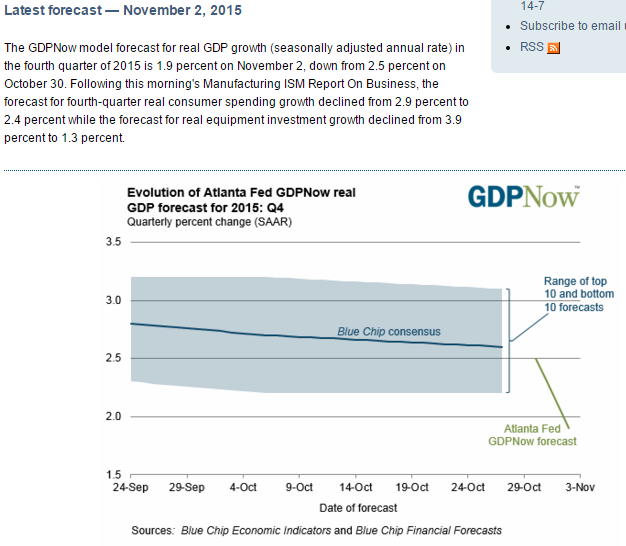

Down to 1.9 for Q4, after being very close for Q1, Q2 and Q3: German Engineering Orders Hit by Lower Demand From China By Nina AdamNov 2 (WSJ) — Germany’s VDMA engineering federation said Monday that its “plant and machinery makers are battling against global markets’ adversities.” German mechanical engineering orders slumped 13% year-over-year in September, hit by a 18% drop in foreign demand. Foreign orders from outside the eurozone were down 7% in the nine months through September from the same period a year earlier. “Companies are feeling the pinch from turbulences in China, which are also affecting other key developing markets,” said Olaf Wortmann, an economist at VDMA, which represents more than 3,000 midsize companies. Still depressed but a hopeful forecast, though not long ago 2.8% year over year growth would have been considered low: RedbookRedbook’s same-store sales tally has been climbing, up 4 tenths in the October 31 to a year-on-year plus 1.9 percent. But the report’s commentary is mixed, saying some retailers benefited from Halloween shopping though it said the fact that Halloween fell on Saturday actually kept shoppers out of stores on Halloween itself. The report’s month-to-month reading shows no meaningful change against September. But the report’s outlook for the key shopping month of November is very strong, forecasting 2.

Topics:

WARREN MOSLER considers the following as important: Employment, GDP, Germany

This could be interesting, too:

Ken Houghton writes Just Learn to Code

Angry Bear writes GDP Grows 2.3 Percent

Merijn T. Knibbe writes Employment growth in Europe. Stark differences.

NewDealdemocrat writes Real GDP for Q3 nicely positive, but long leading components mediocre to negative for the second quarter in a row

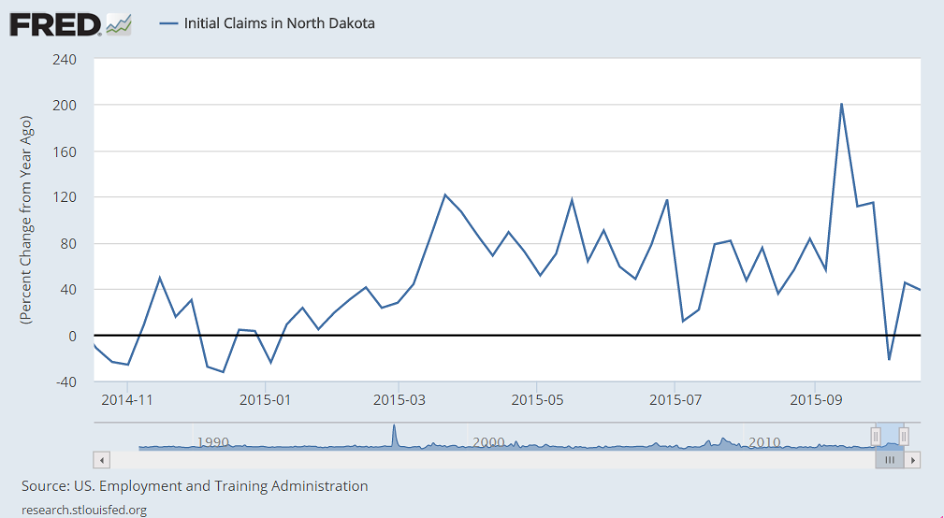

Down to 1.9 for Q4, after being very close for Q1, Q2 and Q3:

German Engineering Orders Hit by Lower Demand From China

By Nina Adam

Nov 2 (WSJ) — Germany’s VDMA engineering federation said Monday that its “plant and machinery makers are battling against global markets’ adversities.” German mechanical engineering orders slumped 13% year-over-year in September, hit by a 18% drop in foreign demand. Foreign orders from outside the eurozone were down 7% in the nine months through September from the same period a year earlier. “Companies are feeling the pinch from turbulences in China, which are also affecting other key developing markets,” said Olaf Wortmann, an economist at VDMA, which represents more than 3,000 midsize companies.

![]()

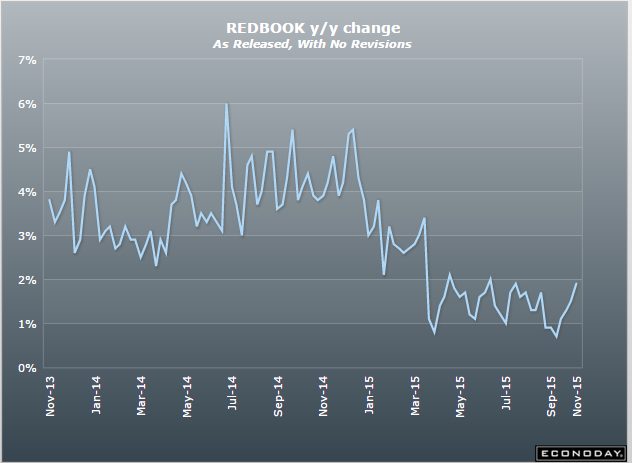

Still depressed but a hopeful forecast, though not long ago 2.8% year over year growth would have been considered low:

Redbook

Redbook’s same-store sales tally has been climbing, up 4 tenths in the October 31 to a year-on-year plus 1.9 percent. But the report’s commentary is mixed, saying some retailers benefited from Halloween shopping though it said the fact that Halloween fell on Saturday actually kept shoppers out of stores on Halloween itself. The report’s month-to-month reading shows no meaningful change against September. But the report’s outlook for the key shopping month of November is very strong, forecasting 2.8 percent year-on-year same-store sales growth for the month.

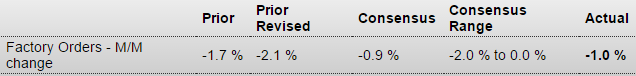

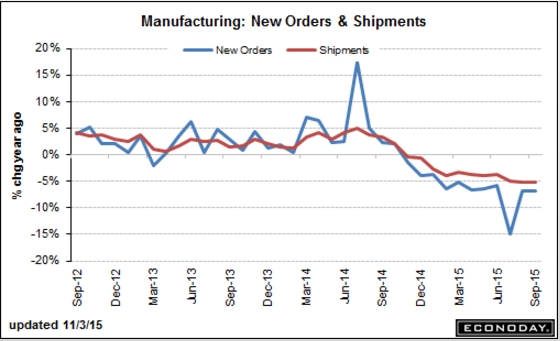

Bad, worse then expected, and prior month revised lower as well:

Factory Orders

Highlights

New orders for the export-hit factory sector fell 1.0 percent in September for the 11th decline in 14 months. Orders for durable goods, initially posted in last week’s advance report, are unrevised at minus 1.2 percent, held down in part by a downswing in civilian aircraft but nevertheless showing wide weakness. Orders for non-durable goods, pulled down by weakness for petroleum and coal products, fell 0.8 percent to extend a run of sizable declines going back to July. The factory sector has been struggling with weakness in the energy sector and especially weak foreign demand that for U.S. goods has been made weaker by the strength in the dollar.