By Marc Chandler (This post first appeared at Marc to Market) ECB President Draghi was unable to arrest the US dollar’s slide and euro’s surge. But he did not try particularly hard. While many investors are a bit stumped by the pace and magnitude of the dollar’s slump, Draghi seemed to imply that it was perfectly understandable given the recovery of the eurozone economy. The economy is the strongest it has been in more than a decade, but the US is no slouch. The US reports the first...

Read More »Did Mnuchin Signal a Shift To A Weak Dollar Policy Today?

By Marc Chandler (this post originally appeared at Marc to Market) Did US Treasury Secretary Mnuchin signal a change in the US dollar policy? Probably not. As Mnuchin and President Trump have done before, a distinction was drawn between short- and longer-term perspectives. In the short-term, a weaker dollar says Mnuchin, is good for US trade and “other opportunities”. In the longer-term, Mnuchin explicitly acknowledged, “the strength of the dollar is a reflection of the strength of...

Read More »The Yuan’s Reserve Currency Status

By Marc Chandler (this post first appeared on Marc to Market) There is nothing quite like a falling dollar to spur take of the erosion of the greenback’s reserve status. There has been talk for several months that China is preparing in yuan-denominated oil contract (with an embedded gold option). It has not been launched yet, but some observers see it as a blow to the dollar’s role. We are...

Read More »NY Mfg survey, Home builder’s index, oil losses, Japan, China trade, euro trade

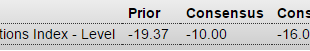

A lot worse than expected and still deep in contraction: Empire State Mfg SurveyHighlightsFor the seventh straight month, the Empire State report is signaling significant contraction for the manufacturing sector. The general business conditions index for February came in below low-end expectations, at minus 16.64 vs even deeper contraction of minus 19.37 in January. New orders, at minus 11.63, are in contraction for a ninth month in a row while employment, though improving to minus 0.99...

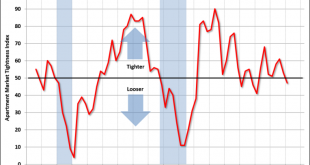

Read More »Apartment market tightness, Euro area trade surplus, Spain

This just keeps going up, which fundamentally tends to drive up the euro which tends to continue to be subject to said upward pressure until the trade picture reverses: Euro Area Balance of TradeThe Eurozone trade surplus increased to €23.6 billion in November of 2015 compared to a €20.2 billion surplus a year earlier. Exports recorded the highest annual gain in four months and imports rebounded. Potential showdown that could drive up Spanish rates: Guindos Ditches Pledge on Spain...

Read More »Mtg prch apps, Housing starts, Industrial production, Euro trade

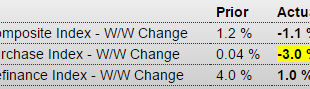

Yes, up vs last year’s dip, but remain depressed and have beenheading south since early this year: MBA Mortgage ApplicationsHighlightsApplication activity was little changed in the December 11 week, up 1 percent for refinancing and down 3.0 percent for home purchases. Year-on-year, purchase applications remain very high, up 34 percent in a gain that in part reflects a pulling forward of demand ahead of what is expected to be a rate hike at today’s FOMC. Rates were little changed in the week...

Read More »Labor market conditions index, Euro and yen charts, Fed discussion

This is the Fed’s own index and it’s on the very weak side: Labor Market Conditions IndexHighlightsFriday’s employment report, led by a 211,000 rise in non-farm payrolls, was solid but didn’t give the labor market conditions index much of a boost, coming in at only plus 0.5 vs expectations for plus 1.7. The October index, however, was revised 6 tenths higher to plus 2.2 reflecting in part the upward revision to that month’s nonfarm payroll growth which now stands at a very impressive...

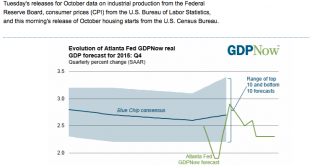

Read More »Atlanta Fed, Investor poll, Fed surveys

The crowd is not always wrong, but it’s not always right, either: Fund managers polled at the start of November have significantly hiked their allocation to equities and cut cash holdings to levels not seen since July, according to research from Bank of America Merrill Lynch.Of the 200 investors managing $576 billion of assets that were quizzed by the bank for its monthly fund manager survey, four-fifths now expect the U.S. Federal Reserve to raise rates this quarter.Some 43 percent of...

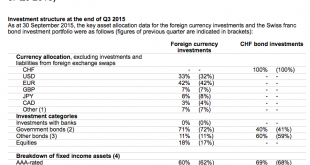

Read More »SNB $US reserves

Note the ‘currency allocation’ of 33% to $US. The SNB was buying euro and selling swiss francs to keep the franc from strengthening beyond 1.20 vs euro. To then get the $US exposure, they would have to sell some of their euro to buy $US. So that means, on average, that for euro sold to buy swiss francs, 33% of those euro were then sold for $US. So agents ‘fleeing the euro’ by buying swiss francs were in fact partially selling their euro to buy $US, with the SNB their ‘agent’. It’s just one...

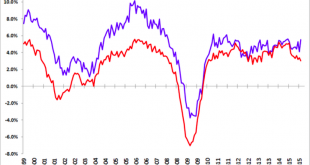

Read More »Employment chart, China trade, SNB

The red line tends to drag down the blue line, often when deficit spending gets too low: Exports drop again, imports drop more, so the trade surplus grows, and the US should see more imports and fewer exports, while euro zone imports are down which adds to their trade surplus: China’s Trade Drop Means More Stimulus Measures Are Coming Exports drop for a fourth month, import declines match recordTrade surplus to help ease currency depreciation pressureChina’s exports fell for a fourth...

Read More » Heterodox

Heterodox