Growth rates still trending lower: Growth rate edging higher from very low levels: Back down to 1% for Q3: On October 5th Saudi price cuts were announced, as they increased discounts to various benchmark prices by substantial amounts. If the reports were accurate, the discount increases create a downward price spiral dynamic as previously described. However, since that announcement oil prices have increased approximately 10% driven by buyers reacting to various news reports ranging from reduced US output to issues surrounding the mid east conflicts. And at the same time the rising oil prices led to a lower $US, higher prices for global equities, and term structures of interest rates moving higher in yield. The risk here is that if the Saudi discounts are in fact in place, oil prices will reverse and head lower until the Saudis alter their pricing structure. And with traders and managers having previously gone ‘the wrong way’ the sell off in oil and equities will be all the more dramatic. The post Credit Check, Atlanta Fed, ECRI, Rail Traffic, Oil Comment appeared first on The Center of the Universe.

Topics:

WARREN MOSLER considers the following as important: Comodities, GDP

This could be interesting, too:

Angry Bear writes GDP Grows 2.3 Percent

NewDealdemocrat writes Real GDP for Q3 nicely positive, but long leading components mediocre to negative for the second quarter in a row

Mike Norman writes Atlanta Fed reduces Q2 GDP forecast once again, as I said they would

Frances Coppola writes Why the Tories’ “put people to work” growth strategy has failed

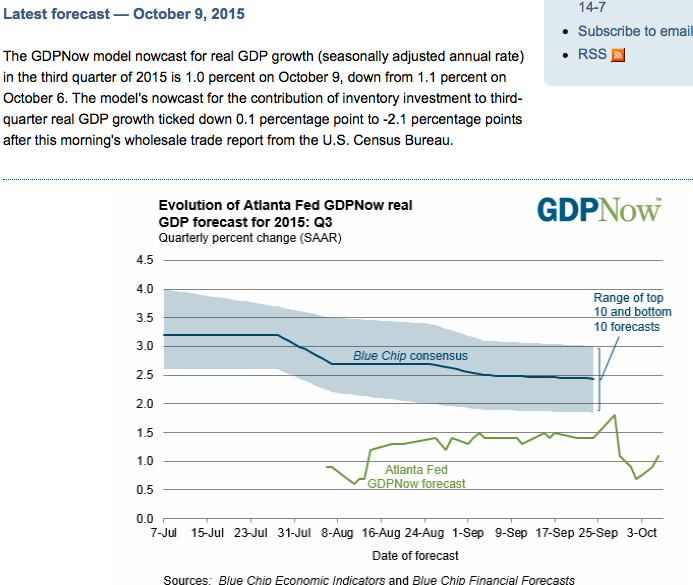

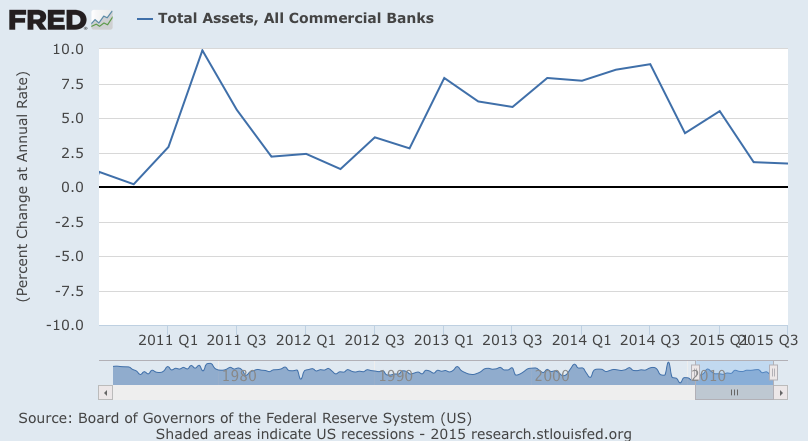

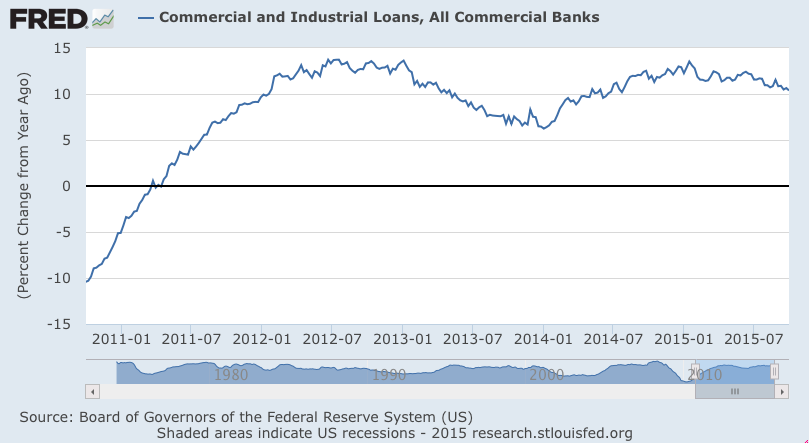

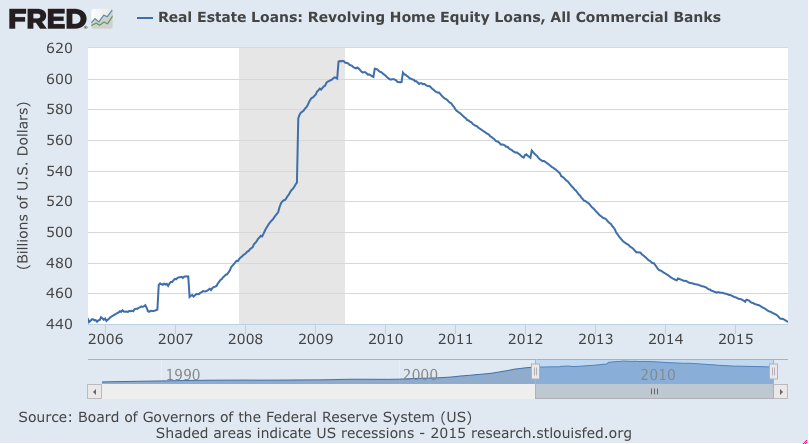

Growth rates still trending lower:

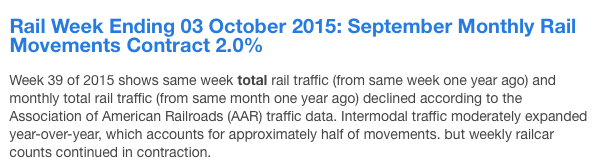

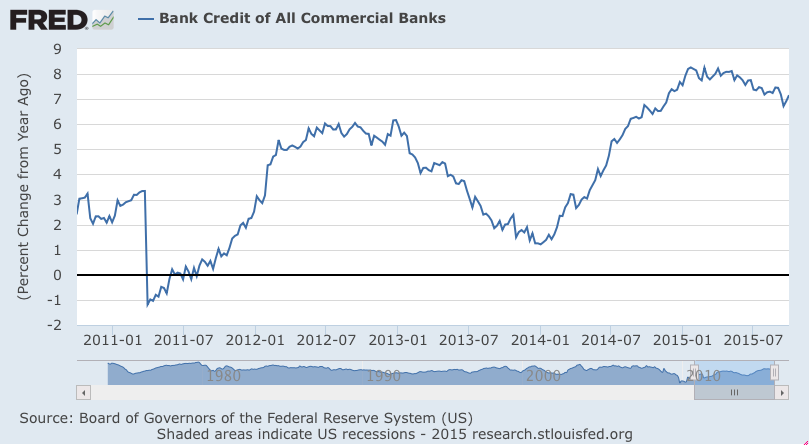

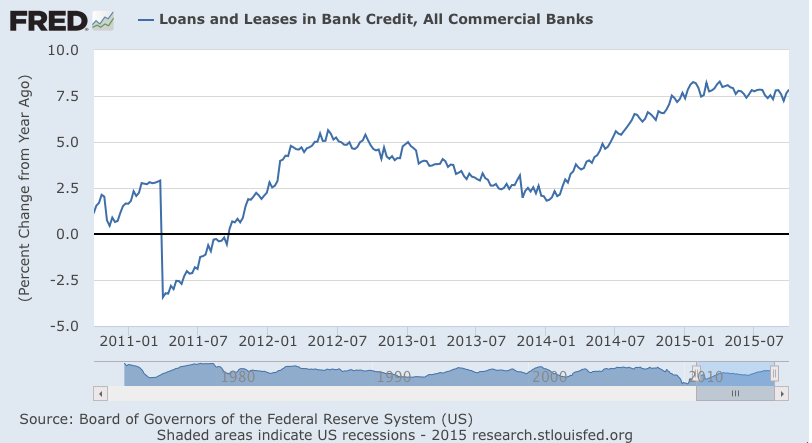

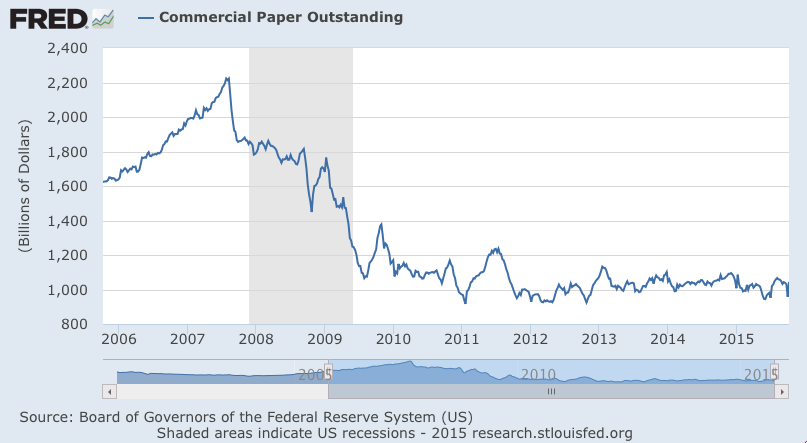

Growth rate edging higher from very low levels:

On October 5th Saudi price cuts were announced, as they increased discounts to various benchmark prices by substantial amounts. If the reports were accurate, the discount increases create a downward price spiral dynamic as previously described.

However, since that announcement oil prices have increased approximately 10% driven by buyers reacting to various news reports ranging from reduced US output to issues surrounding the mid east conflicts. And at the same time the rising oil prices led to a lower $US, higher prices for global equities, and term structures of interest rates moving higher in yield.

The risk here is that if the Saudi discounts are in fact in place, oil prices will reverse and head lower until the Saudis alter their pricing structure. And with traders and managers having previously gone ‘the wrong way’ the sell off in oil and equities will be all the more dramatic.

The post Credit Check, Atlanta Fed, ECRI, Rail Traffic, Oil Comment appeared first on The Center of the Universe.