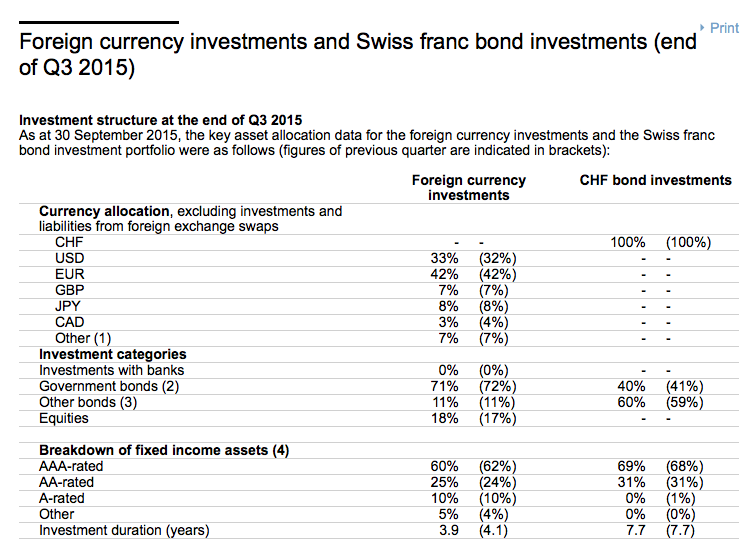

Note the ‘currency allocation’ of 33% to $US. The SNB was buying euro and selling swiss francs to keep the franc from strengthening beyond 1.20 vs euro. To then get the $US exposure, they would have to sell some of their euro to buy $US. So that means, on average, that for euro sold to buy swiss francs, 33% of those euro were then sold for $US. So agents ‘fleeing the euro’ by buying swiss francs were in fact partially selling their euro to buy $US, with the SNB their ‘agent’. It’s just one of the channels for portfolio selling of euro that’s been driving down the euro. Meanwhile, this type of driving down the euro supports the euro area trade surplus which is increasingly ‘draining’ euro from global markets, leaving the sellers of euro ‘short’ and ‘under allocated’ with, collectively, no way to get back their euro (financial assets). Also, in case, the SNB never has to sell it’s $ or euro, as it can hold them indefinitely and let its currency float.

Topics:

WARREN MOSLER considers the following as important: currencies

This could be interesting, too:

Marc Chandler writes The currency market has run on Mnuchin and Draghi

Marc Chandler writes Did Mnuchin Signal a Shift To A Weak Dollar Policy Today?

Marc Chandler writes The Yuan’s Reserve Currency Status

WARREN MOSLER writes NY Mfg survey, Home builder’s index, oil losses, Japan, China trade, euro trade

Note the ‘currency allocation’ of 33% to $US.

The SNB was buying euro and selling swiss francs to keep the franc from strengthening beyond 1.20 vs euro. To then get the $US exposure, they would have to sell some of their euro to buy $US.

So that means, on average, that for euro sold to buy swiss francs, 33% of those euro were then sold for $US.

So agents ‘fleeing the euro’ by buying swiss francs were in fact partially selling their euro to buy $US, with the SNB their ‘agent’.

It’s just one of the channels for portfolio selling of euro that’s been driving down the euro. Meanwhile, this type of driving down the euro supports the euro area trade surplus which is increasingly ‘draining’ euro from global markets, leaving the sellers of euro ‘short’ and ‘under allocated’ with, collectively, no way to get back their euro (financial assets).

Also, in case, the SNB never has to sell it’s $ or euro, as it can hold them indefinitely and let its currency float. That could trigger a weakening of the swiss franc vs the euro should holders of swiss francs someday want to sell them to get their euro back, which is likely since most likely ultimately have euro liabilities to fund: