Here are some things I think I am thinking about: 1) Who Owns the Fed’s Losses? Here’s an interesting article about the Fed’s losses. Since they started raising rates late last year the Fed has 0B of unrealized losses. How problematic is this? First, the Fed earned over .2T in interest over the last 12 years. But they distribute all this income to the US Treasury at the end of every year. They don’t keep this income as retained earnings or a capital buffer because the Fed doesn’t have a capital requirement like a normal bank. But it’s interesting to note that if they did retain their earnings there’s no reason to think that a loss like this would be a net negative. In fact, they’ve been massively profitable over the last 12 years even with this unrealized loss. Second, these are

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here are some things I think I am thinking about:

1) Who Owns the Fed’s Losses?

Here’s an interesting article about the Fed’s losses. Since they started raising rates late last year the Fed has $540B of unrealized losses. How problematic is this?

First, the Fed earned over $1.2T in interest over the last 12 years. But they distribute all this income to the US Treasury at the end of every year. They don’t keep this income as retained earnings or a capital buffer because the Fed doesn’t have a capital requirement like a normal bank. But it’s interesting to note that if they did retain their earnings there’s no reason to think that a loss like this would be a net negative. In fact, they’ve been massively profitable over the last 12 years even with this unrealized loss.

Second, these are unrealized losses on risk free assets. The Fed will manage their balance sheet in such a way that they let older bonds mature and these newer ones with unrealized losses will almost certainly mature at par with time.

Third, no taxpayer bears the nominal cost of this. You could argue that there’s a real cost to the Fed’s policies to the extent that they cause inflation, but the point is that there’s no nominal economic risk to these losses.

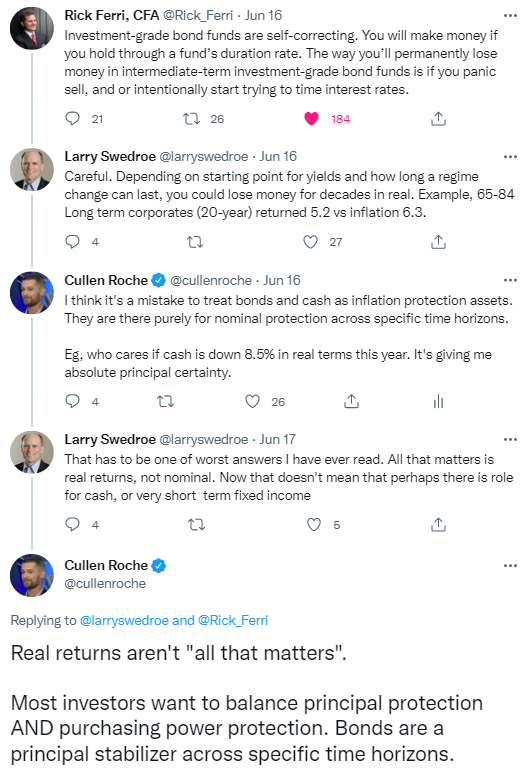

2) Are Real Returns “All that matter”?

Rick Ferri wrote a good tweet about how the only people who need to worry about current bond portfolio losses are people who won’t hold them to maturity. He’s right. Just like the Fed’s unrealized losses, the losses you’ve incurred in high quality bonds are just temporary. As Rick says, the only way you’ll lose money is if you panic sell and don’t have the patience to let them do what they’re designed to do over time. That doesn’t make the unrealized losses enjoyable, but it does mean they’re temporary.

unrealized losses enjoyable, but it does mean they’re temporary.

Anyhow, Larry Swedroe, whose work I also love, responded saying that the bonds can experience real losses for much longer than some people think. I see this a lot and I really think it’s fundamentally wrong to judge high quality bonds as real return instruments. To me, high quality bonds serve one main purpose in a portfolio – to provide you with stability over specific time periods. For instance, a 5 year T-note might be very volatile over 5 months, or 5 hours, but over 5 years that instrument will not be volatile. If you match that bond to a specific time horizon then it’s very stable in nominal terms.

Larry thought this was dumb. He actually said it “has to be one of the worst answers I have ever read”. Ouch. But then Larry said “real returns are all that matter” and I think that is very wrong. Of course people are very worried about real returns. You want inflation protection in your portfolio. But you also want nominal stability. I call this the “Savings Portfolio Scale” and it’s part of my overarching view on approaching asset management from the perspective of a “Total Portfolio” approach.

This is what makes investing so hard. You need to hold long duration assets like stocks to earn a real return. But you need to hold short-term stable instruments like cash to meet your uncertain short-term liabilities. Real returns matter, but so do nominal returns because it’s the nominal return instruments that give you short-term predictability. If you could generate super stable real returns like Bernie Madoff pretended to do then you’d have achieved the Holy Grail of investing because you’ve balanced your need for nominal stability with your need for purchasing power protection. Of course, Bernie Madoff returns aren’t a real thing.

3) Inflation – Who Dunnit?

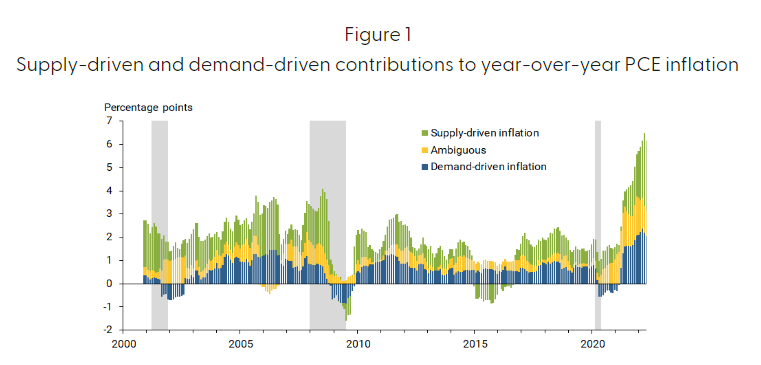

There’s been a lot of political banter about what caused the inflation – the stimulus or the supply shock. I’ve always maintained that it was a a lot of both. You couldn’t just pin this on one thing or the other because the whole COVID inflation experience was a mix of supply shocks and a huge demand-led stimulus shock. And last week we finally got a more objective answer on this topic.

Adam Shapiro from the San Francisco Fed showed that the inflation was…a mix of supply and demand issues. In the beginning of COVID demand dominated the inflation issue, but as soon as Russia invaded Ukraine it turned into more of a mix of both:

Adam Shapiro from the San Francisco Fed showed that the inflation was…a mix of supply and demand issues. In the beginning of COVID demand dominated the inflation issue, but as soon as Russia invaded Ukraine it turned into more of a mix of both:

To get a sense of whether supply or demand factors are responsible for current elevated inflation levels, I compare current supply- and demand-driven inflation to their average levels from the 10 years before the pandemic. During the pre-pandemic period, PCE inflation averaged 1.5%, considerably below the April 2022 rate of 6.3%. Figure 2 compares the most recent contributions of supply-driven inflation in panel A and demand-driven inflation in panel B against their respective 2010–2019 averages. Supply-driven inflation is currently contributing 2.5 percentage points (pp) more than its pre-pandemic average, while demand-driven inflation is currently contributing 1.4pp more. Thus, supply-driven inflation explains a little more than half of the 4.8pp gap between current levels of year-over-year PCE inflation and its pre-pandemic average level. Demand factors explain a smaller share of elevated inflation levels, accounting for about one-third of the difference. The ambiguous category, which is not shown, explains the remainder of the difference.

So, hopefully we can close the case on this one and stop trying to make a political football out of a pretty complex issue.