Still weak and worse than expected. And prices weakening as well: New Home Sales HighlightsGrowth in new homes isn’t spectacular but, given how soft general economic conditions are, the sector is posting moderate and still respectable numbers. March sales came in at a 511,000 annualized rate which is on the low side of expectations but the report includes a 7,000 upward revision to 519,000 for February which now stands as among the very best months since 2008. Year-on-year, sales are up 5.4 percent, right in line with permits which are up 4.6 percent. Lack of new homes on the market, which has been holding down sales, improved a bit in April, to 246,000 units for a 2.1 percent monthly gain. And sales relative to supply is also improving, to 5.8 months vs 5.6 months in February and 5.1 months a year ago. Supply at 6.0 months relative to sales is generally considered to be consistent with a balanced market. New homes aren’t showing much price traction, down 3.2 percent in the month to a median 8,000 which is down, not up, 1.8 percent from last year. Still negative and worse than expected: Dallas Fed Mfg SurveyHighlightsThe decent of the Dallas Fed report may be flattening out, hopefully. The production index posted its second straight positive reading, at 5.8 in April vs 3.3 in March, but the really good news is new orders which popped into the plus column, to 6.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Still weak and worse than expected.

And prices weakening as well:

New Home Sales

Highlights

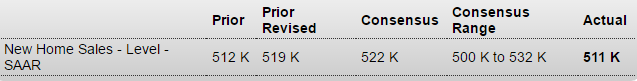

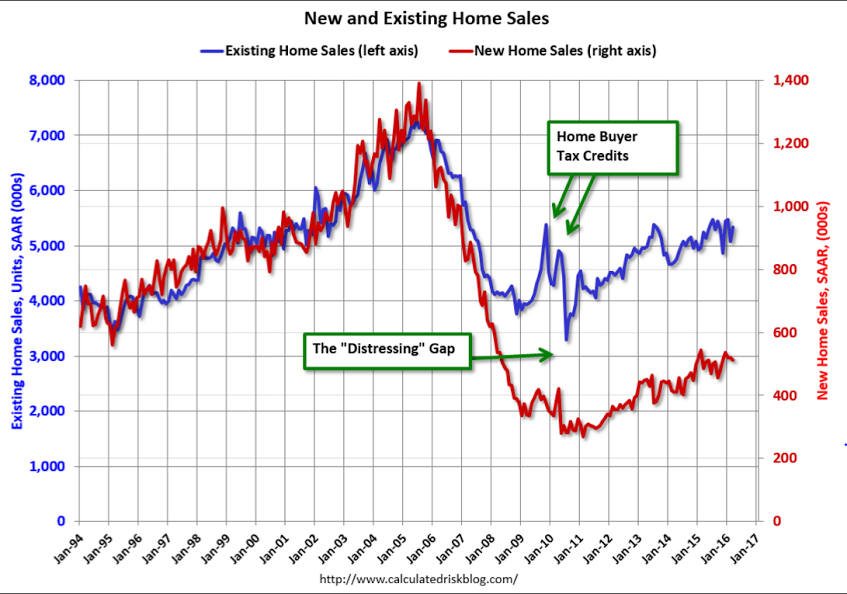

Growth in new homes isn’t spectacular but, given how soft general economic conditions are, the sector is posting moderate and still respectable numbers. March sales came in at a 511,000 annualized rate which is on the low side of expectations but the report includes a 7,000 upward revision to 519,000 for February which now stands as among the very best months since 2008. Year-on-year, sales are up 5.4 percent, right in line with permits which are up 4.6 percent.Lack of new homes on the market, which has been holding down sales, improved a bit in April, to 246,000 units for a 2.1 percent monthly gain. And sales relative to supply is also improving, to 5.8 months vs 5.6 months in February and 5.1 months a year ago. Supply at 6.0 months relative to sales is generally considered to be consistent with a balanced market.

New homes aren’t showing much price traction, down 3.2 percent in the month to a median $288,000 which is down, not up, 1.8 percent from last year.

Still negative and worse than expected:

Dallas Fed Mfg Survey

Highlights

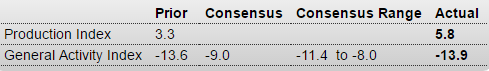

The decent of the Dallas Fed report may be flattening out, hopefully. The production index posted its second straight positive reading, at 5.8 in April vs 3.3 in March, but the really good news is new orders which popped into the plus column, to 6.2 following four straight declines. Capacity utilization is another plus, up for a second month.Still, the overall assessment is negative, at minus 13.9 for the general activity index which is a 16th straight negative score, a run that can be traced back directly to the collapse in oil prices. Employment remains weak, at minus 3.7 for a fourth straight contraction. Price data do show some life with wages up and raw materials, which had been week, also up. Selling prices, however, remain a big negative, at minus 6.6 for what is also a 16th straight month in the wrong column.