Part of the Fed’s mandate is to hit it’s 2% inflation target:Still at recession type levels:This is also what recession looks like:The anointed ‘driver of the economy’ continues to falter as previously discussed: Housing Market IndexHighlightsThe housing market index from the nation’s home builders shows weakness, at 62 for November and missing the Econoday consensus by 2 points. And compared to a revised October, the index is down 3 points. Yet readings in the report, though slowing, remain solid and one important detail is favorable.Of the report’s three components, future sales are down a sizable 5 points but the level is still in the seventies, exactly at 70. Present sales, which is the most heavily weighted component, fell 3 points to 67, also still a strong level.The positive in the report is a 1 point rise in traffic, a component which, at 48 in the latest report, has been lagging badly but is getting closer to the breakeven 50 mark. Weakness in this reading has been reflecting lack of first-time buyers in the market.Turning to regional data, the highest composite score goes to the West, at an enormously strong 77, followed by the South, at 62. Two less watched regions for new homes, the Midwest and North, trail at 59 and 52.

Topics:

WARREN MOSLER considers the following as important: GDP, inflation, Japan

This could be interesting, too:

Matias Vernengo writes Serrano, Summa and Marins on Inflation, and Monetary Policy

Angry Bear writes Voters Blame Biden and Harris for Inflation

Angry Bear writes GDP Grows 2.3 Percent

Lars Pålsson Syll writes How inequality causes financial crises

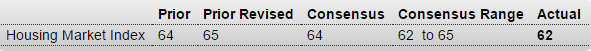

Part of the Fed’s mandate is to hit it’s 2% inflation target:

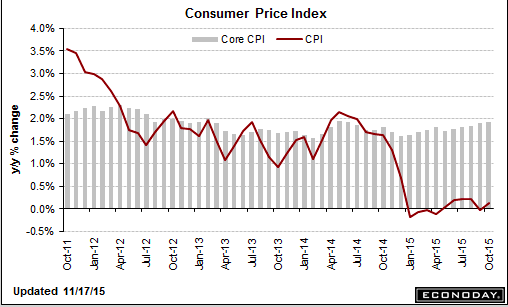

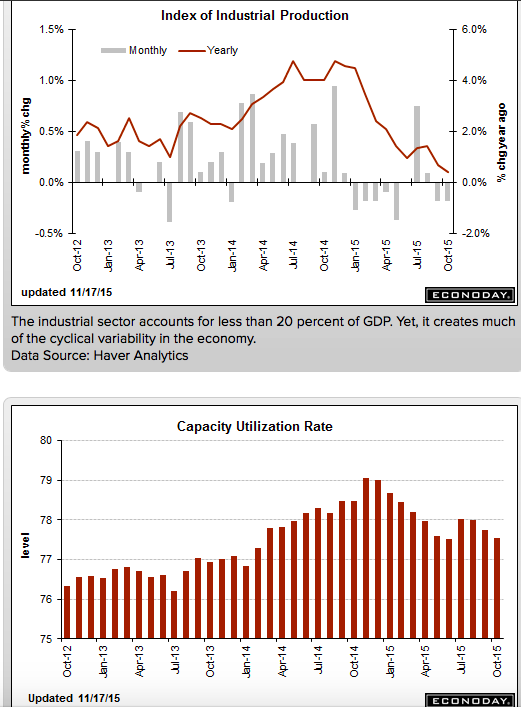

Still at recession type levels:

This is also what recession looks like:

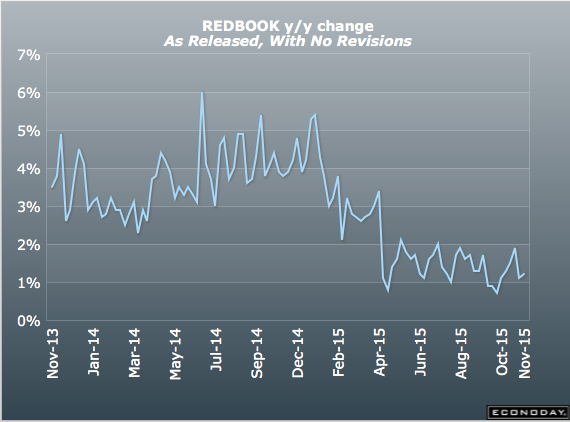

The anointed ‘driver of the economy’ continues to falter as previously discussed:

Housing Market Index

Highlights

The housing market index from the nation’s home builders shows weakness, at 62 for November and missing the Econoday consensus by 2 points. And compared to a revised October, the index is down 3 points. Yet readings in the report, though slowing, remain solid and one important detail is favorable.Of the report’s three components, future sales are down a sizable 5 points but the level is still in the seventies, exactly at 70. Present sales, which is the most heavily weighted component, fell 3 points to 67, also still a strong level.

The positive in the report is a 1 point rise in traffic, a component which, at 48 in the latest report, has been lagging badly but is getting closer to the breakeven 50 mark. Weakness in this reading has been reflecting lack of first-time buyers in the market.

Turning to regional data, the highest composite score goes to the West, at an enormously strong 77, followed by the South, at 62. Two less watched regions for new homes, the Midwest and North, trail at 59 and 52.

There are positives in this report but the decline in both future and present sales is a reminder that both starts and permits for single-family homes have been slowing. Despite the rise in traffic, this report probably pulls back the housing outlook by a degree.

October 2015 Sea Container Counts Continue to Show Trade Recession Continues

By Steven Hansen

The data for this series continues to be in contraction. The year-to-date volumes are contracting for both exports and imports. The trade sector remains in a recession.

Federal agencies don’t need ‘capital’ to function.

This is simply unspent income that reduces aggregate demand:

FHA Meets Minimum Reserve Requirement for First Time Since 2009

(WSJ) — The Federal Housing Administration, which backs low-down-payment mortgages popular with first-time home buyers, said its insurance fund’s net worth at the end of September was $23.8 billion, up from a year-earlier level of $4.8 billion. Its capital reserve ratio, which by law is required to stay above 2%, rose to 2.07%, the first time it met the threshold since the start of the agency’s 2009 fiscal year. With the private subprime-mortgage market largely gone, the agency offers some of the easiest terms available, letting borrowers with a credit score as low as 580 make a down payment of as little as 3.5%.

Passenger car registrations: +8.2% over ten months; +2.9% in October

(ACEA) — In October 2015, the EU passenger car market continued its upward trend, despite a slower rate of increase (+2.9%), marking the 26th consecutive month of growth. Demand for new passenger cars saw momentum slowing down in all major markets. Registrations in Italy (+8.6%), Spain (+5.2%), Germany (+1.1%) and France (+1.0%) kept growing, even though less strong than in past months, while the UK market declined in October (-1.1%). Across the region, new passenger car registrations totalled 1,104,868 units, also supported by growth in the EU’s new member states (EU-12).

Can’t admit fiscal works and monetary doesn’t:

Abe to call for supplementary budget topping 3tn yen

(Nikkei) — Prime Minister Shinzo Abe will direct the Japanese government to put together a supplementary budget totaling more than 3 trillion yen ($24.2 billion) next week to help shore up a flagging economy. The government is set to compile measures to cope with the Trans-Pacific Partnership trade pact on Nov. 25 and steps for promoting active civic engagement on Nov. 26, with both to be incorporated into the extra budget for fiscal 2015. The prime minister declined to characterize the supplementary budget as a stimulus measure, since doing so could be seen as admitting defeat on Abenomics.

Capital spending delays took toll on July-September GDP

(Nikkei) —Weak capital investment led Japan’s economy to shrink by an annualized 0.8% in the three months ended September. A 1.3% drop in capital investment was the main cause of the decline. Corporations had planned to invest a good deal this fiscal year, though the follow-through has been lacking. Machinery orders, which typically lead capital investment by three to six months, slipped 10% for the July-September quarter. But if the outlook for economic growth overseas remains hazy, more companies could put investment on hold.