Lowering wages is not the solution In connection with being awarded The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel a couple of years ago, Thomas Sargent, in an interview with Swedish Television, declared that workers ought to be prepared for having low unemployment compensations in order to get the right incentives to search for jobs. This old mercantilist idea has very little support in research, since it has turned out to be exceedingly difficult to really get clear cut results of causality on the issue. Many well-known and influential economists have for decades been writing out the same prescription — lower wages — for solving no matter what problem facing our economies. As in the 1920s, more and more right-wing politicians — and economists — suggest that lowering wages is the right medicine to strengthen the competitiveness of their faltering economies, get the economy going, increase employment and create growth that will get rid of the towering debts and create balance in the state budgets. But, intimating that one could solve economic problems by impairing unemployment compensations and wage cuts, in dire times, should really be taken more as a sign of how low the confidence in our economic system has sunk.

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

Lowering wages is not the solution

In connection with being awarded The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel a couple of years ago, Thomas Sargent, in an interview with Swedish Television, declared that workers ought to be prepared for having low unemployment compensations in order to get the right incentives to search for jobs.

This old mercantilist idea has very little support in research, since it has turned out to be exceedingly difficult to really get clear cut results of causality on the issue.

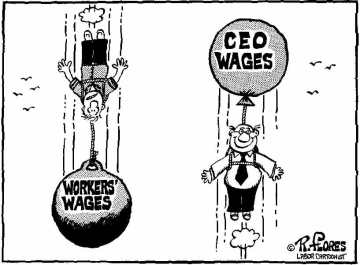

Many well-known and influential economists have for decades been writing out the same prescription — lower wages — for solving no matter what problem facing our economies.

Many well-known and influential economists have for decades been writing out the same prescription — lower wages — for solving no matter what problem facing our economies.

As in the 1920s, more and more right-wing politicians — and economists — suggest that lowering wages is the right medicine to strengthen the competitiveness of their faltering economies, get the economy going, increase employment and create growth that will get rid of the towering debts and create balance in the state budgets.

But, intimating that one could solve economic problems by impairing unemployment compensations and wage cuts, in dire times, should really be taken more as a sign of how low the confidence in our economic system has sunk. Wage cuts and lower unemployment compensation levels – of course – do not save neither competitiveness, nor jobs.

What is needed more than anything else in these times is stimulus and economic policies that increase effective demand.

On a societal level wage cuts only increase the risk of more people getting unemployed. To think that that one can solve economic crisis in this way is a turning back to those faulty economic theories and policies that John Maynard Keynes conlusively showed to be wrong already in the 1930s. It was theories and policies that made millions of people all over the world unemployed.

It’s an atomistic fallacy to think that a policy of general wage cuts would strengthen the economy. On the contrary. The aggregate effects of wage cuts would, as shown by Keynes, be catastrophical. They would start a cumulative spiral of lower prices that would make the real debts of individuals and firms increase since the nominal debts wouldn’t be affected by the general price and wage decrease. In an economy that more and more has come to rest on increased debt and borrowing this would be the entrance-gate to a debt deflation crises with decreasing investments and higher unemployment. In short, it would make depression knock on the door.

The impending danger for today’s economies is that they won’t get consumption and investments going. Confidence and effective demand have to be reestablished. The problem of our economies is not on the supply side. Overwhelming evidence shows that the problem today is on the demand side. Demand is — to put it bluntly — simply not sufficient to keep the wheels of the economies turning. To suggest that the solution is lower wages and unemployment compensations is just to write out a prescription for even worse catastrophes.