Anyone notice that the annual growth rate of employment continues the deterioration that began with the collapse in oil capex?Or that, once again, it looks like most all the new jobs were taken by people previously considered out of the labor force?And the anemic wage growth also contributes to the narrative of a continuously deteriorating plight for people trying to work for a living: Employment SituationHighlightsThe labor market is stronger than most assessments with December results well outside top-end estimates and big upward revisions underscoring the strength of prior months. Nonfarm payrolls jumped 292,000 in December which is 92,000 above the consensus and 43,000 above Econoday’s high forecast. The gain importantly is led by professional & business services which is considered a leading component for future hiring and which rose 73,000 for the second outsized gain of the last three months. Construction, boosted by the nation’s unseasonable weather, has also been adding workers, up 45,000 in December. Upward revisions to the two prior months total 50,000 with November now at 252,000 and October over 300,000 at 307,000.Despite payroll strength, the unemployment rate held steady at 5.0 percent as more people looked for work in the month. The labor force participation rate improved 1 tenth to 62.6 percent as did the employment-to-population ratio, to 59.5 percent.

Topics:

WARREN MOSLER considers the following as important: China, Employment, trade

This could be interesting, too:

Ken Houghton writes Just Learn to Code

Dean Baker writes Donald Trump is badly nonfused # 67,218: The story of supply and demand

Merijn T. Knibbe writes Peak babies has been. Young men are not expendable, anymore.

Merijn T. Knibbe writes Employment growth in Europe. Stark differences.

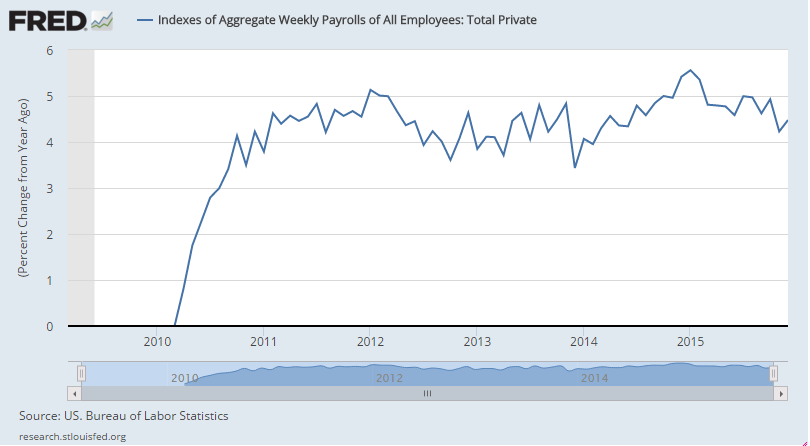

Anyone notice that the annual growth rate of employment continues the deterioration that began with the collapse in oil capex?

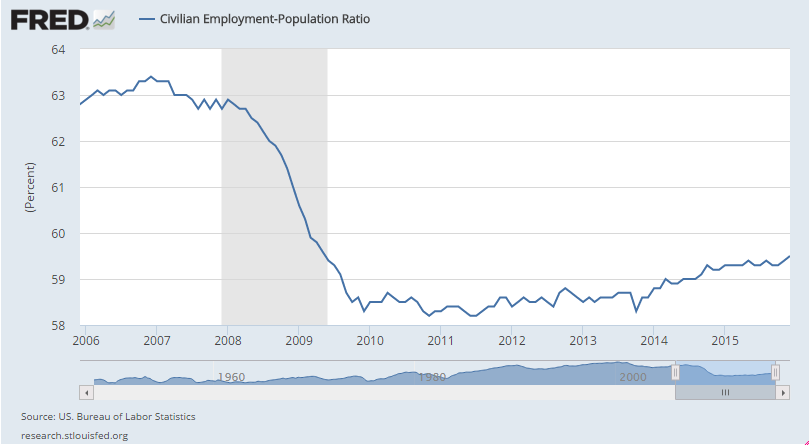

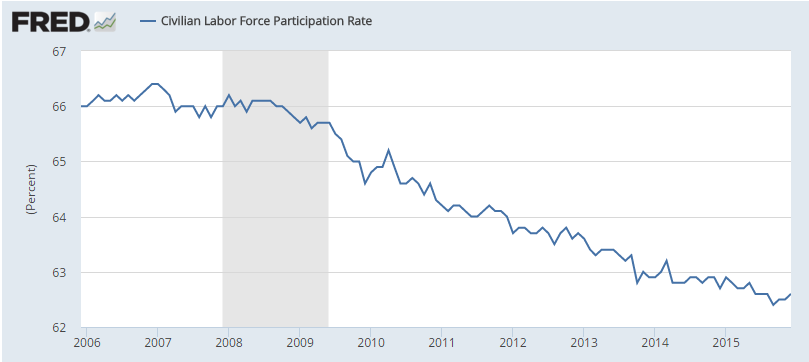

Or that, once again, it looks like most all the new jobs were taken by people previously considered out of the labor force?

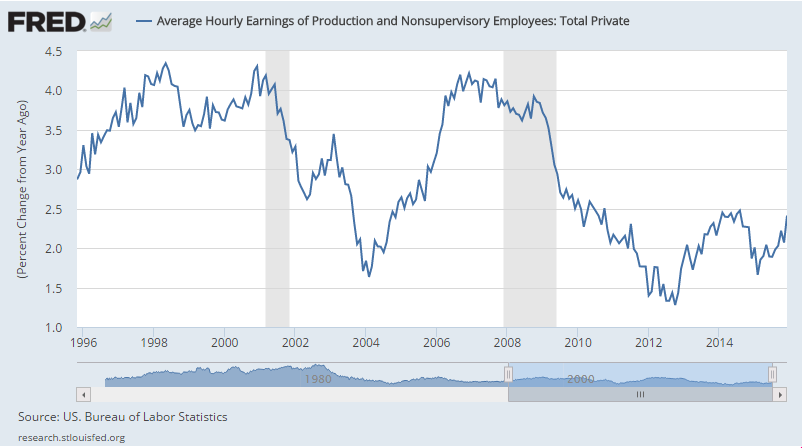

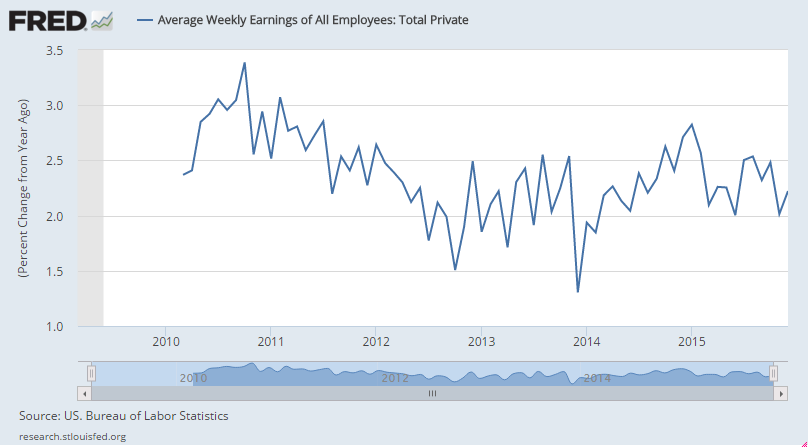

And the anemic wage growth also contributes to the narrative of a continuously deteriorating plight for people trying to work for a living:

Employment Situation

Highlights

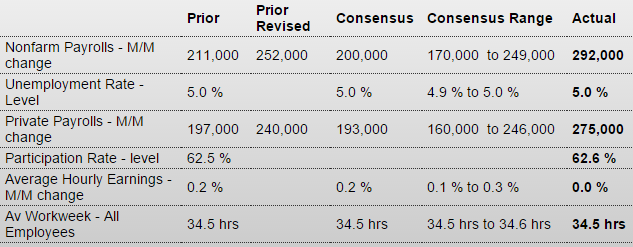

The labor market is stronger than most assessments with December results well outside top-end estimates and big upward revisions underscoring the strength of prior months. Nonfarm payrolls jumped 292,000 in December which is 92,000 above the consensus and 43,000 above Econoday’s high forecast. The gain importantly is led by professional & business services which is considered a leading component for future hiring and which rose 73,000 for the second outsized gain of the last three months. Construction, boosted by the nation’s unseasonable weather, has also been adding workers, up 45,000 in December. Upward revisions to the two prior months total 50,000 with November now at 252,000 and October over 300,000 at 307,000.Despite payroll strength, the unemployment rate held steady at 5.0 percent as more people looked for work in the month. The labor force participation rate improved 1 tenth to 62.6 percent as did the employment-to-population ratio, to 59.5 percent. Wages, also despite the payroll strength, came in unchanged though the year-on-year rate, boosted by an easy year-ago comparison, rose 2 tenths to 2.5 percent which, however, is lower than many expected. The average workweek held unchanged at 34.5 hours while manufacturing hours slipped 0.1 percent which will pull down estimates for next week’s industrial production report.

Turning back to industry payrolls, the bureau of labor statistics is highlighting a 34,000 rise in temporary help services. This is a subcomponent of professional & business services and is considered an especially sensitive barometer for future hiring. Other industries posting gains include trade & transportation at 31,000, government at 17,000, and manufacturing at a modest 8,000. Mining payrolls, hurt by low commodity prices, continue to contract, down 8,000 and are one of the few industries in the minus column.

This report is strong and should confirm confidence that the U.S. economy is, or at least was in December, largely insulated against global weakness. The strength of this report is certain to grab global attention though the lack of wage punch underscores the two-track economy and the Fed’s dilemma — strong job growth but weak inflation.

Also decelerating since the oil capex collapse:

So 10 million + people decided all at once they didn’t ever want to work anymore in 2008? That is, we still have massive ‘slack’ in the ‘labor market’ best I can tell:

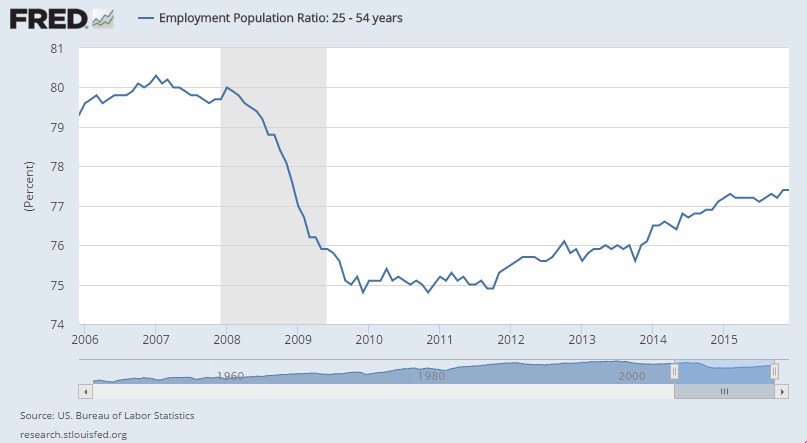

And this is still higher than it was in the prior recession:

Earnings continue to grow only at depressed rates, maybe because of all the ‘slack’ in the ‘labor market?’

Inventories fell, but sales fell even more, so the inventory to sales ratio went up.

Not good!!!

Wholesale Trade

Highlights

Wholesale inventories fell a sizable 0.3 percent for a second straight month in November. Sales at the wholesale level fell an even sharper 1.0 percent in the month and, despite the decline in inventories, drove the stock-to-sales ratio up to 1.32 vs 1.31 in the two prior months. A year-ago, the ratio was at 1.23 in what is confirmation that inventories in the sector remain heavy. Inventories of farm products and petroleum rose due to weak sales while inventories of furniture and metals fell on strong sales. Previously released data on the factory sector show a 0.3 percent inventory contraction in November. The missing piece, retail inventories, will be posted following next week’s retail sales report.

‘Monetary Policy’ in this case means currency management. So we called China a currency manipulator and predator when they bought fx reserves to keep their currency from getting too strong too fast from FDI flows, etc., and then when they let their currency float as FDI flows reversed we criticized them.

And we had a ‘strong dollar policy’ while at the same time telling China their currency needed to appreciate when they were buying fx to moderate the appreciation. It’s all be continuous ‘talking out of both sides of the mouth’

And with a large trade and current account surplus it’s only a matter of time until China is again accumulating fx reserves to keep their currency from appreciating. But in light of the current criticism of their weakening currency, maintaining ‘stability’ when it’s back in appreciation mode may be applauded.

China central bank to maintain prudent monetary policy, keep yuan stable