Cumulative TTM earnings for the entire S&P 500 about .5T … Fed transferring 5% IOR on T Reserve Balances to Depositories = 0B annual… Treasury in transition process of paying 5% on T public debt to USD savers in Treasury Securities Accounts = (eventually) .25T annual….Collectively these two are in process of providing approximately additional amount of annual free munnie equivalent to what a year of blood sweat and tears shed by all of the millions of people working at the S&Ps are earning…And the Art Degree morons are trying to tell us this is supposed to be bearish? ?

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

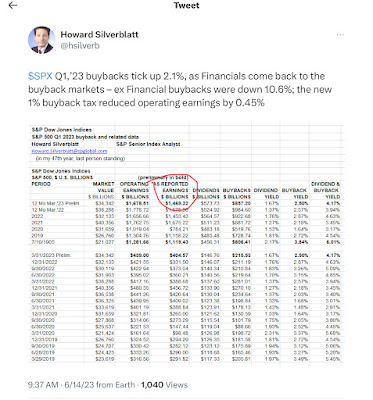

Cumulative TTM earnings for the entire S&P 500 about $1.5T … Fed transferring 5% IOR on $3T Reserve Balances to Depositories = $150B annual… Treasury in transition process of paying 5% on $25T public debt to USD savers in Treasury Securities Accounts = (eventually) $1.25T annual….

Collectively these two are in process of providing approximately additional amount of annual free munnie equivalent to what a year of blood sweat and tears shed by all of the millions of people working at the S&Ps are earning…

And the Art Degree morons are trying to tell us this is supposed to be bearish? ?