Pretending that the distribution of income and wealth that results from a long set of policy decisions is somehow the natural workings of the market is not a serious position … Pretending that distributional outcomes are just the workings of the market is convenient for any beneficiaries of this inequality, even those who consider themselves liberal … But we should not structure our understanding of the economy around political convenience. There is no way of escaping the fact that levels of output and employment are determined by policy, that the length and strength of patent and copyright monopolies are determined by policy, and that the rules of corporate governance are determined by policy. The people who would treat these and other policy decisions determining the

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

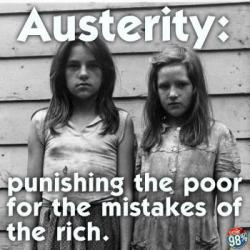

Pretending that the distribution of income and wealth that results from a long set of policy decisions is somehow the natural workings of the market is not a serious position …

Pretending that distributional outcomes are just the workings of the market is convenient for any beneficiaries of this inequality, even those who consider themselves liberal …

But we should not structure our understanding of the economy around political convenience. There is no way of escaping the fact that levels of output and employment are determined by policy, that the length and strength of patent and copyright monopolies are determined by policy, and that the rules of corporate governance are determined by policy. The people who would treat these and other policy decisions determining the distribution of income as somehow given are not being honest.

No one ought to doubt that the idea that capitalism is an expression of impartial market forces of supply and demand, bears but little resemblance to actual reality. Wealth and income distribution, both individual and functional, in a market society is to an overwhelmingly high degree influenced by institutionalized political and economic norms and power relations, things that have relatively little to do with marginal productivity in complete and profit-maximizing competitive market models.

No one ought to doubt that the idea that capitalism is an expression of impartial market forces of supply and demand, bears but little resemblance to actual reality. Wealth and income distribution, both individual and functional, in a market society is to an overwhelmingly high degree influenced by institutionalized political and economic norms and power relations, things that have relatively little to do with marginal productivity in complete and profit-maximizing competitive market models.