I’ll break this down into three things, but it’s really just one thing – war. 1) Is it time to panic? Here’s some good perspective of geopolitical conflicts and market returns over the last 75 years from Tom Morgan and BCA research (Tom is a great follow on Twitter by the way in case you don’t already). Long story short, this always causes short-term turmoil with the market generally falling at least 10% and then rebounding over the course of the coming year. Of course, this is an unusual situation given COVID, high valuations and generally frothy conditions coming off all the stimulus of the last 24 months. But the long and short of it is that geopolitical conflicts are a lot more frequent than we might like to admit and the market always overcomes the short-term turmoil. I think

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

I’ll break this down into three things, but it’s really just one thing – war.

1) Is it time to panic?

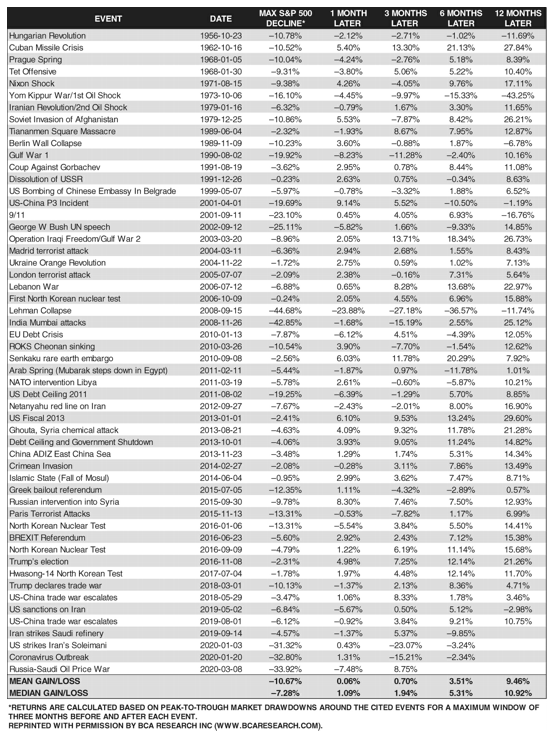

Here’s some good perspective of geopolitical conflicts and market returns over the last 75 years from Tom Morgan and BCA research (Tom is a great follow on Twitter by the way in case you don’t already). Long story short,  this always causes short-term turmoil with the market generally falling at least 10% and then rebounding over the course of the coming year. Of course, this is an unusual situation given COVID, high valuations and generally frothy conditions coming off all the stimulus of the last 24 months. But the long and short of it is that geopolitical conflicts are a lot more frequent than we might like to admit and the market always overcomes the short-term turmoil.

this always causes short-term turmoil with the market generally falling at least 10% and then rebounding over the course of the coming year. Of course, this is an unusual situation given COVID, high valuations and generally frothy conditions coming off all the stimulus of the last 24 months. But the long and short of it is that geopolitical conflicts are a lot more frequent than we might like to admit and the market always overcomes the short-term turmoil.

I think this is the most important takeaway from all of this. I like to advocate for what I call “Discipline Based Investing” and a cornerstone of Discipline Based Investing is understanding specific assets and their corresponding time horizons. Cash is an overnight instrument. Bonds are 6 year instruments on average. And stocks are best thought of as multi-decade instruments. If you construct a portfolio properly you need to match those time horizons to your financial and behavioral needs. It’s completely counterproductive to look at the stock market in any given day, month or year and worry about all the short-term gyrations of that instrument because it is an instrument that accrues its cash flows from underlying entities over very long periods of time.

That said, you need to revisit your risk profile in times like these. I like to take an optimistic view of the world, but Vladimir Putin is out here threatening actual nuke attacks on countries that intervene. And as much as I’d like to hope that’s just an empty threat it’s increasingly looking like Putin has lost his marbles and is dealing with some sort of existential autocratic crisis. If you can’t stomach the potential that the world could be a mess for 5+ years then your asset allocation might be wrong and you need to rebalance it accordingly before you realize this in 5 years.

2) The inflation story is getting (even more) complex.

We were just starting to see real signs that inflation was peaking. The Manheim Used Car Index declined for a second consecutive month, the rate of change in commodities was slowing and COVID restrictions were finally starting to end. And then Russia attacked the Ukraine and now all of that looks like it’s in flux again.

Russia is one of the largest exporters of oil and gas in the world while Ukraine is one of the most important resource oriented economies in the world. The disruptions across the region are causing commodity prices to surge and will exacerbate already constrained supply chains. I was starting to feel very confident about the peak in inflation, but now I am not so certain. This throws a wrench in everything.

How the Fed responds will be interesting. My guess is that they’ll raise rates less than previously expected because the war has the potential to cause so much uncertainty. The Fed wants to wrangle inflation, but they don’t want to cause a widespread recession. They’ll have to tread carefully for the rest of the year.

3) What comes next?

I’ve mentioned on many occasions that the range of potential outcomes coming out of COVID was as wide as I’ve ever seen. The COVID stimulus and economic recovery was so unusual and the boom was so disjointed that I wouldn’t be surprised to see 10%+ inflation or a deflationary asset price bust in the next 24 months. No one knows. And the war in Ukraine just made the range of outcomes even wider.

I am always an advocate of global diversification and all weather style portfolios, but I think it’s more important than ever to adhere to this style of asset allocation. Having highly concentrated portfolio bets with potentially catastrophic asymmetric exposure is a huge risk. We’re going to hear lots of opinions about what should happen and what will happen, but the reality is that the global economy is going to be hugely impacted by the decisions of a deranged autocrat for what could be many years. Hope for the best, but plan for the worst.

Take care everyone.