Here are some things I think I am thinking about: 1) Inflation has peaked. Back in January I said inflation had peaked. This morning’s Core PCE data seals the deal for me – it looks like inflation peaked in February. So, I missed it by a month. Still, this one looks very clear to me from here on out. The year over year comparisons become much flatter as the year goes on. By the end of the year a lot of the underlying inflation components are going to be negative. Given all the broad economic weakness and potential downside in housing, my baseline is that inflation is still going to be well above the Fed’s 2% target by year-end, but I think the odds of a runaway 1970s style inflation are very, very low now. There is no chance of hyperinflation. I would actually argue that the risk of

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here are some things I think I am thinking about:

1) Inflation has peaked.

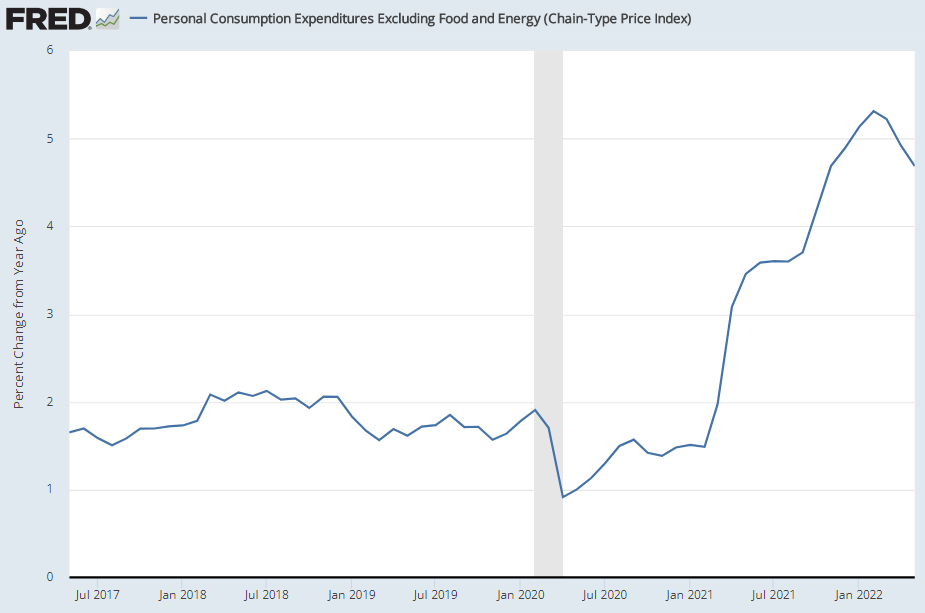

Back in January I said inflation had peaked. This morning’s Core PCE data seals the deal for me – it looks like inflation peaked in February. So, I missed it by a month. Still, this one looks very clear to me from here on out. The year over year comparisons become much  flatter as the year goes on. By the end of the year a lot of the underlying inflation components are going to be negative. Given all the broad economic weakness and potential downside in housing, my baseline is that inflation is still going to be well above the Fed’s 2% target by year-end, but I think the odds of a runaway 1970s style inflation are very, very low now. There is no chance of hyperinflation. I would actually argue that the risk of deflation is substantially higher at this point than the risk of hyperinflation.

flatter as the year goes on. By the end of the year a lot of the underlying inflation components are going to be negative. Given all the broad economic weakness and potential downside in housing, my baseline is that inflation is still going to be well above the Fed’s 2% target by year-end, but I think the odds of a runaway 1970s style inflation are very, very low now. There is no chance of hyperinflation. I would actually argue that the risk of deflation is substantially higher at this point than the risk of hyperinflation.

We’re starting to see this broadly across the economy already. Freight shipping prices are cratering, lumber prices are cratering, broader commodity prices are down 20% in the last month. When you combine this with the year over year comps heading into the back half of the year it’s very hard to see inflation moving higher unless China invades Taiwan and or Russia’s war gets out of control and causes commodities to surge to unimaginable prices. Those are certainly risks, but the baseline at this point has to be falling rates of positive inflation with an outside chance of deflation in 2023 if the Fed keeps rates too tight.

2) The Fed got it wrong both ways.

Another big theme of mine in recent years was that the Fed was behind the curve both ways. In 2020 I repeatedly said the Fed would have to backpedal by raising rates to get ahead of inflation in 2021. But what I got wrong was that they would panic right when inflation was surging. I’ve actually been shocked by their aggressive stance and I frankly think it’s been a little reckless and overreactive. In short, it looks like inflation was on the verge of turning over at the end of 2021, but then the Russian invasion caused commodities to surge which made the Fed think that inflation was more permanent than they thought. Except it now looks like they panicked into a supply side issue and now they’re exacerbating what was already an underlying demand side problem.

So, now it looks like the Fed got it wrong both ways. Not only did they think inflation wasn’t a problem in 2021, but they got super aggressive in early 2022 right when inflation was peaking. And now we are all trying to assess whether they got too aggressive and nuked the housing market. My view is that they’ve thrown a big wrench in the housing market. Basically, current mortgage rates combined with current high house prices create a huge distortion that makes housing unaffordable for too many people. So one of two things has to happen here – either house prices have to fall substantially OR mortgage rates need to come back down. Or some combo of the two. My guess is that the housing market will look very weak at the end of the year and the Fed will be starting to talk about walking back some of the rate hikes to stabilize things.

In other words, I think they will have gotten it wrong THREE times. They will have underestimated inflation risk in 2021, then overestimated inflation risk in 2022 which will force them to cut in 2023. Pretty impressive stuff.

3) Widespread disinflation by any definition, right?

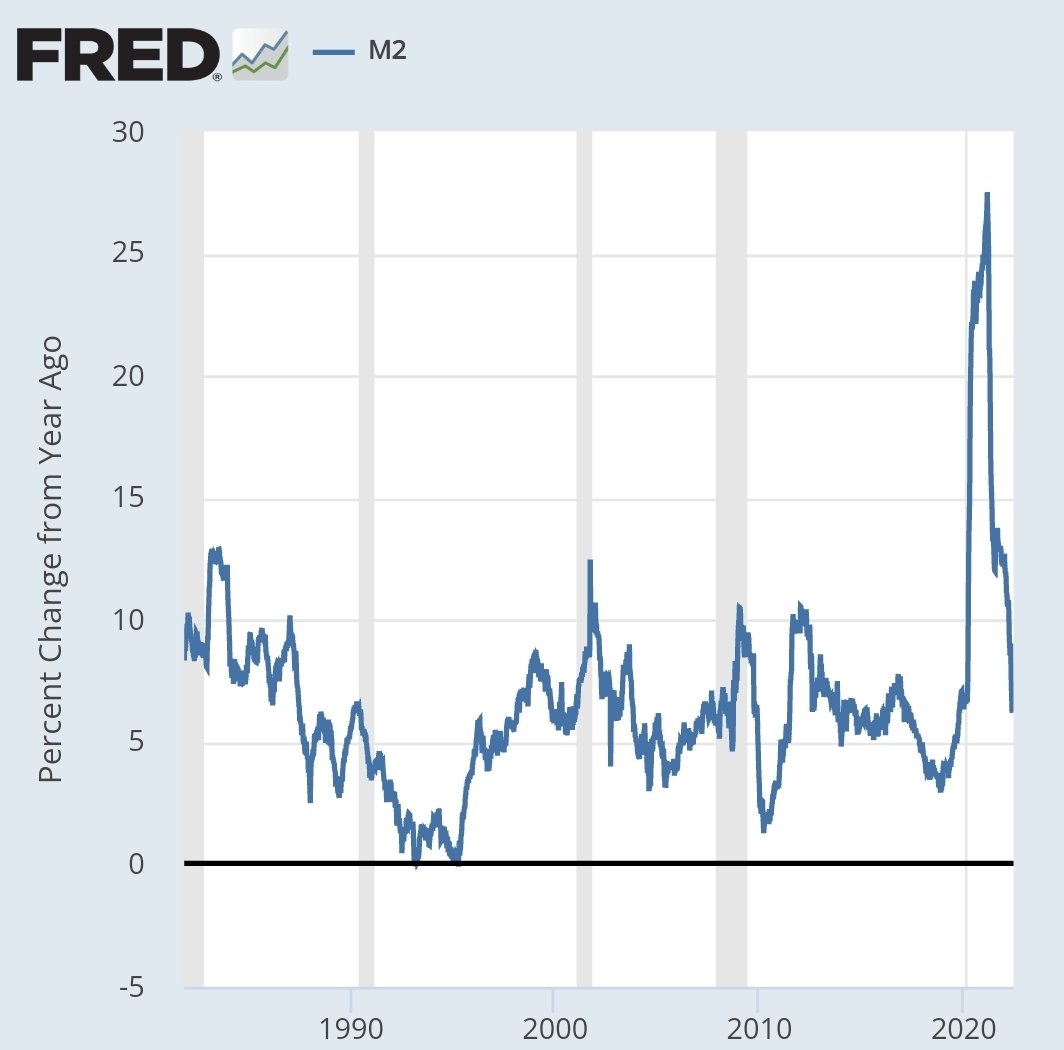

One thing that keeps me up at night is worrying that people will continue to define inflation as an increase in the money supply. In short, I argue that this is wrong because the money supply is usually increasing because people are usually borrowing more which is creating more deposits. This isn’t inherently good or bad. It really depends on how the money is used. So, defining inflation as an increase in the money supply is like defining weight gain as food intake. No, no, no. There are lots of other factors that could contribute to weight gain and while food intake is certainly one of them it’s not the only one.

One thing that keeps me up at night is worrying that people will continue to define inflation as an increase in the money supply. In short, I argue that this is wrong because the money supply is usually increasing because people are usually borrowing more which is creating more deposits. This isn’t inherently good or bad. It really depends on how the money is used. So, defining inflation as an increase in the money supply is like defining weight gain as food intake. No, no, no. There are lots of other factors that could contribute to weight gain and while food intake is certainly one of them it’s not the only one.

Given that some people like defining inflation this way, it’s interesting to note that there is massive disinflation in the money supply. If we look at the latest M2 growth, for instance, it’s back down to its historical trend levels. This is a huge collapse in the growth rate and it’s coming from a very significant tightening both in Monetary Policy and Fiscal Policy. So, not only has core PCE rolled over, but we’re now seeing a huge disinflationary trend in the money supply. This will also continue and there’s even a chance that it will be negative by early 2023.