The Total Bond Market is down 5.5% from its 2021 peak. The 10 year T-Note is down 10.7% from its 2020 high. But with the market pricing in 7 rate hikes and inflation showing signs of topping it’s worth asking if the worst is behind us? I believe we’re getting close to the end of this bond bear market. I’ll explain why. 1) Bond bear markets are a totally different beast from stock bear markets. It’s become increasingly common to hear that we should abandon bonds in favor of stocks or other higher risk income paying instruments. But it’s important to understand the difference in risks here. The chart at the right shows the calendar year drawdowns of the stock market vs the bond market. In short, a -10% decline in bonds is very bad whereas a -30%+ decline in stocks is very bad. So we’re

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

The Total Bond Market is down 5.5% from its 2021 peak. The 10 year T-Note is down 10.7% from its 2020 high. But with the market pricing in 7 rate hikes and inflation showing signs of topping it’s worth asking if the worst is behind us? I believe we’re getting close to the end of this bond bear market. I’ll explain why.

1) Bond bear markets are a totally different beast from stock bear markets.

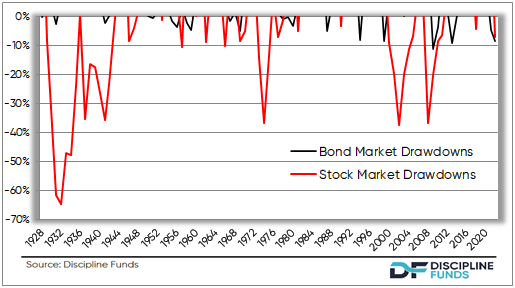

It’s become increasingly common to hear that we should abandon bonds in favor of stocks or other higher risk income paying instruments. But it’s important to understand the difference in risks here. The chart at the right shows the calendar year drawdowns of the stock market vs the bond market. In short, a -10% decline in bonds is very bad whereas a -30%+ decline in  stocks is very bad. So we’re talking about totally different animals here. A bond bear market is nothing at all like a stock market bear market.

stocks is very bad. So we’re talking about totally different animals here. A bond bear market is nothing at all like a stock market bear market.

The trouble with this is that people who own bonds typically have a more conservative risk profile. So, even a -10% decline can feel like a big decline. It’s totally understandable to feel that way, but return requires some risk and if you can’t stomach some short-term volatility in order to earn some long-term return then the stock and bond markets aren’t’ the right place to put your money.

The point is, it’s helpful to understand the relative size of potential downside risk you have in any instrument and the bond market, while being a relatively low risk instrument, is not a no risk instrument. But it also isn’t anything remotely similar to the stock market in terms of risk.

At present, the current drawdown in bonds is consistent with levels that are close to the worst drawdown levels.

2) The Fed can’t raise rates much.

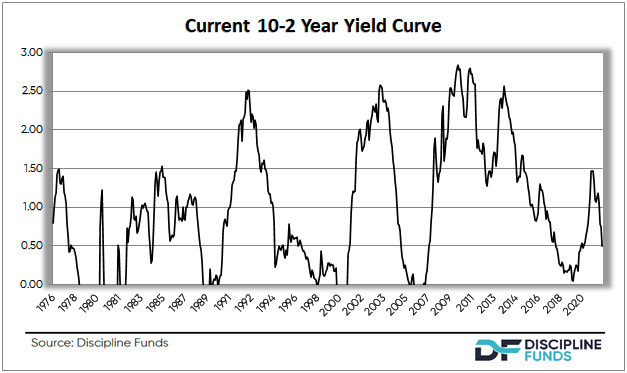

The Fed ultimately controls the yield on government bonds (and their short-term price changes). And in an extreme environment we might even expect them to implement yield curve control wherein they execute QE by purchasing long bonds at a specific price. I don’t think we’re headed there because I don’t think the bond market is in need of yield curve control because the economy is still too fragile to sustain very high rates. This is evident in how much the yield curve is flattening.

I’ve mentioned in recent months that the Fed is constrained by how much they can raise rates before they invert the yield curve. Inverted yield curves have always been a precursor to recessions and we’re getting awfully close to inversion already. So the Greenspan Conundrum is back in play here.

I’ve mentioned in recent months that the Fed is constrained by how much they can raise rates before they invert the yield curve. Inverted yield curves have always been a precursor to recessions and we’re getting awfully close to inversion already. So the Greenspan Conundrum is back in play here.

But how much upside risk exists in bonds at present? With the 2 year yield already at 1.6% it means that the Fed has already tightened quite a bit and is running out of runway. If we consider recent history as a guide then the recent 1.35% increase in rates has coincided with a 0.65% increase in the 10 year yield. Extrapolating that trend into the future means the Fed would invert the curve if they raise rates to ~2.5%. They aren’t going to do that and they likely won’t even let it get close to that. It’s much more likely that the Fed would raise to 1.5-2% and if the curve inverts it will invert because the long-end drops just like it did in 2007 and 2019 prior to the last two inversions (in which case bond investors will earn positive returns along the way).

In short, the downside risk in a 10 year bond is fairly limited with a reasonable downside expectation of about -2.5% (4.5% from duration risk plus the coupon) IF the Fed gets more aggressive. In other words, I believe we’re closer to the trough in the bond bear than the peak.

Some things to keep in mind about bonds….

1) Bonds don’t necessarily lose money when rates rise.

One of the first things we learn about bonds is that bond prices and interest rates are inversely correlated. This is true, but only in the short-term. In the long-term, if you hold your bonds to maturity then you just clip a coupon along the way and receive your principal back after a specified period. For instance, if you hold an intermediate term government Treasury bond fund with an average maturity of 6 years then that portfolio gets rolled over every 6 years. If you plan on holding that fund for 6 years it’s very similar to holding a bond to maturity meaning that the likelihood of principal losses over a rolling 3-5 year period are low. What that fund does in any 6 month period might be unnerving, but is really inconsequential if you’re using it properly.

I wrote a long piece on this back in 2016 when people were predicting doom and gloom in the bond market before the Fed started hiking.

2) Bonds still diversify as rates rise.

When viewed over the proper time horizons bonds are always a good stock market hedge. This is true in rising rate environments AND falling rate environments. For instance, from the period of 1940-1980 interest rates marched steadily higher. But a 10 year T-Note earned a nominal return of 2.5% per year. More importantly, a 50/50 stock/bond portfolio earned 8% per year while reducing the standard deviation of a 100% stock market portfolio by 50%.

I wrote another long piece on this concept back in 2018 when people were predicting doom and gloom in the bond market.

3) Don’t fall victim to short-termism in bonds.

One of the interesting things about bonds and bond funds is the increasing short-termism. When I used to purchase bonds for clients in the beginning of my career we would often purchase a physical bond. And although that bond changed in price every day we didn’t pay much attention to it because we knew we were just clipping a coupon over a specific time period. You couldn’t see the price change because you just owned a physical note without the noise of the internet. But in today’s world you can log-in to your account and check the price of a bond fund every instant of the trading day. And while I am a huge advocate of bond funds I don’t love that this added liquidity also adds behavioral risk.

The key to overcoming this behavioral risk is to understand bond maturities and ignore the short-term moves. A high quality 10 year T-Note will earn 2% on average for the next 10 years. And it might lose 10% in the next 10 months on its way to earning that average 2% per year return. Nobody knows what the market is going to do in the short-term, but we know what high quality bonds will do over the long-term with near precision. That’s the main benefit of bonds – they dampen stock market risk and provide the certainty of income across specific time horizons even if they’re somewhat volatile in the short-term. This is part of why I’ve become a big advocate of using bucketing strategies with asset liability matching. Segment your assets across specific time horizons and then stick to those time horizons through all the short-term noise. You’ll sleep better, perform better and waste a lot less time thinking about the short-term noise in the markets.