Something I wrote that got published in 1998: Revised down, note how the year over year growth has been continuously decelerating ever since the collapse of oil capex, and the strength in consumer spending looks like it could be about healthcare premiumus, which portends cutbacks elsewhere, hence the weaker q3 retail sales, etc. And with inventories still looking way too high, proactive inventory building doesn’t seem likely. Nor does the most recent housing data bode well for housing in q3: Highlights Second-quarter GDP proved very soft, at only a plus 1.1 percent annualized rate for the second estimate following even softer rates in the prior two quarters of 0.8 and 0.9 percent. But masked in the latest quarter is a very strong 4.4 percent annualized growth rate for consumer spending which is 2 tenths higher than the first estimate. Inventory draw is the quarter’s culprit, pulling down GDP by a very steep 1.3 percentage points. But, in a counter-intuitive twist, lighter inventory in times of slow economic growth is a major positive for future production and employment and is a major plus for the ongoing quarter. Residential investment is a disappointment in the second-quarter data, falling at a 7.7 percent annualized rate but following large gains in prior quarters.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

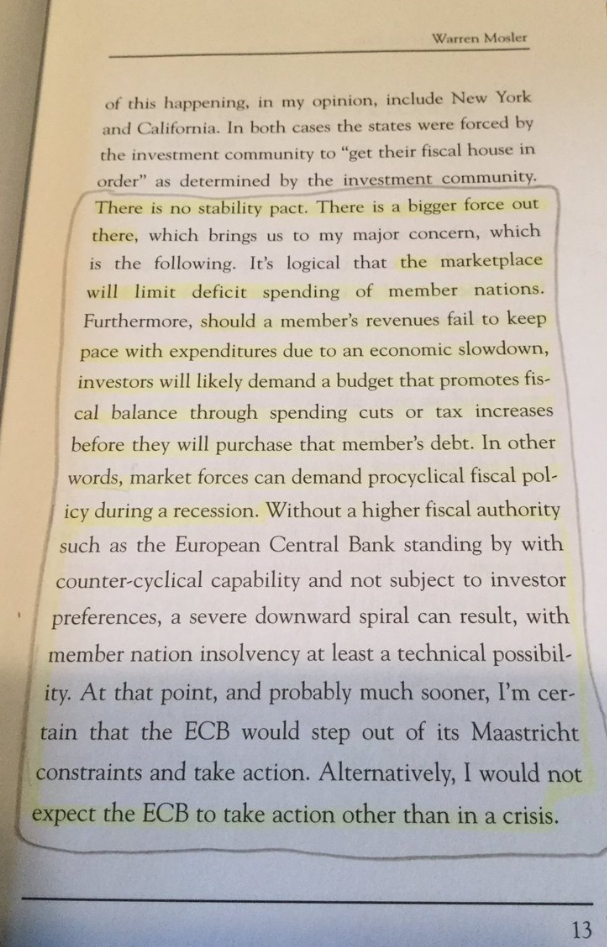

Something I wrote that got published in 1998:

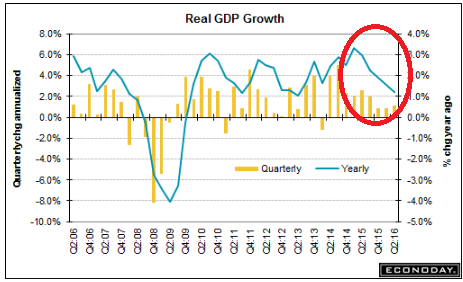

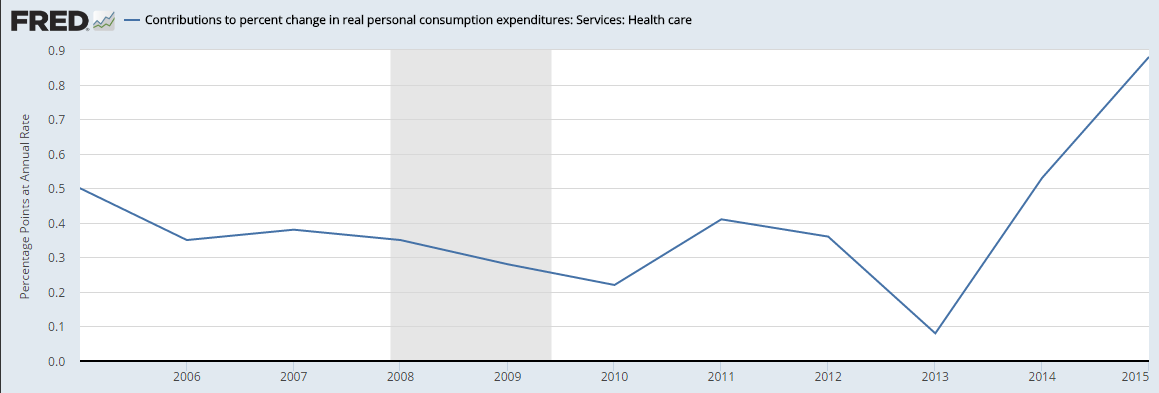

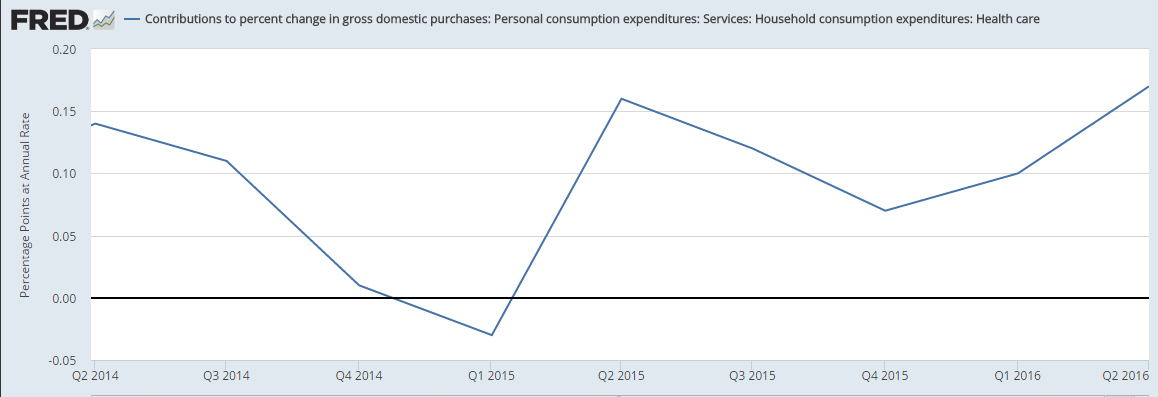

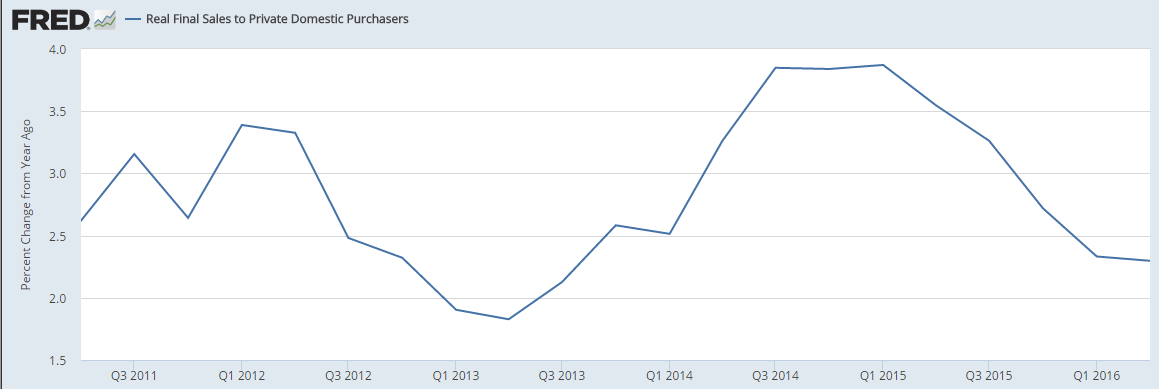

Revised down, note how the year over year growth has been continuously decelerating ever since the collapse of oil capex, and the strength in consumer spending looks like it could be about healthcare premiumus, which portends cutbacks elsewhere, hence the weaker q3 retail sales, etc. And with inventories still looking way too high, proactive inventory building doesn’t seem likely. Nor does the most recent housing data bode well for housing in q3:

Highlights

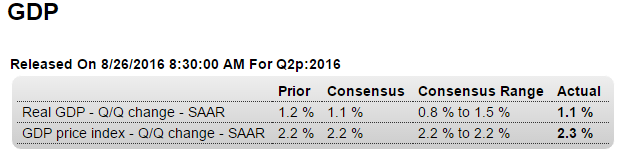

Second-quarter GDP proved very soft, at only a plus 1.1 percent annualized rate for the second estimate following even softer rates in the prior two quarters of 0.8 and 0.9 percent. But masked in the latest quarter is a very strong 4.4 percent annualized growth rate for consumer spending which is 2 tenths higher than the first estimate. Inventory draw is the quarter’s culprit, pulling down GDP by a very steep 1.3 percentage points. But, in a counter-intuitive twist, lighter inventory in times of slow economic growth is a major positive for future production and employment and is a major plus for the ongoing quarter.

Residential investment is a disappointment in the second-quarter data, falling at a 7.7 percent annualized rate but following large gains in prior quarters. And building strength in new home sales points to a rebound for this reading in the third quarter. The biggest disappointment in the quarter is another decline, at a 0.9 percent rate, in nonresidential fixed business investment which points to business caution and continuing problems ahead for worker productivity. Price data show some pressure tied to oil with the GDP price index up 1 tenth from the first estimate to a year-on-year 2.3 percent.

The major takeaway from the second quarter is not the headline growth rate but the strength of the consumer, evident in the solid 2.4 percent rise in final sales, which is double the pace of the two prior quarters. The early outlook for the third quarter is positive, with estimates trending at about 3 percent growth.

This one’s the contribution to PCE from July 29 data:

This is the contribution to GDP from today’s data:

Decelerating year over year:

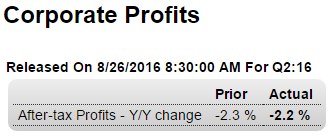

Not quite as bad but still negative:

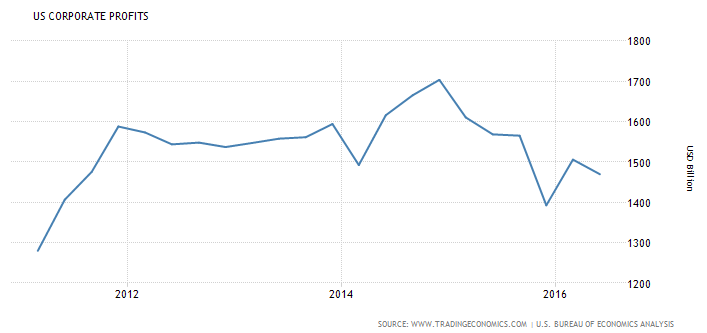

United States Corporate Profits

Corporate profits in the United States decreased by 2.4 percent or $36.3 billion to $1469.7 billion in the second quarter of 2016, after rising an upwardly revised 8.1 percent in the previous period, preliminary estimates showed. Dividends decreased 0.9 percent or $8.2 billion in the second quarter (compared to a gain of 0.8 percent or $7.3 billion in Q1) and undistributed profits dropped 5.2 percent or $28.1 billion (compared to a rise of 24.3 percent or $106.1 billion in Q1). Also, net cash flow with inventory valuation adjustment, the internal funds available to corporations for investment, fell 1.1 percent or $22 billion, after going up by 5.7 percent or $112.7 billion in the previous period.

Highlights

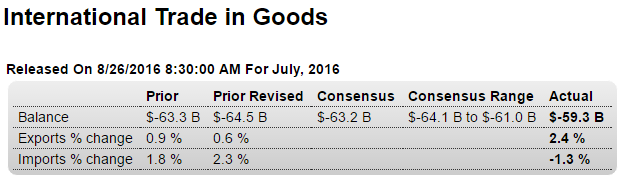

A surge in food exports helped cut the nation’s goods gap in July to $59.3 billion from June’s revised $64.5 billion. Exports of foods, feeds & beverages rose 31 percent in the month though export prices of agricultural goods actually dipped slightly in the month. Other export readings are less favorable including a decline for capital goods, reflecting weak global investment in new equipment, and a small dip for consumer goods. A dip in imports also helped narrow the headline gap in July as capital goods imports and especially consumer goods imports fell sharply. The improvement in today’s headline is a big plus for early third-quarter GDP estimates but it doesn’t point to strength in underlying cross-border demand.

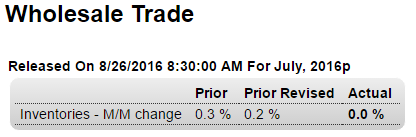

Looks like inventories continue to decline which doesn’t bode well for current output, as previously discussed:

Highlights

Wholesales inventories are unchanged in the preliminary reading for July following a 0.2 percent build in June. Retail inventories fell 0.4 percent in July vs a 0.3 percent build in June. These results point to the need for inventory rebuilding and are a positive for the economic outlook.

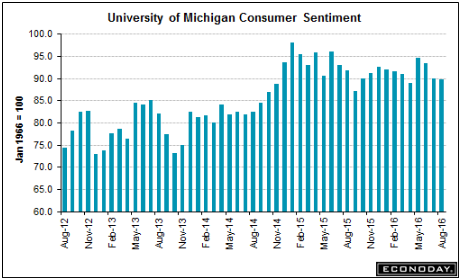

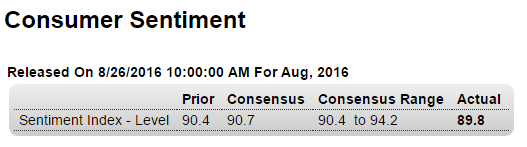

Less than expected and declining, with the move up 4 months ago now completely reversed:

Highlights

Consumer sentiment is steady and respectable, at 89.8 for the final August reading and a 6 tenths dip from mid-month and a 2 tenths dip from final July. The expectations component edged higher in the month to 78.7 which hints at confidence in the jobs outlook. Hinting at marginal softening in the current jobs market is the current conditions index which is down 2.0 points to a still solid 107.0. Inflation readings are especially weak in this report, reflecting in part this month’s downturn in gasoline prices. One-year expectations are down 2 tenths to 2.5 percent with the 5-year outlook down 1 tenth and also at 2.5 percent.