Looks a lot more negative since the October 5 Saudi price cuts than the futures markets. These price are more indicative of prices of physical oil vs financial portfolio activities:Note the lack of results of ‘monetary policy’: China’s October factory, services surveys show economy still wobbly Nov 1 (Reuters) — Activity in China’s manufacturing sector unexpectedly contracted in October for a third straight month, an official survey showed on Sunday, fuelling fears the economy may still be losing momentum in the fourth quarter despite a raft of stimulus measures.Adding to those concerns, China’s services sector, which has been one of the few bright spots in the economy, also showed signs of cooling last month, expanding at its slowest pace in nearly seven years.“As deflation risks intensify, a further RRR cut before end of this year is still possible,” ANZ said, referring to reducing the amount of reserves that banks must hold in order to free up more funds for new loans.The official Purchasing Managers’ Index(PMI) was at 49.8 in October, the same pace as in previous month and lagging market expectations of 50.0, according to the National Bureau of Statistics(NBS). A reading below 50 points suggests an contraction.

Topics:

WARREN MOSLER considers the following as important: China, Comodities, GDP

This could be interesting, too:

Angry Bear writes GDP Grows 2.3 Percent

Dean Baker writes Donald Trump is badly nonfused # 67,218: The story of supply and demand

Merijn T. Knibbe writes Peak babies has been. Young men are not expendable, anymore.

Robert Skidelsky writes In Memory of David P. Calleo – Bologna Conference

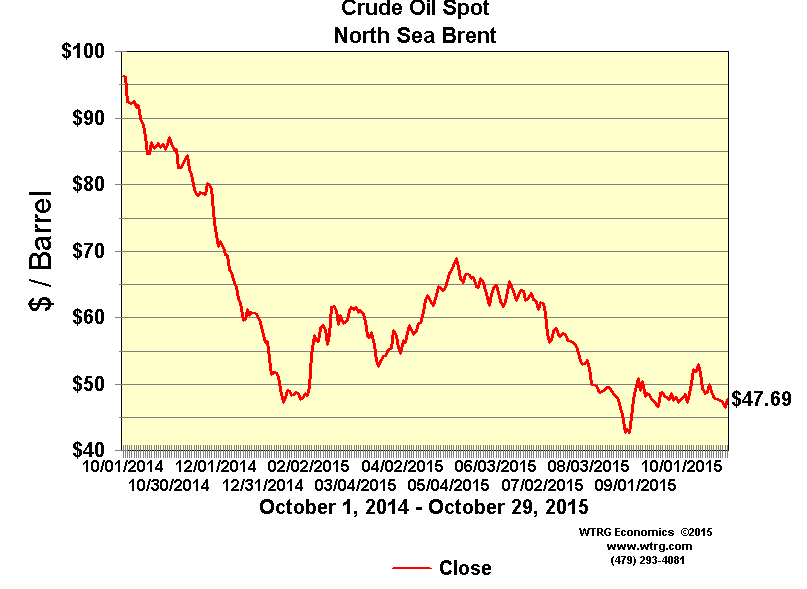

Looks a lot more negative since the October 5 Saudi price cuts than the futures markets. These price are more indicative of prices of physical oil vs financial portfolio activities:

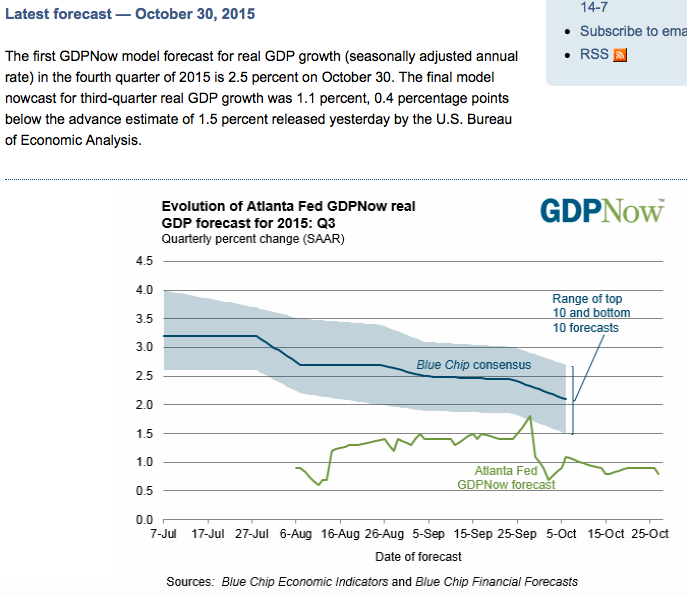

Note the lack of results of ‘monetary policy’:

China’s October factory, services surveys show economy still wobbly

Nov 1 (Reuters) — Activity in China’s manufacturing sector unexpectedly contracted in October for a third straight month, an official survey showed on Sunday, fuelling fears the economy may still be losing momentum in the fourth quarter despite a raft of stimulus measures.

Adding to those concerns, China’s services sector, which has been one of the few bright spots in the economy, also showed signs of cooling last month, expanding at its slowest pace in nearly seven years.

“As deflation risks intensify, a further RRR cut before end of this year is still possible,” ANZ said, referring to reducing the amount of reserves that banks must hold in order to free up more funds for new loans.

The official Purchasing Managers’ Index(PMI) was at 49.8 in October, the same pace as in previous month and lagging market expectations of 50.0, according to the National Bureau of Statistics(NBS). A reading below 50 points suggests an contraction.

New export orders contracted for a 13th straight month, though the sub-index for new orders – a proxy for both domestic and foreign demand – edged up marginally to 50.3, compared with September’s 50.2.

Faced with persistently weak demand, factory owners continued to lay off workers and at a slightly faster pace than in September.

As for the services sector, whose growth has helped offset persistent weakness in manufacturing, the official non-manufacturing PMI fell to 53.1 in October from September’s 53.4. Though still a solid pace of expansion, it was the lowest reading since late 2008 during the global financial crisis, a similar survey showed.

SMALL FIRMS FACING BIGGER STRESSES

Activity in small and mid-sized firms continued to contract in October, with more small firms seeing fund shortages compared to big ones, the official survey showed. Small companies account for up to 80 percent of urban employment and 60 percent of China’s GDP.

The government has cut interest rates six times since November and lowered the amount of cash that banks must hold as reserves four times this year. The latest cut in interest rates and banks’ reserve requirement came on Oct 23.

Beijing has also quickened spending on infrastructure and eased curbs on the ailing property sector. The latter have helped revive weak home sales and prices but have not yet reversed a sharp decline in property investment.

Many economists had expected economic growth would bottom out in the third quarter, with a modest improvement late this year and into early 2016 as additional stimulus measures gradually take effect.

Starting out at 2.5% this quarter. We’ll see how it evolves as numbers are released: