Here are some things I am thinking about heading into the weekend. 1) Balancing Intrinsic and Extrinsic goals to achieve happiness. Adam Grant posted this wonderful paper discussing intrinsic and extrinsic goals relative to overall happiness. In short, intrinsic goals are things like relationships, community and health. They’re things that you can measure based on your own subjective views. Extrinsic goals are things like wealth, fame and beauty. They are measured by other people’s subjective perceptions of you. What the study found was that people who focus on intrinsic goals more than extrinsic goals, tend to be happier on average. This is essentially work/life balance in a formalized framework. But I loved this paper because the extrinsic goals are usually things that people

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here are some things I am thinking about heading into the weekend.

1) Balancing Intrinsic and Extrinsic goals to achieve happiness. Adam Grant posted this wonderful paper discussing intrinsic and extrinsic goals relative to overall happiness. In short, intrinsic goals are things like relationships, community and health. They’re things that you can measure based on your own subjective views. Extrinsic goals are things like wealth, fame and beauty. They are measured by other people’s subjective perceptions of you. What the study found was that people who focus on intrinsic goals more than extrinsic goals, tend to be happier on average.

This is essentially work/life balance in a formalized framework. But I loved this paper because the extrinsic goals are usually things that people structure very rigidly. Your job, for instance, is something that you make time for because it has to be structured in a very specific manner. Whereas many people’s exercise schedules or relationship schedules tend to be far less structured.

For me, the big takeaway was that we all need to structure our intrinsic goals better and specifically make time for them. As you can probably tell from my “All Duration” paper I am increasingly rigid about structuring time in all facets of life. And this paper is a great perspective because I think most people don’t structure their intrinsic goals that well.1 We should structure them in a manner similar to the way we structure our work lives where we make specific time for things. Anyhow, go have a read of the paper (or just the abstract). It’s only 100 pages. Ha.

2) Fed Haters. I guess I’ve finally joined the long list of Fed haters. Not really though. I try to spend most of my time just explaining what the Fed is. They’re a big boring clearing house that does some other stuff like QE and interest rate management. In general, I’ve tended to downplay the efficacy of policies like QE. I basically think it’s an asset swap of safe government assets for other safe government assets. So its impact is smaller than most people assume. Interest rates are more controversial. I think of interest rates as a sledge hammer. You can tap a wall with a sledge hammer. Or you can smash it.

When the Fed changes rates very quickly they’re smashing stuff. When they raise rates slowly they’re tapping the wall. So, in the last 9 months they’ve slammed the wall really hard. This has been one of the fastest and most aggressive Fed rate hikes in history. And this is why I am not a huge fan of discretionary interest rate policy. When the Fed is wrong they tend to have to swing the hammer really hard to catch up with the fact that they weren’t slamming it hard enough before. And now it looks like they’re swinging too hard as credit and equity markets melt.

Anyhow, there was this great rant by Jeremy Siegel on CNBC earlier this week that really hits the nail on the head here. The Fed easily could have moved earlier and more methodically. Instead, they’re now slamming the hammer and things are starting to break. Not great.

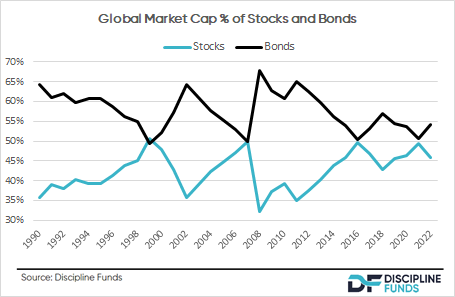

3) Global Equity Market Caps are Still Elevated. Here’s an update on relative global market capitalizations between stocks and bonds. There’s a cyclical ebb and flow here which is generally driven by equity booms and busts. This bust hasn’t been that big though as equity market cap is only down to 45%. Even if bonds hadn’t declined in value this year we’d still only be at 42%. Which is all indicative of just how huge the equity bull market has been in the last few years.

Anyhow, this chart has always annoyed me for reasons that would probably only annoy a big nerd like me. But I always found it fascinating how the actual market cap of stocks and bonds change so much and yet “passive” indexers like 60/40 advocates would just rebalance back to a fixed weight and claim to be passive because the nominal number doesn’t change. A truly passive multi-asset index fund should have a dynamic weight that tracks the actual market caps. Not only would this result in less need for rebalancing, but it is a much more accurate reflection of what the actual “market” is doing. So your 60/40 actually ends up being a very active deviation from the actual market caps. Which can be great in bear markets (when you overbalance back to a more bullish position) and awful in bull markets if you rebalance back to a high equity position right before a big market crash.

In my opinion a smarter way to implement that is to actually invert the weights the way I do with my countercyclical strategies. This way you’re not only better reflecting the actual average market caps over time, but you’re rebalancing away from the stock when they boom over time which reduces the risk of over exposure in a downturn like 2022. Sure, your portfolio is likely to be lower return on average compared to the riskier 60/40, but who cares about that if you can’t stick with it during the busts?

Anyhow, I am surprised that asset management firms construct fixed weight multi-asset funds. It doesn’t really make sense when you dig into the actual market structure.

1 – Don’t even get me started on whether people structure their financial lives well. In my opinion this is the biggest problem in asset management. We all structure portfolios to optimize risk for return but without the element of time in that equation it’s virtually worthless and perhaps even counterproductive as far as our financial planning needs go.