Summary:

The idiots at S&P are at it again, downgrading China's "debt." This asinine rating agency does not understand the distinction between a currency issuing nation (of which, China is one) and a country that doesn't issue currency or, that has debt denominated in another currency.All of China's "debt" is denominated in yuan, which they have the monopoly power to issue. There is zero risk that China wouldn't be able to meet its obligations in yuan.Anyway, what do you expect from a firm that rated all of the junk debt that caused the housing crisis AAA?By the way, S&P is not alone. Moody's and Fitch are also just as bad. All three have their heads up their asses.

Topics:

Mike Norman considers the following as important: China, Debt, Moody's, S&P

This could be interesting, too:

The idiots at S&P are at it again, downgrading China's "debt." This asinine rating agency does not understand the distinction between a currency issuing nation (of which, China is one) and a country that doesn't issue currency or, that has debt denominated in another currency.All of China's "debt" is denominated in yuan, which they have the monopoly power to issue. There is zero risk that China wouldn't be able to meet its obligations in yuan.Anyway, what do you expect from a firm that rated all of the junk debt that caused the housing crisis AAA?By the way, S&P is not alone. Moody's and Fitch are also just as bad. All three have their heads up their asses.

Topics:

Mike Norman considers the following as important: China, Debt, Moody's, S&P

This could be interesting, too:

Dean Baker writes Donald Trump is badly nonfused # 67,218: The story of supply and demand

Merijn T. Knibbe writes Peak babies has been. Young men are not expendable, anymore.

Robert Skidelsky writes In Memory of David P. Calleo – Bologna Conference

The idiots at S&P are at it again, downgrading China's "debt." This asinine rating agency does not understand the distinction between a currency issuing nation (of which, China is one) and a country that doesn't issue currency or, that has debt denominated in another currency.

All of China's "debt" is denominated in yuan, which they have the monopoly power to issue. There is zero risk that China wouldn't be able to meet its obligations in yuan.

Anyway, what do you expect from a firm that rated all of the junk debt that caused the housing crisis AAA?

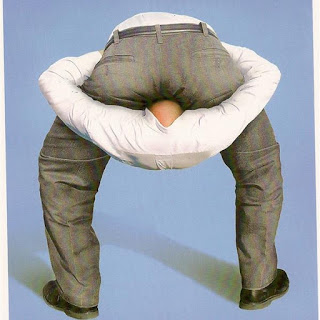

By the way, S&P is not alone. Moody's and Fitch are also just as bad. All three have their heads up their asses.