Initial and continuing claims edge closer to signaling recession – by New Deal democrat There’s a blizzard of data this morning. I’ll report on retail sales and Industrial production later. But let’s start with initial jobless claims, which were unchanged this week at 262,000, the highest level in over 18 months. The 4 week average increased 9,250 to 246,750. Continuing claims, with a one week lag, increased 20,000 to 1.775 million: Recently a similar spike over 260,000 was revised away due to a State’s reporting issue. So far it has not happened this time. YoY initial claims are up 20.7%. The more important 4 week average is up 15.4%, the first time it has been over 12.5% since immediately after the pandemic. Continuing claims are up

Topics:

NewDealdemocrat considers the following as important: Hot Topics, jobless claims, New Deal Democrat, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Initial and continuing claims edge closer to signaling recession

– by New Deal democrat

There’s a blizzard of data this morning. I’ll report on retail sales and Industrial production later.

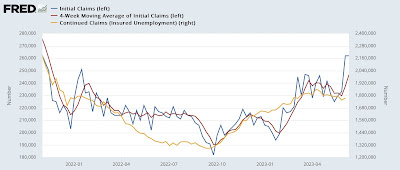

But let’s start with initial jobless claims, which were unchanged this week at 262,000, the highest level in over 18 months. The 4 week average increased 9,250 to 246,750. Continuing claims, with a one week lag, increased 20,000 to 1.775 million:

Recently a similar spike over 260,000 was revised away due to a State’s reporting issue. So far it has not happened this time.

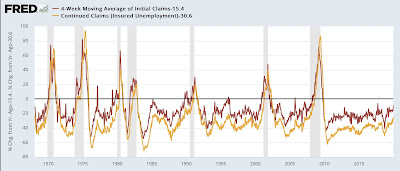

YoY initial claims are up 20.7%. The more important 4 week average is up 15.4%, the first time it has been over 12.5% since immediately after the pandemic. Continuing claims are up 30.6%:

Here is 50 year+ look at the Yoy% change in the 4 week average and continuing claims, both normed to 0 as of this week’s reading:

Except for brief spikes of only a few weeks, only once in the past 50+ years (specifically, 1989) has the 4 week average of initial claims been this higher YoY without there being an imminent recession. Continuing claims this much higher YoY has *always* signaled a recession, with no false positives or negatives.

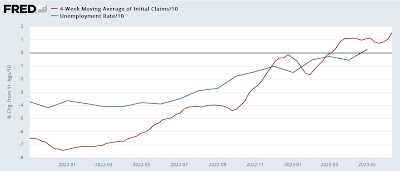

Finally, since initial claims lead the unemployment rate, here is what the latest data implies for the YoY change in the unemployment rate in the next several months:

The unemployment rate could climb another 0.2% or 0.3% in the next few months. This would still not trigger the Sahm rule, which retrospectively reliably tells us we are in a recession after it starts.

Yellow flag from initial jobless claims turns a little more orangey, Angry Bear, New Deal democrat