this point. Bitcoin has been around for over a decade and has amassed a total value of over $1T. The total crypto market is over $2T. Now, you might argue that this market is bigger than it should be. Or you might argue that this market is far more popular than it should be. In fact, crypto is just 1% of global financial assets so it’s reasonable to say that crypto gets far more attention than its market size reflects.

At the same time, I guess this doesn’t mean that Bitcoin can’t go to $0 at some point. But by now I think we all have to admit that a market that’s this big needs to be given some due. Maybe not as much attention as it gets, but dismissing it outright seems equally irrational.

3) ETFs won. Nir Kaissar has a good piece on Bloomberg about the battle between ETFs and mutual funds. As I’ve previously discussed, ETFs are just better and fairer vehicles for many reasons. And money is increasingly flooding into ETFs, in large part from mutual funds and mutual fund conversions. Like Nir, I am surprised this took so long. He writes:

“Looking back, it’s a wonder it took investors so long to discover ETFs. While they’re almost identical to mutual funds, ETFs differ in two ways that give them a demonstrable edge. One is cost. The median expense ratio for U.S.-based ETFs is 0.5% a year, compared with 0.93% across all share classes of mutual funds. The savings can add up to tens of thousands of dollars or more over an investing lifetime.

ETFs are also more tax efficient. When investors pull money from a mutual fund, the fund must sell some of its holdings to generate the necessary cash. If those holdings have appreciated in value, the fund’s remaining shareholders are stuck with the tax bill. “

Yes indeed. And as Nir says, there’s still $17T in mutual funds that is waiting to find a new home in ETFs so this trend might be a long way in the making.