The inflation story looked pretty clear to me before Russia invaded Ukraine. COVID had caused supply constraints and unemployment, we responded with T of government spending and so we ended up with the perfect recipe for high-ish inflation. By the beginning of this year there were signs that auto prices were rolling over, commodity prices were slowing their rate of change and the global economy was fully opening back up and supply chains were loosening. And then boom. Russia invaded Ukraine and commodity prices went absolutely berserk. This surge in prices is very clearly supply driven, but the problem is that we already had a demand driven inflation problem building before that. So the Fed is now in an impossible position. We’re going to get some very uncomfortable CPI readings in

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

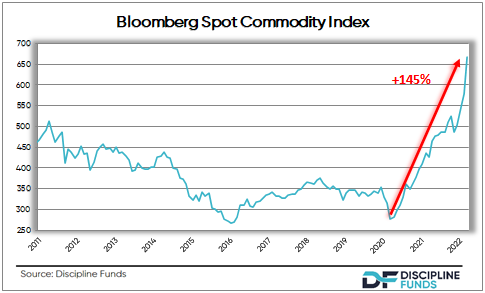

The inflation story looked pretty clear to me before Russia invaded Ukraine. COVID had caused supply constraints and unemployment, we responded with $7T of government spending and so we ended up with the perfect recipe for high-ish inflation. By the beginning of this year there were signs that auto prices were rolling over, commodity prices were slowing their rate of change and the global economy was fully opening back up and supply chains were loosening. And then boom. Russia invaded Ukraine and commodity prices went absolutely berserk.

This surge in prices is very clearly supply driven, but the problem is that we already had a demand driven inflation problem building before that. So the Fed is now in an impossible position. We’re going to get some very uncomfortable CPI readings in the coming year because of this supply related commodity boom. I was on record saying that inflation had peaked before Russia invaded, but that forecast is completely out the window now. It will be totally wrong and we might even get double digit CPI in the coming year.

that we already had a demand driven inflation problem building before that. So the Fed is now in an impossible position. We’re going to get some very uncomfortable CPI readings in the coming year because of this supply related commodity boom. I was on record saying that inflation had peaked before Russia invaded, but that forecast is completely out the window now. It will be totally wrong and we might even get double digit CPI in the coming year.

This is the craziest economic environment I have ever witnessed or studied. You already had an unprecedented scenario with COVID and now the prospect of WW3 on top of it. I was on record in 2020 saying the Fed would be backpedaling on low rates because of high inflation. But now I think they’re going to have to DOUBLE BACKPEDAL. I think there’s an increasing risk that they’ll backpedal on 0% rates, raise at the March FOMC meeting and then the economy is going to get walloped by the supply constrained commodity boom which will force the Fed to move to a more cautious position.

We have an incredibly dangerous confluence of events here. You had a demand boom which had caused an asset price boom. So we had bubbly stock, cryptocurrency and housing prices. And then we got hit with a supply constrained commodity boom on top of the demand boom. If you’re a Fed official this is your worst nightmare. Actually, that assumes that we don’t get some sort of financial contagion from the decimation of the 11th largest economy in the world. And that assumes they don’t spread their economic collapse in other unimaginable ways. I am finding all these risks uncomfortably high.

I don’t know. It’s all so much. I’m still digesting my thoughts on it all to be honest. I guess the good news is none of us are Jerome Powell. He’s gonna be public enemy #1 no matter how this ends. Scratch that, Putin is obviously public enemy #1, but Powell is going to be a close second when people start seeing $5-$6 gas all over the place….