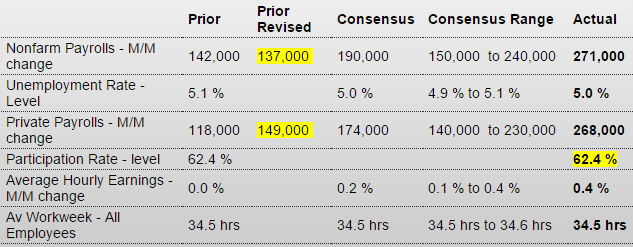

Much higher than expected, so unless next month’s number settles back down the Fed will be expected to hike rates some. Note from the chart that the last few November releases showed similar spikes followed by much lower prints: Employment SituationHighlightsBring on that rate hike! Nonfarm payrolls surged 271,000 in October vs expectations for 190,000 and against Econoday’s top-end forecast for 240,000. Revisions in prior months are not a factor. The unemployment is down 1 tenth at 5.0 percent with average hourly, to underscore all the strength, jumping 0.4 percent. Government payrolls did not inflate the headline payroll gain as private payrolls rose 268,000. There’s still one more employment report to go before the December FOMC but it seems academic following today’s report.Among the superlatives, the 240,000 rise for nonfarm payrolls is the strongest since December last year. The 5.0 percent unemployment rate is the lowest since April 2008. The broadly defined U-6 unemployment rate, a favorite of Janet Yellen’s, is down 2 tenths to 9.8 percent for the lowest reading since May 2008. The year-on-year rate for average hourly earnings, at plus 2.5 percent, is the strongest since July 2009.

Topics:

WARREN MOSLER considers the following as important: Employment

This could be interesting, too:

Ken Houghton writes Just Learn to Code

Merijn T. Knibbe writes Employment growth in Europe. Stark differences.

NewDealdemocrat writes In-depth look at the leading indicators from the employment report

NewDealdemocrat writes One more time: bifurcation in the jobs report, as Establishment Survey shows continued jobs growth, while Household Survey comes close to triggering the “Sahm Rule”

Much higher than expected, so unless next month’s number settles back down the Fed will be expected to hike rates some.

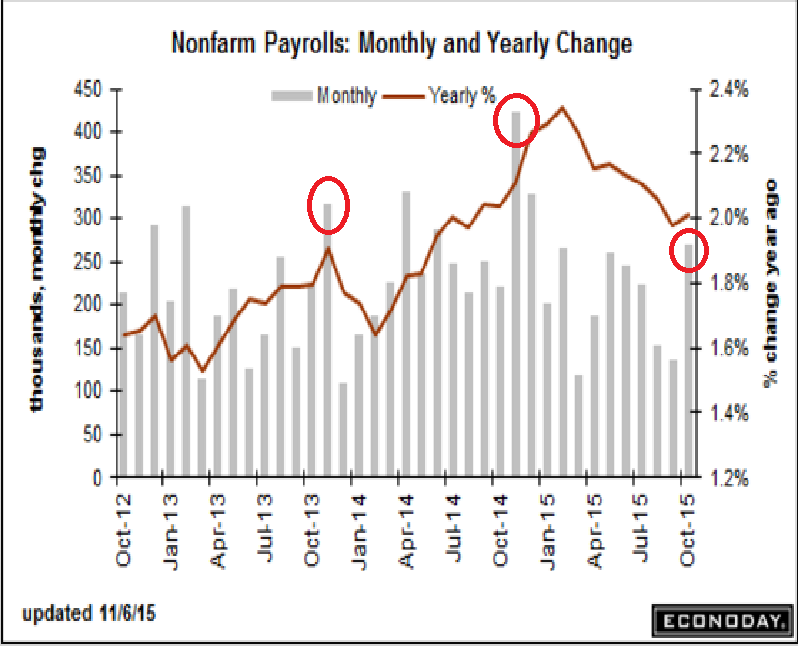

Note from the chart that the last few November releases showed similar spikes followed by much lower prints:

Employment Situation

Highlights

Bring on that rate hike! Nonfarm payrolls surged 271,000 in October vs expectations for 190,000 and against Econoday’s top-end forecast for 240,000. Revisions in prior months are not a factor. The unemployment is down 1 tenth at 5.0 percent with average hourly, to underscore all the strength, jumping 0.4 percent. Government payrolls did not inflate the headline payroll gain as private payrolls rose 268,000. There’s still one more employment report to go before the December FOMC but it seems academic following today’s report.Among the superlatives, the 240,000 rise for nonfarm payrolls is the strongest since December last year. The 5.0 percent unemployment rate is the lowest since April 2008. The broadly defined U-6 unemployment rate, a favorite of Janet Yellen’s, is down 2 tenths to 9.8 percent for the lowest reading since May 2008. The year-on-year rate for average hourly earnings, at plus 2.5 percent, is the strongest since July 2009.

Payrolls in professional & business services surged 78,000 in the month with the subcomponent of temporary help services – considered a leading indicator of future hiring – up a very strong 25,000. Trade & transportation rose 51,000 while retail trade, which is gearing up for the holidays, rose 44,000. Construction spending is strong and payrolls show it, up 31,000 in the month. But the tide failed to lift the export-hit manufacturing sector where payrolls were unable to rise, unchanged in the month following two prior declines.

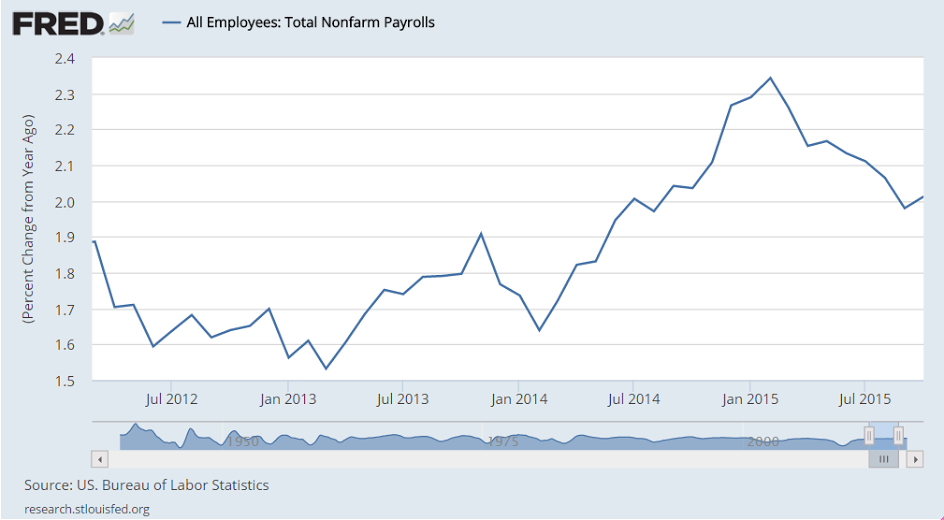

Payroll employment growth still looks to be decelerating since the oil price collapse:

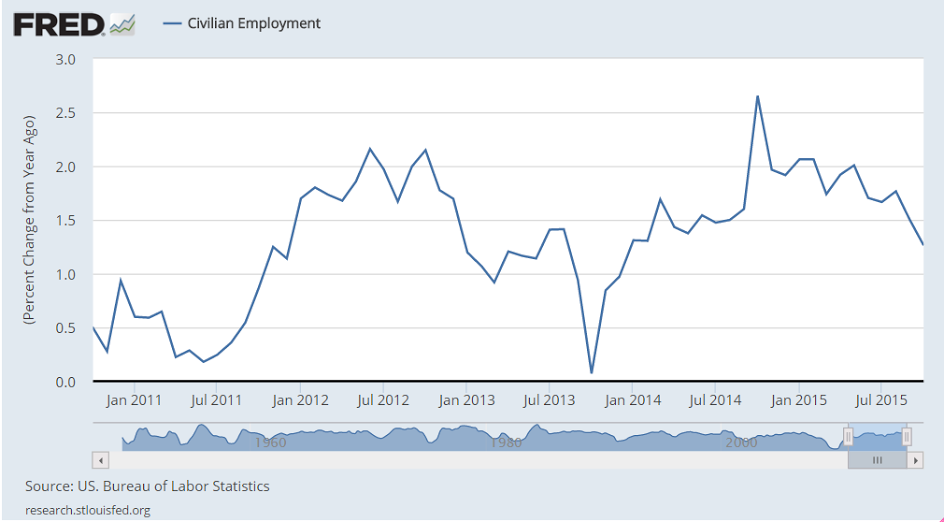

And this is from the Household survey employment report, also decelerating since the oil price collapse: