Whooboy. What a CPI print. Here are some highlights in case you have a life and don’t drool over BLS reports: The all items index experienced its largest increase (4.2%) since Sept 2008. The used car index was up 10% in April, its largest increase since 1953. The core index (ex food and energy) was up 0.9% in April, its largest increase since April 1982. Fun. There will be a tendency in many circles to assume that this is the return of the 1970s or something like that. I think we need to relax and try not to overreact. Here’s why: 1) These figures are exaggerated by base effects. The price index troughed in May of 2020 at 256. So the year over year comps start looking exaggerated because of the COVID effect. Basically, the economy was in crash mode last April and May so prices

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Whooboy. What a CPI print. Here are some highlights in case you have a life and don’t drool over BLS reports:

- The all items index experienced its largest increase (4.2%) since Sept 2008.

- The used car index was up 10% in April, its largest increase since 1953.

- The core index (ex food and energy) was up 0.9% in April, its largest increase since April 1982.

Fun. There will be a tendency in many circles to assume that this is the return of the 1970s or something like that. I think we need to relax and try not to overreact. Here’s why:

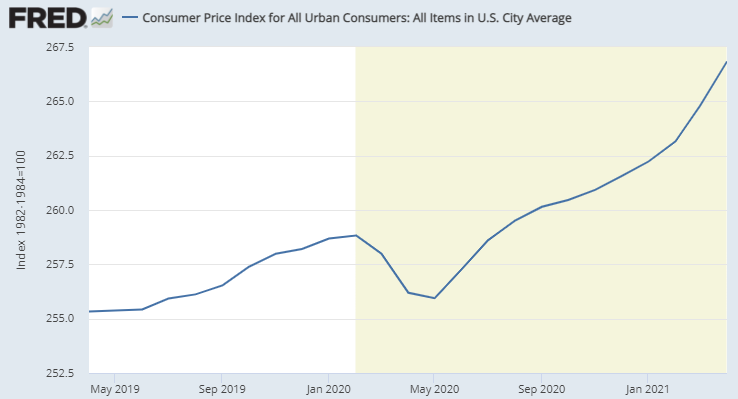

1) These figures are exaggerated by base effects. The price index troughed in May of 2020 at 256. So the year over year comps start looking exaggerated because of the COVID effect. Basically, the economy was in crash mode last April and May so prices collapsed. And now the economy is booming so you have an exaggerated base effect where the numbers look high in large part because we’re comparing it to a severely depressed environment. In my opinion 3-4% was always the upside risk, as I said last July. So these figures aren’t exactly shocking.

To get some sense of the future we can start to think about how these figures might compare to today’s figure. Basically, you’d need a continued surge in some of these unusual items like used cars in order for a 4.2% rate of inflation to persist. That is a very unlikely outcome.

All that said, we’re going to get several more months of what looks like high-ish inflation since the base effect will persist for most of the Summer.

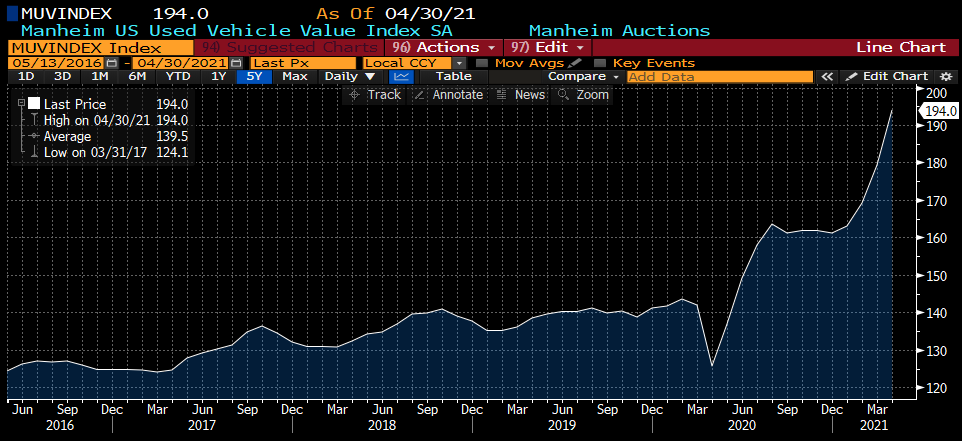

2) These figures are impacted by several acute prices. Used cars contributed 0.35% to core CPI. Add in hotels and car rentals and almost half of the core CPI increase is caused by 5% of of the index. That’s not gonna continue. For instance, look at used car prices in the last year. This surge is very unlikely to persist. Hell, we’re more likely to see this sort of index being a DRAG on prices a year from now.

(Manheim Used Car Index)

3) What if we’re wrong though? What if the labor market roars back to life in H2? What if some of these prices aren’t so transitory? I mean, I would have never predicted a 4x increase in lumber prices in the last year. There are lots of weird supply related things going on in the economy. And while I am fairly confident that these high inflation readings won’t persist I am also uncertain about many of the things going on in the macroeconomy these days because it’s just such a weird environment. And that’s what break-evens seem to be saying as well. Bond investors are hedging their bets a bit here. While we want to believe the Fed and the transitory narrative I tend to think that the Fed is just trying to reinforce expectations. They like what they’re seeing now since it confirms that the recovery is gaining momentum. Jerome Powell doesn’t care about 4% headline inflation. He cares about seeing 4% unemployment at the end of the year. Then he’ll start getting worried about prices.

(2 year break-even inflation rate)

Personally, if I ran the Fed I’d be changing the language and starting to talk about tapering the balance sheet. I think there’s a lot of weird stuff that kind of worries me. It’s not just consumer prices. The real estate market around the country is whackadoodle. People are buying meme crypto coins just for fun. The Gamestop stuff and the endless surge in stocks. There is speculative fervor all over the place. And while asset prices aren’t a major concern for the Fed I do think the total amount of weirdness in prices is alarming. Maybe it’s just the risk manager in me speaking, but I’d be hinting at rate hikes by now….

The bottom line is – don’t overreact here. I think the Fed is likely right that this is mostly transitory and inflation will moderate back into the 3% range before long.

Got Questions/Comments? Go To the Forum for More.