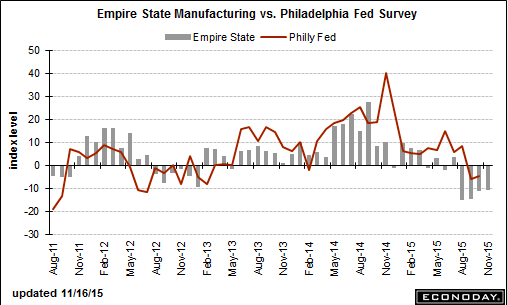

The recession continues: Empire State Mfg SurveyHighlightsNegatives are beginning to run in Empire State with the index at minus 10.74 in November, right in line with the prior four readings and well below the Econoday consensus for minus 5.00. Several components are showing extended weakness including unfilled orders, at minus 18.18 for the lowest reading of the year, and also the workweek, at minus 14.55 for a fifth straight decline and the weakest run since mid 2013. With unfilled orders down and the workweek down, it’s no surprise that employment is down, at minus 7.27 for a third straight loss and the weakest streak since late 2009. And prices, even outside of energy and commodities, are not helped by weak demand with prices for final goods at minus 4.55 for a third straight decline and the longest run of contraction since early 2013.Good news is hard to find but there is easing weakness in new orders, at minus 11.82 vs October’s minus 18.91, and in shipments as well, at minus 4.10 vs minus 13.61. Still, this is the sixth straight decline for new orders and the fourth straight for shipments. Manufacturers are keeping their inventories down while delivery times, reflecting the weakness in shipments, are speeding up.This report is the first indication on November’s factory sector and it points to another run of weak regional reports, starting Thursday with the Philly Fed.

Topics:

WARREN MOSLER considers the following as important: China, equities

This could be interesting, too:

Dean Baker writes Donald Trump is badly nonfused # 67,218: The story of supply and demand

Merijn T. Knibbe writes Peak babies has been. Young men are not expendable, anymore.

Robert Skidelsky writes In Memory of David P. Calleo – Bologna Conference

The recession continues:

Empire State Mfg Survey

Highlights

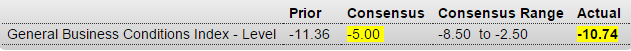

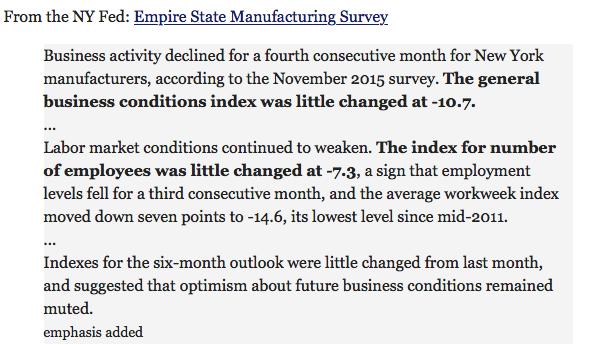

Negatives are beginning to run in Empire State with the index at minus 10.74 in November, right in line with the prior four readings and well below the Econoday consensus for minus 5.00. Several components are showing extended weakness including unfilled orders, at minus 18.18 for the lowest reading of the year, and also the workweek, at minus 14.55 for a fifth straight decline and the weakest run since mid 2013. With unfilled orders down and the workweek down, it’s no surprise that employment is down, at minus 7.27 for a third straight loss and the weakest streak since late 2009. And prices, even outside of energy and commodities, are not helped by weak demand with prices for final goods at minus 4.55 for a third straight decline and the longest run of contraction since early 2013.Good news is hard to find but there is easing weakness in new orders, at minus 11.82 vs October’s minus 18.91, and in shipments as well, at minus 4.10 vs minus 13.61. Still, this is the sixth straight decline for new orders and the fourth straight for shipments. Manufacturers are keeping their inventories down while delivery times, reflecting the weakness in shipments, are speeding up.

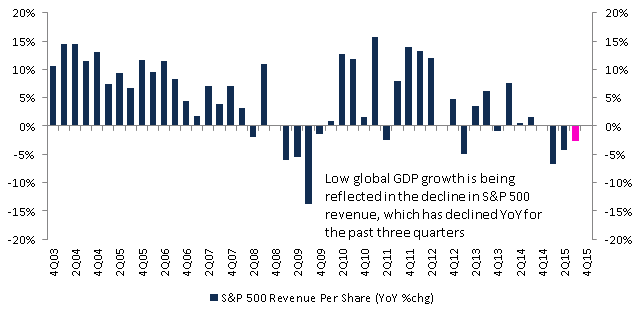

This report is the first indication on November’s factory sector and it points to another run of weak regional reports, starting Thursday with the Philly Fed. The factory sector, hit by weak exports and in contraction for a full year, is becoming perhaps the economy’s Achilles heal — and also perhaps a dovish wildcard for the December FOMC.

Power usage has been a reasonable growth indicator:

China’s power use drops slightly in Oct.

Nov 16 (Xinhua) — China’s electricity consumption edged down 0.2 percent to 449.1 billion kilowatt hours (kwh) in October. In the first ten months, power use rose 0.7 percent from a year earlier to 4.58 trillion kwh. China’s value-added industrial output of the electricity, heating, gas and water sectors lost 0.3 percent in October, while September saw 0.7-percent growth. Electricity use in the service sector rose 7.1 percent in the first ten months, the agricultural sector posted a 3.0 percent increase, while use by the industrial sector dropped 1.1 percent from a year earlier, the NEA said.

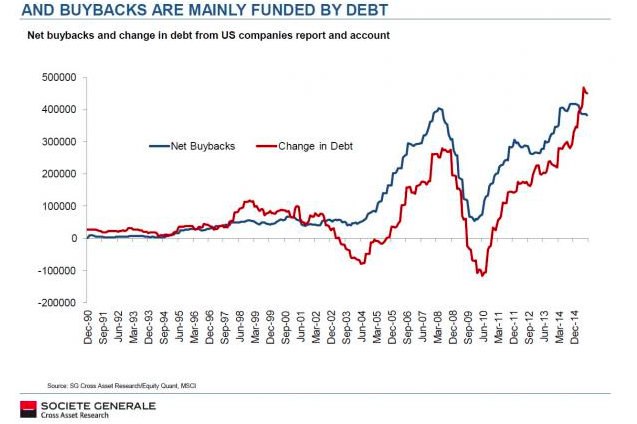

So seems the new corporate debt is largely going towards stock buy backs, substituting debt for equity on the balance sheets, leaving corps more leveraged than otherwise: