Paul Samuelson — a case of badly invested intelligence Paul Samuelson claimed that the ‘ergodic hypothesis’ is essential for advancing economics from the realm of history to the realm of science. But is it really tenable to assume that ergodicity is essential to economics? The answer can only be — as I have argued here here here here and here — NO WAY! Obviously yours truly is far from the only researcher being critical of Paul Samuelson. This is what Ole Peters writes in a highly interesting article on Samuelson’s stance on the ‘ergodic hypothesis’: Samuelson said that we should accept the ergodic hypothesis because if a system is not ergodic you cannot treat it scientifically. First of all, that’s incorrect, although I think I understand how he ended

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

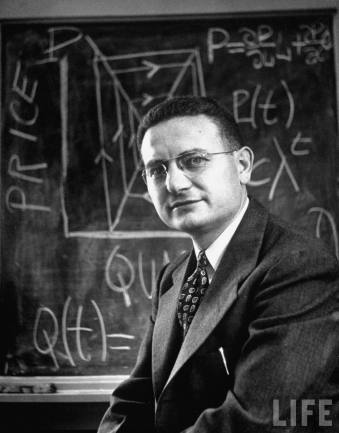

Paul Samuelson — a case of badly invested intelligence

Paul Samuelson claimed that the ‘ergodic hypothesis’ is essential for advancing economics from the realm of history to the realm of science.

Paul Samuelson claimed that the ‘ergodic hypothesis’ is essential for advancing economics from the realm of history to the realm of science.

But is it really tenable to assume that ergodicity is essential to economics?

The answer can only be — as I have argued

and

here — NO WAY!

Obviously yours truly is far from the only researcher being critical of Paul Samuelson. This is what Ole Peters writes in a highly interesting article on Samuelson’s stance on the ‘ergodic hypothesis’:

Samuelson said that we should accept the ergodic hypothesis because if a system is not ergodic you cannot treat it scientifically. First of all, that’s incorrect, although I think I understand how he ended up with this impression: ergodicity means that a system is very insensitive to initial conditions or perturbations and details of the dynamics, and that makes it easy to make universal statements about such systems …

Another problem with Samuelson’s statement is the logic: we should accept this hypothesis because then we can make universal statements. But before we make any hypothesis—even one that makes our lives easier—we should check whether we know it to be wrong. In this case, there’s nothing to hypothesize. Financial and economic systems are non-ergodic. And if that means we can’t say anything meaningful, then perhaps we shouldn’t try to make meaningful claims. Well, perhaps we can speak for entertainment, but we cannot claim that it’s meaningful.

And this is Nassim Taleb’s verdict on Samuelson’s view on how to do economics:

The tragedy is that Paul Samuelson, a quick mind, is said to be one of the most intelligent scholars of his generation. This was clearly a case of very badly invested intelligence. Characteristically, Samuelson intimidated those who questioned his techniques with the statement “Those who can, do science, others do methodology.” If you knew math, you could “do science.” … Alas, it turns out that it was Samuelson and most of his followers who did not know much math, or did not know how to use what math they knew, how to apply it to reality. They only knew enough math to be blinded by it.

Samuelson was a formalist committed to mathematical economics. Where did this methodological stance take him? Nowhere I would argue. It is one thing to come up with ‘minimally realist’ models of ‘possibly true’ worlds.’ And something completely different to give us relevant truths about real-world systems. Just giving us a set of possible truths doesn’t suffice. We are looking for how-actually explanations and not how-possibly explanations. The model world is not the real world. Model worlds may well be ergodic. Real-world economies are not.

Samuelson’s elaborations on revealed preference theory show this in an illuminating way. The very raison d’être for developing revealed preference theory in the 1930s and 1940s was to be able to ascertain people’s preferences by observation of their actual behaviour on markets and not having to make unobservable psychological assumptions or rely on any utility concepts. This turned out to be impossible. Samuelson et consortes had to assume unchanging preferences, which, of course, was in blatant contradiction to the attempt of building a consumer and demand theory without non-observational concepts. Preferences are only revealed from market behaviour when specific theoretical constraining assumptions are made. Without making those assumptions there are no valid inferences to make from observing people’s choices on a market.

But still, a lot of mainstream economists consider the approach offered by revealed preference theory great progress. As people like Robinson, Georgescu-Roegen, and Kornai have shown, this is, however, nothing but an illusion. Revealed preference theory does not live up to what it claims to offer. As part of the economist’s tool-kit, it is of extremely limited use.

If we want to be able to explain the behaviour and choices people make, we have to know something about people’s beliefs, preferences, uncertainties, and understandings. Revealed preference theory does not provide us with any support whatsoever in accomplishing that.

So why did Samuelson basically fail in his theoretical endeavours?

One reason is that he did not — like most of mainstream economists that have followed in his footsteps — seriously reflect on the fact that limiting model assumptions in economic science always have to be closely examined since if we are going to be able to show that the mechanisms or causes that we isolate and handle in our models are stable in the sense that they do not change when we ‘export’ them to our ‘target systems,’ we have to be able to show that they do not only hold under ceteris paribus conditions and a fortiori only are of limited value to our understanding, explanations or predictions of real economic systems.

Another reason is that he confused epistemology and ontology. The validity of the inferential models we as scientists use ultimately depends on the assumptions we make about the entities to which we apply them. Applying a relevant modelling strategy presupposes far-reaching ontological presuppositions. If we are prepared to assume that societies and economies are like urns filled with coloured balls in fixed proportions, then fine. But — really — who could earnestly believe in such an utterly ridiculous analogy? In a real world full of ‘unknown unknowns’ and genuine non-ergodic uncertainty, urns are of little avail.