Coronavirus pandemic cripples U.S. economy The economic toll tied to the coronavirus pandemic intensifies. Over the last three weeks, more than 16 million Americans have made unemployment claims. The unemployment rate is now over 10%. In the coming weeks, more people will face income and job losses. So how do we get out of this unprecedented crisis? To both Keynes and Lerner, it was evident that the state has the ability to promote full employment and a stable price level — and that it should use its powers to do so. If that means that it has to take on debt and (more or less temporarily) underbalance its budget — so let it be! Public debt is neither good nor bad. It is a means to achieve two over-arching macroeconomic goals — full employment and price

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

Coronavirus pandemic cripples U.S. economy

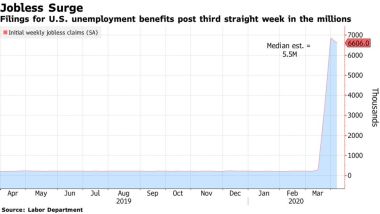

The economic toll tied to the coronavirus pandemic intensifies. Over the last three weeks, more than 16 million Americans have made unemployment claims. The unemployment rate is now over 10%. In the coming weeks, more people will face income and job losses.

The economic toll tied to the coronavirus pandemic intensifies. Over the last three weeks, more than 16 million Americans have made unemployment claims. The unemployment rate is now over 10%. In the coming weeks, more people will face income and job losses.

So how do we get out of this unprecedented crisis?

To both Keynes and Lerner, it was evident that the state has the ability to promote full employment and a stable price level — and that it should use its powers to do so. If that means that it has to take on debt and (more or less temporarily) underbalance its budget — so let it be! Public debt is neither good nor bad. It is a means to achieve two over-arching macroeconomic goals — full employment and price stability. What is sacred is not to have a balanced budget or running down public debt per se, regardless of the effects on the macroeconomic goals. If ‘sound finance,’ austerity and balanced budgets means increased unemployment and destabilizing prices, they have to be abandoned.