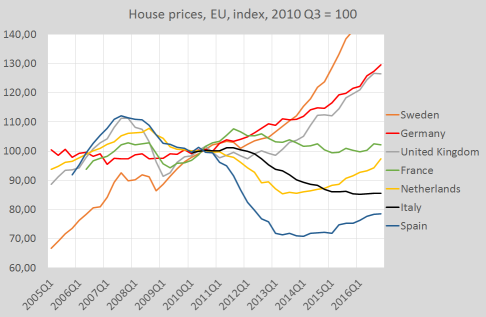

Is there a EU housing bubble? Low interest rates are criticized by some economists as these should encourage asset price bubbles. Houses are our most important asset. Are house prices in the EU at this moment increasing too fast? Not yet in Southern Europe … However … Swedish prices are of the chart. Dutch prices are rapidly increasing (and continued to do so during the first six months of 2017). German prices have, by now, increased with a third (house ownership in Germany is less common than in many other countries but the increase means that there will, quite soon, be a push to sell houses to renters – who of course have to borrow from the big banks). Yes, there is a northern European bubble. And it is rapidly inflating: during the last six months

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

Is there a EU housing bubble?

Low interest rates are criticized by some economists as these should encourage asset price bubbles. Houses are our most important asset. Are house prices in the EU at this moment increasing too fast?

Not yet in Southern Europe … However … Swedish prices are of the chart. Dutch prices are rapidly increasing (and continued to do so during the first six months of 2017). German prices have, by now, increased with a third (house ownership in Germany is less common than in many other countries but the increase means that there will, quite soon, be a push to sell houses to renters – who of course have to borrow from the big banks). Yes, there is a northern European bubble. And it is rapidly inflating: during the last six months (not in the graph) prices have continued to increase …

House prices show continued increases which are way higher than the increases of nominal income of households … Actions have to be taken: a gradual increase (with clear forward guidance) of land value taxes (the money raised has to be used to lower VAT on labor), a gradual decrease of Loan to Value ratio’s (with clear forward guidance) and a gradual banishment of tax deductions of interest paid (with clear forward guidance).

It won’t happen.

Yes indeed, house prices are increasing fast in EU. And more so in Sweden than in any other member state. Sweden’s house price boom started in mid-1990s, and looking at the development of real house prices during the last three decades there are reasons to be deeply worried. The indebtedness of the Swedish household sector has also risen to alarmingly high levels:

In its latest report on Sweden, The European Commission warns Sweden about rising house prices and spiralling household debts:

The government’s 22-point housing market plan addresses some underlying factors for housing shortage, including measures to increase the amount of available land for construction, reduce construction costs and shorten planning process lead times. However, some other structural inefficiencies, including weak competition in the construction sector, do not receive appropriate attention. The housing shortage is exacerbated by barriers hindering the efficient use of the existing housing stock. Sweden’s tightly regulated rental market creates lock-in and ‘insider/outsider’ effects, but no significant policy action has been taken to introduce more flexibility in setting rents. In the owner-occupancy market, relatively high capital gains taxes reduce homeowner mobility. A temporary reform of the deferral rules for capital gains taxes on property transaction was introduced, but this will probably have limited effect. Lack of available and affordable housing can also limit labour market mobility and the effective integration of migrants into the labour market, and contribute to intergenerational inequality.

Yours truly has been trying to argue with ‘very serious people’ that it’s really high time to ‘take away the punch bowl.’ Mostly I have felt like the voice of one calling in the desert.

Where do housing bubbles come from? There are of course many different explanations, but one of the more fundamental mechanisms at work is easy to explain with the following arbitrage argument:

Where do housing bubbles come from? There are of course many different explanations, but one of the more fundamental mechanisms at work is easy to explain with the following arbitrage argument:

Assume you have a sum of money (A) that you want to invest. You can put the money in a bank and receive a yearly interest (r) on the money. Disregarding — for the sake of simplicity — risks, asset depreciations and transaction costs that may possibly be present, rA should equal the income you would alternatively receive if instead you buy a house with a down-payment (A) and let it out during a year with a rent (h) plus changes in house price (dhp) — i. e.

rA = h + dhp

Dividing both sides of the equation with the house price (hp) we get

hp = h/[r(A/hp) – (dhp/hp)]

If you expect house prices (hp) to increase, house prices will increase. It’s this kind of self generating cumulative process à la Wicksell-Myrdal that is the core of the housing bubble. Unlike the usual commodities markets where demand curves usually point downwards, on asset markets they often point upwards, and therefore give rise to this kind of instability. And, the greater the leverage (the lower A/hp), the greater the increase in prices.

The Swedish housing market is living on borrowed time. It’s really high time to take away the punch bowl. What is especially worrying is that although the aggregate net asset position of the Swedish households is still on the solid side, an increasing proportion of those assets is illiquid. When the inevitable drop in house prices hits the banking sector and the rest of the economy, the consequences will be enormous.

It hurts when bubbles burst …