Weakness now includes the service sector: United States Services PMIThe Markit Flash US Services PMI came in at 50.9 in August of 2016, down from 51.4 in the previous month and below market expectations of 52. It is the lowest reading since February with business activity, new orders and employment all slowing due to subdued demand conditions and uncertainty ahead of the presidential election. Up a bit more than expected for the month, but remains in contraction year over year: Highlights The factory sector, after a frustrating first half of the year, is now definitely showing life. Durable goods orders jumped 4.4 percent in July in a headline gain exaggerated by a swing higher for commercial aircraft but including gains across most readings. Excluding the gain for aircraft and no change for autos, orders rose a very sizable 1.5 percent. And the strength includes core capital goods where orders jumped 1.6 percent to show new demand for business equipment and machinery. Though the gain for new orders points to future strength for shipments, shipment data for July are soft. Total shipments rose only 0.2 percent in the month with core capital goods shipments, which are an input into the nonresidential investment component of the GDP report, down 0.4 percent to get the third-quarter off to a slow start.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

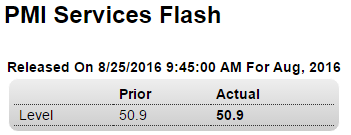

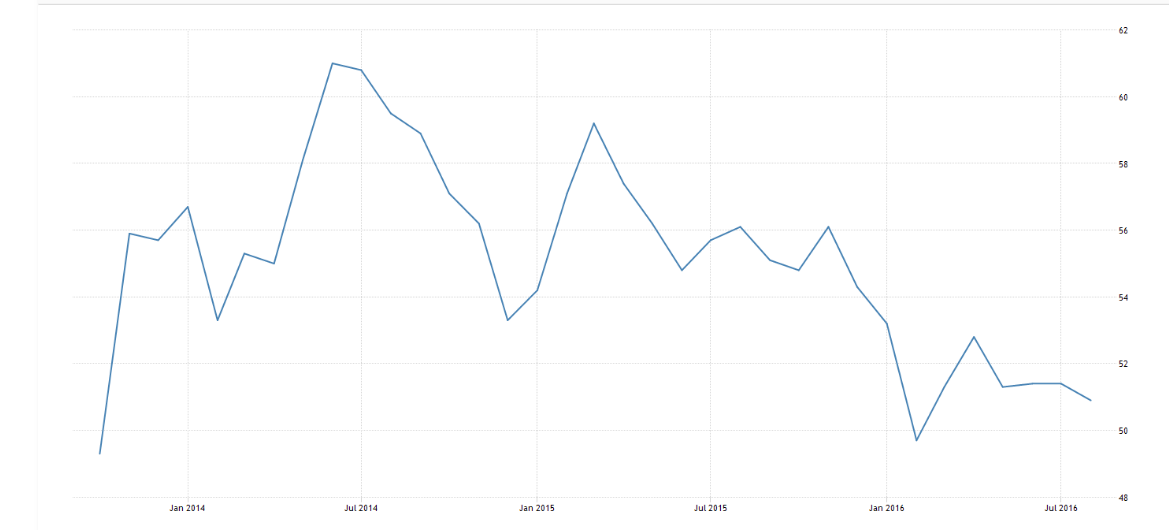

Weakness now includes the service sector:

United States Services PMI

The Markit Flash US Services PMI came in at 50.9 in August of 2016, down from 51.4 in the previous month and below market expectations of 52. It is the lowest reading since February with business activity, new orders and employment all slowing due to subdued demand conditions and uncertainty ahead of the presidential election.

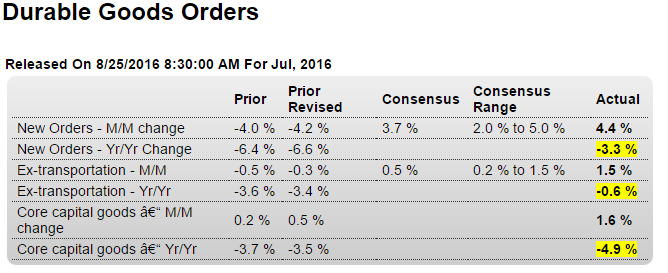

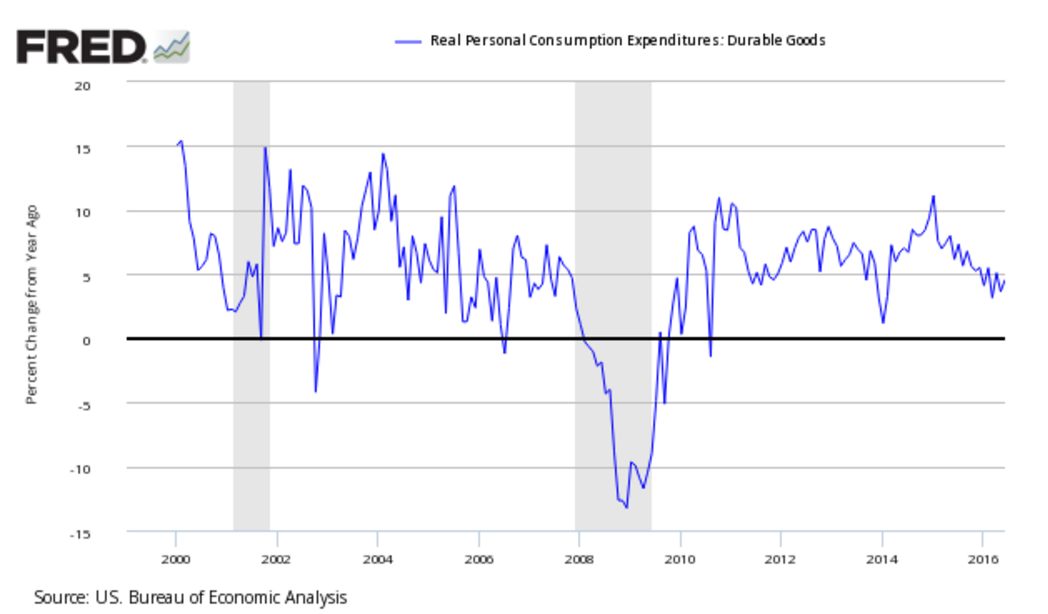

Up a bit more than expected for the month, but remains in contraction year over year:

Highlights

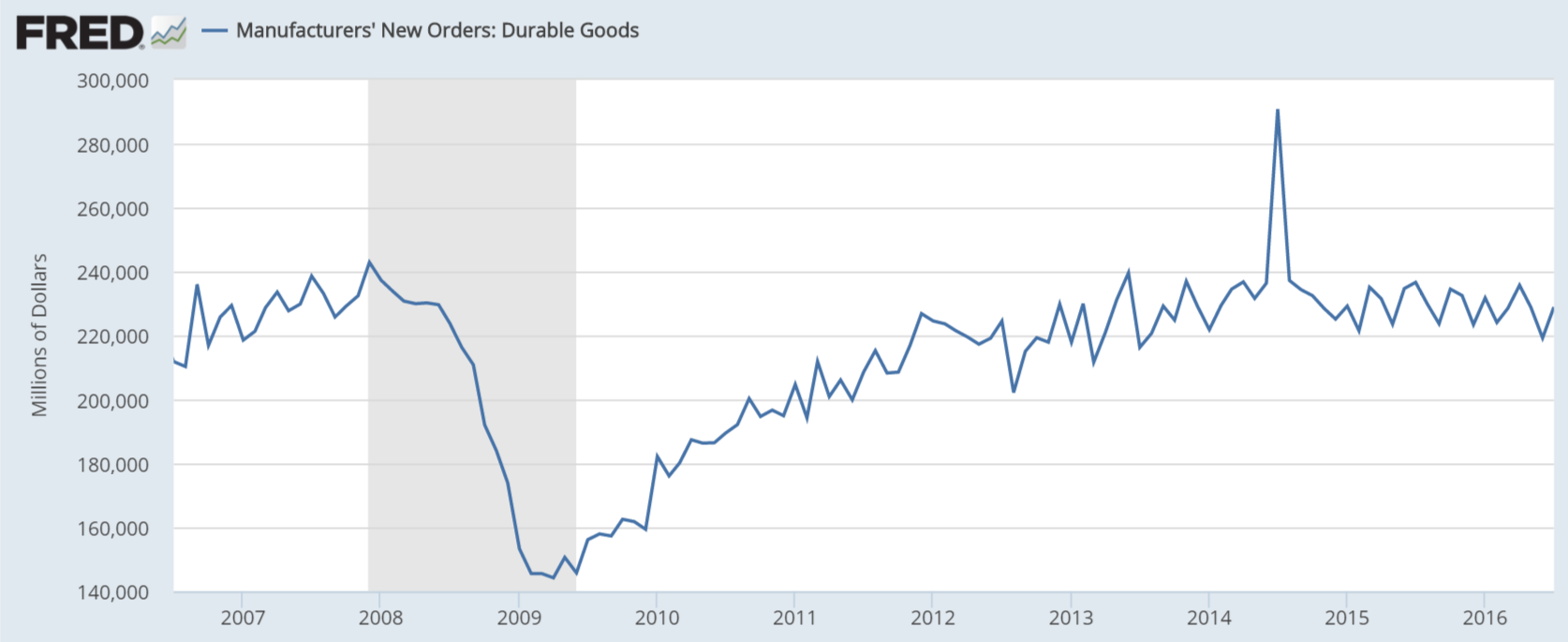

The factory sector, after a frustrating first half of the year, is now definitely showing life. Durable goods orders jumped 4.4 percent in July in a headline gain exaggerated by a swing higher for commercial aircraft but including gains across most readings. Excluding the gain for aircraft and no change for autos, orders rose a very sizable 1.5 percent. And the strength includes core capital goods where orders jumped 1.6 percent to show new demand for business equipment and machinery.

Though the gain for new orders points to future strength for shipments, shipment data for July are soft. Total shipments rose only 0.2 percent in the month with core capital goods shipments, which are an input into the nonresidential investment component of the GDP report, down 0.4 percent to get the third-quarter off to a slow start. And immediate negatives for tomorrow’s second estimate of second-quarter GDP are incremental downward revisions to core capital goods shipments in June and May, now at minus 0.5 and minus 0.7 percent.

Unfilled orders are also a concern in the report, down 0.1 percent in July on top of June’s very steep 0.9 percent decline. Lack of unfilled orders is not only a negative for production but also for employment. On the plus side, inventories broke a long run of contraction with a 0.3 percent rise and are still very lean with the inventory-to-shipments ratio unchanged at 1.64.

Turning back to new orders, other areas of monthly strength include both primary and fabricated metals, electrical equipment, and defense aircraft. A general trend reading underscoring the report’s strength is the year-on-year new order rate for ex-transportation, now at only minus 0.6 percent vs minus 3.4 percent in June.

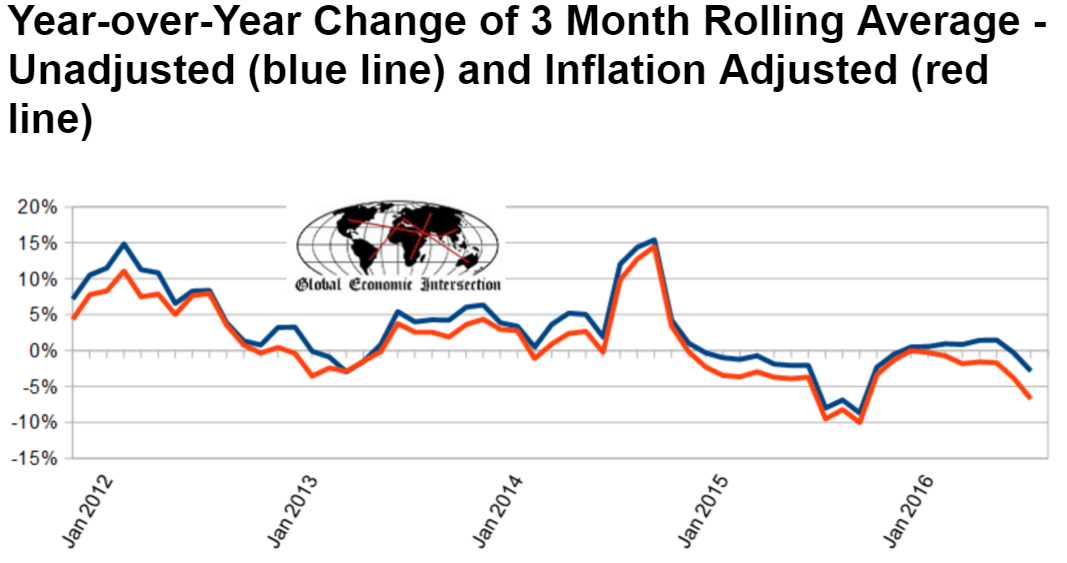

The 3 month moving average, which smooths out some of the month to month volatility, isn’t looking so good:

Inflation adjusted but otherwise unadjusted new orders are down 9.9 % year-over-year. Backlog (unfilled orders) decelerated 0.2 % month-over-month, but is still contracting 2.2 % year-over-year. The Federal Reserve’s Durable Goods Industrial Production Index (seasonally adjusted) growth decelerated 0.2 % month-over-month, up 0.6 % year-over-year [note that this is a series with moderate backward revision – and it uses production as a pulse point (not new orders or shipments)] – three month trend is decelerating, but the trend over the last year is relatively flat.

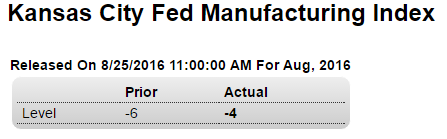

Remains in contraction, while the head of that Fed keeps calling for rate hikes:

Highlights

Conditions in the Kansas City manufacturing sector, hit as it is by weakness in the energy sector, remain very difficult. The composite index is at minus 4 this month to extend a nearly unbroken string of contraction going back through last year. New orders are at minus 7, backlog orders at minus 4, and employment is at minus 10. Production is down, shipments are down, and inventories are down. Price data are soft with selling prices in a second month of contraction. This morning’s durable goods report is very positive but doesn’t extend to this report which, like other regional Fed reports and to a greater degree, is pointing to weakness this month for the factory sector.