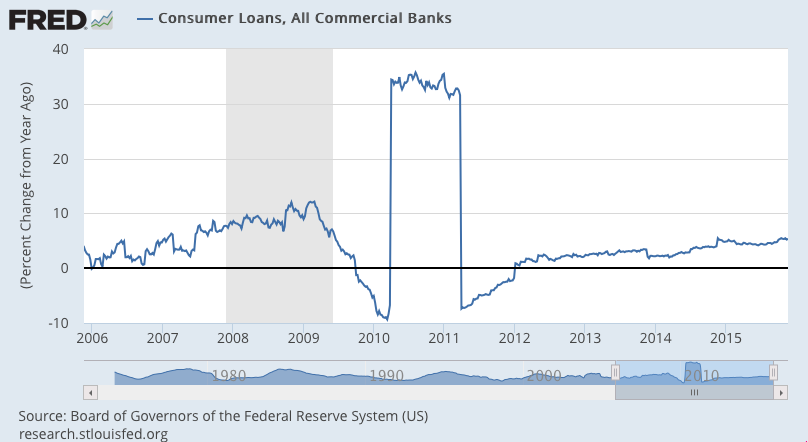

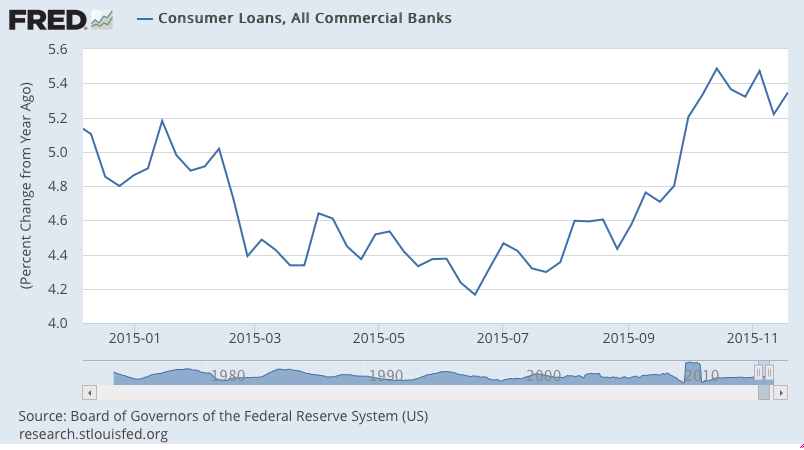

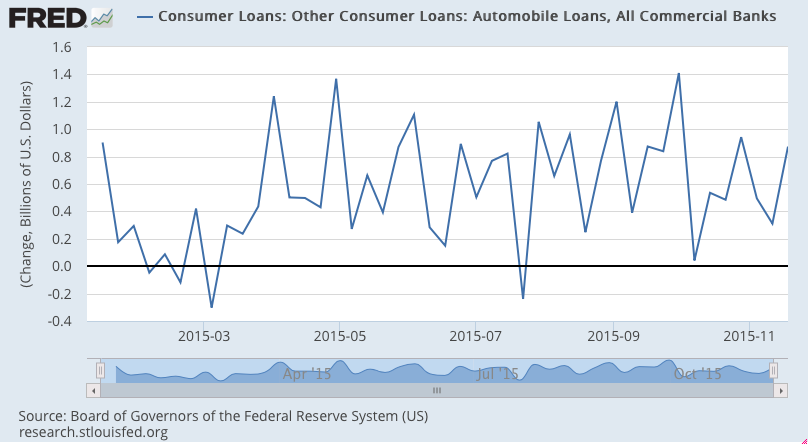

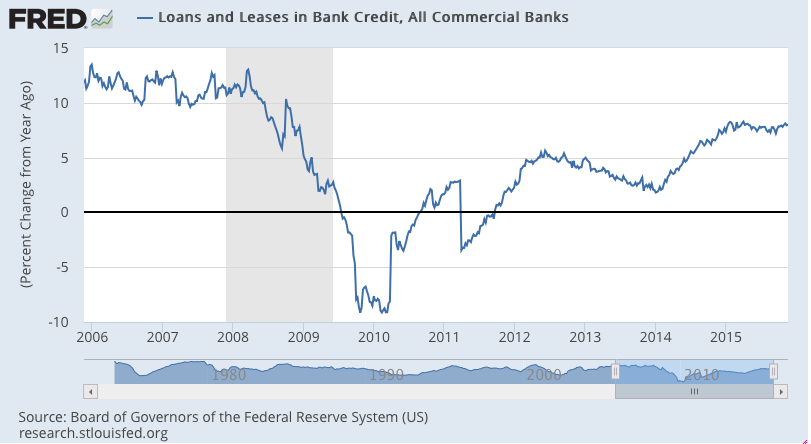

Nothing of consequence here. Growth still below prior cycles and not accelerating as it was beginning to do before oil capex collapsed: While growth of real estate lending is still far below the prior cycle, it has been increasing, probably due to fewer ‘all cash’ purchases, and the modest recovery in prices and sales:Consumer credit growth remains modest and, if If anything, is softening most recently: Looks to me like car loan growth is slowing a bit:

Topics:

WARREN MOSLER considers the following as important: Credit

This could be interesting, too:

NewDealdemocrat writes Two long leading indicators – real money supply and credit conditions – worsen

Stavros Mavroudeas writes Comment on Miguel Ramirez’s paper, ‘Credit, Indebtedness and Speculation in Marx’s Political Economy’ – ECONOMIC THOUGHT

Mike Norman writes Vladimir Asriyan, Luc Laeven, Alberto Martin — Credit booms and information depletion

Mike Norman writes Brad DeLong — This is, I think, both right and wrong. China has an… interesting property-rights system—your property is secure not …

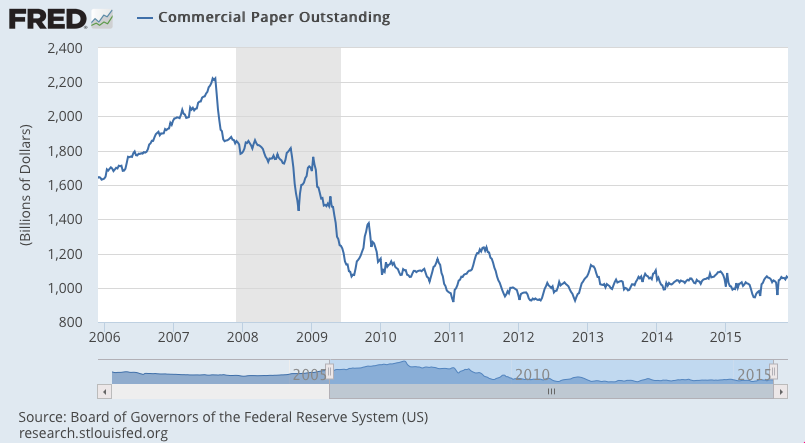

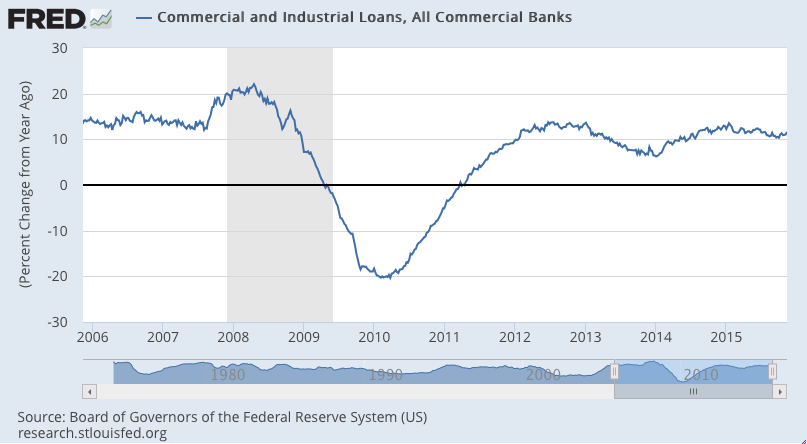

Nothing of consequence here. Growth still below prior cycles and not accelerating as it was beginning to do before oil capex collapsed:

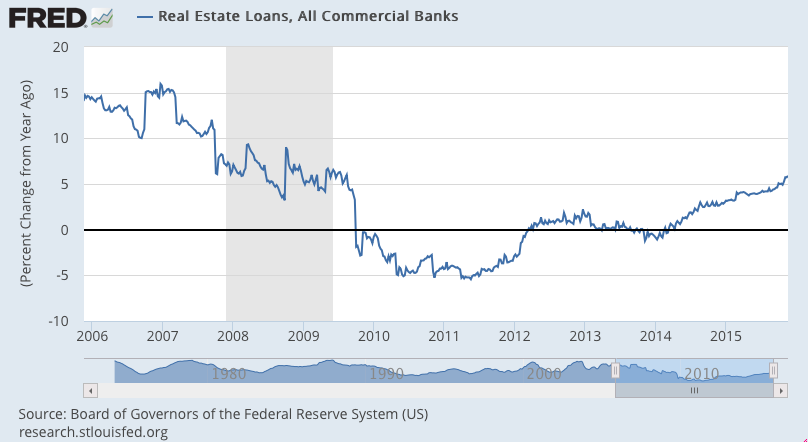

While growth of real estate lending is still far below the prior cycle, it has been increasing, probably due to fewer ‘all cash’ purchases, and the modest recovery in prices and sales:

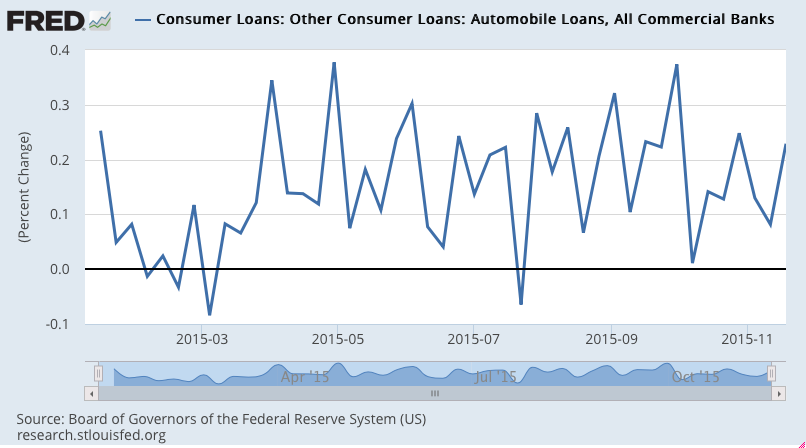

Consumer credit growth remains modest and, if If anything, is softening most recently: