The Russian stock market collapse has been jaw dropping with a near 80% loss in just a matter of weeks. Here are some important lessons we can all learn from this epic catastrophe. Lesson #1 – Beware of home bias. Below is a great chart from Jeffrey Kleintop at Schwab showing how much investors tend to overweight their home country. Virtually everyone does it. And it makes some sense especially if you can access a market like the USA where a good amount of the domestic corporate revenues come from abroad. But the key lesson here is that even investors in the developed world have a huge amount of home bias in their portfolios which exposes them to unnecessary country specific risk. We often talk about diversification in an allocation sense, but less so in a location sense or even an

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

The Russian stock market collapse has been jaw dropping with a near 80% loss in just a matter of weeks. Here are some important lessons we can all learn from this epic catastrophe.

Lesson #1 – Beware of home bias.

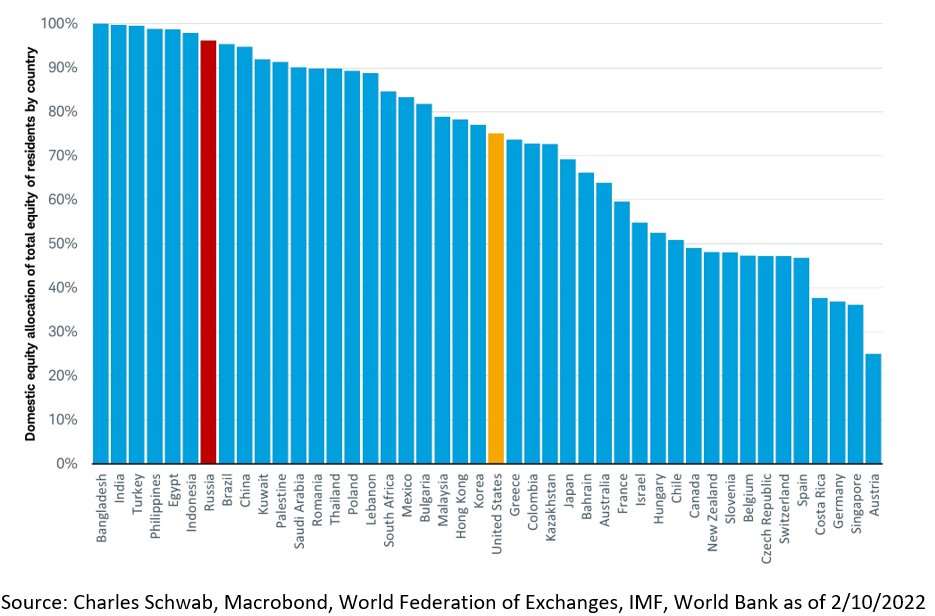

Below is a great chart from Jeffrey Kleintop at Schwab showing how much investors tend to overweight their home country. Virtually everyone does it. And it makes some sense especially if you can access a market like the USA where a good amount of the domestic corporate revenues come from abroad. But the key lesson here is that even investors in the developed world have a huge amount of home bias in their portfolios which exposes them to unnecessary country specific risk.

We often talk about diversification in an allocation sense, but less so in a location sense or even an instrument sense. It’s crucial to understand that stocks from the USA aren’t the same as stocks from Europe or that bonds from the USA aren’t the same as bonds from Russia. Diversifying across locations is just as important as diversifying across asset classes.

This is even more important given the illiquidity risks in some instruments and markets. The reason I am a big advocate of market cap weighted indexing is because it significantly reduces single entity risk, sector risk, country risk and instrument risk. For example, I am watching RSX and other Russian related ETFs experience significant liquidity constraints because the underlying isn’t trading. This country specific risk can be exacerbated by the fact that the actual instruments can magnify that country risk when they don’t reflect the underlying fundamentals during illiquid periods.

This is even more important given the illiquidity risks in some instruments and markets. The reason I am a big advocate of market cap weighted indexing is because it significantly reduces single entity risk, sector risk, country risk and instrument risk. For example, I am watching RSX and other Russian related ETFs experience significant liquidity constraints because the underlying isn’t trading. This country specific risk can be exacerbated by the fact that the actual instruments can magnify that country risk when they don’t reflect the underlying fundamentals during illiquid periods.

Lesson # 2 – Diversification is more important than ever.

If there’s one common theme I’ve harped on over and over again in the last 2 years it’s diversification. The world has become big messy place almost out of nowhere. We got a bit spoiled by 10 years of low and stable growth. Now it’s all changed and no one knows what the future holds. In a world where we can access diversification at such a low cost there’s no reason why we need to have concentrated risks in our savings portfolios.

As an example of this just consider something like Vanguard Total World vs Russia’s market. Through February the Total World market was down -7.22% while RSX was down 60% year-to-date. Or consider a simple Total World and Total Bond allocation of 50/50. Even with bonds down on the year the bonds STILL dampened the volatility of the portfolio by 33% and reduced the negative return to -5.2%. If you add in commodities or housing to this mix your returns are closer to flat or might even be positive on the year.

Diversification works. All weather portfolios work.

Lesson #3 – Anything can happen.

It’s easy to take things for granted in the developed world. We have ample food, stable economies, stock prices that seem to (mostly) only go up. I hope it’s like this for the rest of my life. But I wouldn’t bet all-in on it because crazy things can and do happen.

We often talk about hedging “tail risk” in finance. This is the risk of the anomalous event that no one expects. Japanese stocks going sideways for 20 years. Black Monday. The Great Financial Crisis. The Pandemic crash. If the last few years have taught us anything it’s that anything can happen. WW3, global pandemics, etc. No one knows what’s coming down the pike and while it’s great to hope for the best you also need to prepare for the worst.