LA area Port Traffic declined in October By Bill McBrideFirst, from the WSJ: Quiet U.S. Ports Spark Slowdown Fears For the first time in at least a decade, imports fell in both September and October at each of the three busiest U.S. seaports, according to data from trade researcher Zepol Corp. analyzed by The Wall Street Journal. …The declines came during a stretch from late summer to early fall known in the transportation world as peak shipping season, when cargo volumes typically surge through U.S. ports. It is a crucial few months for the U.S. economy as well: High import volumes can signal a confident view on the economy among retailers and manufacturers, while fears of a slowdown grow when ports are quiet. Note: There were some large swings in LA area port traffic earlier this year due to labor issues that were settled in late February. Port traffic surged in March as the waiting ships were unloaded (the trade deficit increased in March too), and port traffic declined in April. They’ve been starting too high and revising down for a very long time now! Fourth Quarter 2015 Survey of Professional Forecasters Shave Their Growth Estimates for 2016 and 2017 from the Philadelphia FedGrowth in real GDP in 2016 and 2017 looks a little slower now than it did three months ago, according to 45 forecasters surveyed by the Federal Reserve Bank of Philadelphia.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

LA area Port Traffic declined in October

By Bill McBride

First, from the WSJ: Quiet U.S. Ports Spark Slowdown Fears

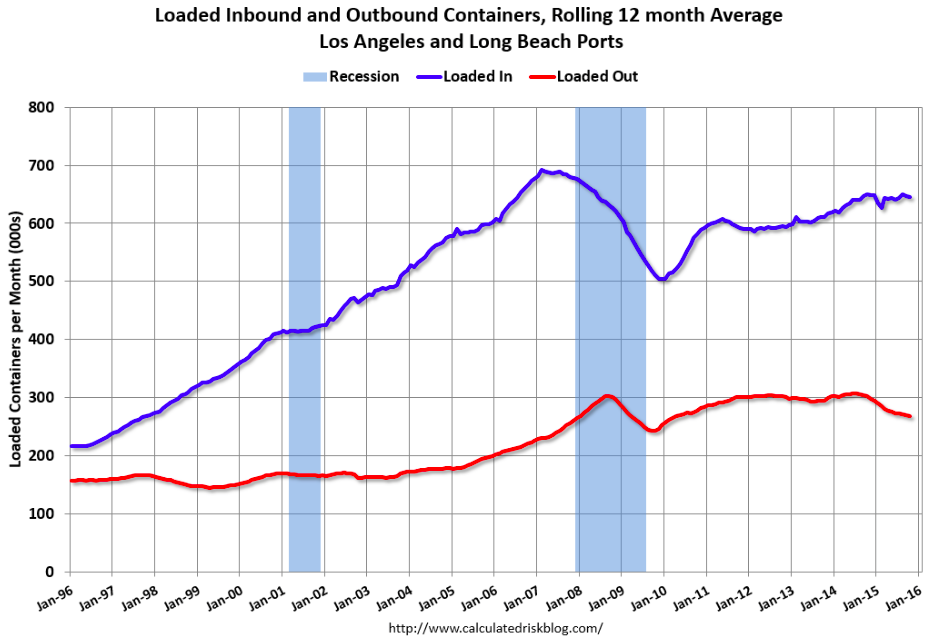

For the first time in at least a decade, imports fell in both September and October at each of the three busiest U.S. seaports, according to data from trade researcher Zepol Corp. analyzed by The Wall Street Journal. …

The declines came during a stretch from late summer to early fall known in the transportation world as peak shipping season, when cargo volumes typically surge through U.S. ports. It is a crucial few months for the U.S. economy as well: High import volumes can signal a confident view on the economy among retailers and manufacturers, while fears of a slowdown grow when ports are quiet.

Note: There were some large swings in LA area port traffic earlier this year due to labor issues that were settled in late February. Port traffic surged in March as the waiting ships were unloaded (the trade deficit increased in March too), and port traffic declined in April.

They’ve been starting too high and revising down for a very long time now!

Fourth Quarter 2015 Survey of Professional Forecasters Shave Their Growth Estimates for 2016 and 2017

from the Philadelphia Fed

Growth in real GDP in 2016 and 2017 looks a little slower now than it did three months ago, according to 45 forecasters surveyed by the Federal Reserve Bank of Philadelphia. The forecasters currently see growth in the annual-average level of real GDP at 2.6 percent in 2016 and 2.5 percent in 2017. These current estimates represent downward revisions to the outlook of three months ago, when the forecasters thought 2016 growth would be 2.8 percent and 2017 growth would be 2.6 percent. Notably, the forecasters have raised their growth estimates for 2018. They now see real GDP growing 2.8 percent in 2018, up from the previous estimate of 2.4 percent.

Japan economy shrinks 0.8 pct in Q3, back in recession