As per the charts, a big dip last month was followed but a partial recover this month, but overall it’s going nowhere: Factory Orders Employment dropped from 52.1 to 49.7- not good: ISM Non-Mfg IndexHighlightsThe great bulk of the nation’s economy enjoyed a solid February based on ISM’s non-manufacturing report where the headline index held solidly over breakeven 50, at 53.4 vs January’s 53.5.New orders came in at 55.5, down 1 point from January but still very solid. And backlog orders continue to expand, at 52.0 for a second month in a row. Strength in orders points to future strength in employment which, however, in the report’s only negative dipped 2.5 points to 49.7 for the first sub-50 reading since February 2014.Other details include a nearly 4 point rise in output (defined as business activity in this report) which is a solid indication for first-quarter growth. Prices for inputs remain in contraction and inventories continue to expand modestly. Export sales are also up though exports for this sample, in contrast to manufacturing, are limited.The dip in employment is one of the few hints of trouble for tomorrow’s employment report, but it may prove a one-month event. Otherwise, readings in this report are positive, a contrast to this morning’s PMI services report and an indication of extending strength for the domestic economy.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

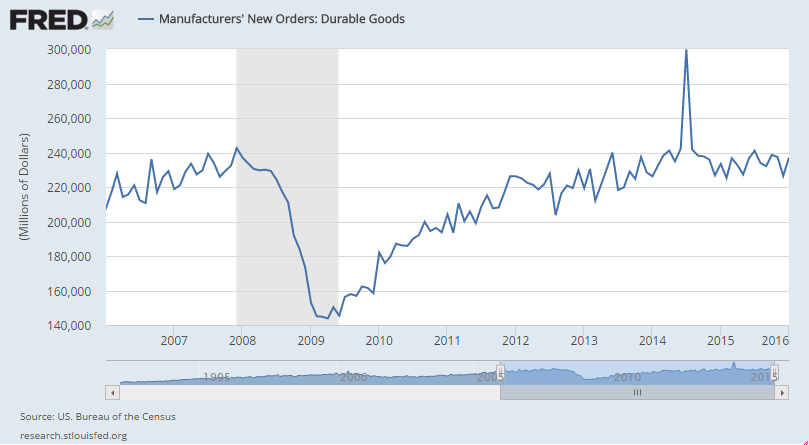

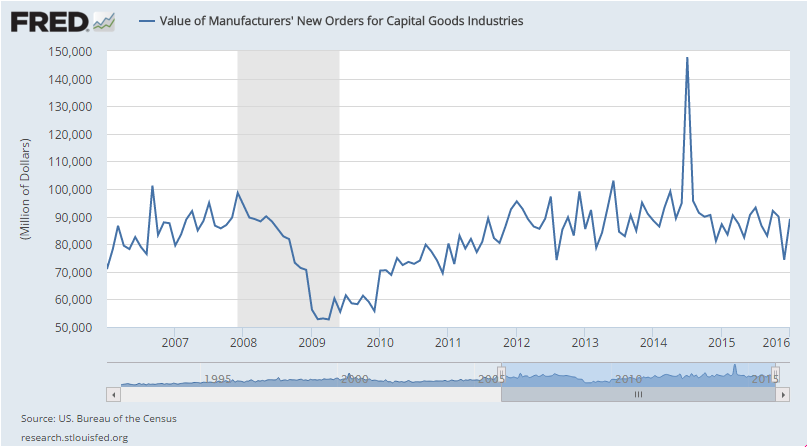

As per the charts, a big dip last month was followed but a partial recover this month, but overall it’s going nowhere:

Factory Orders

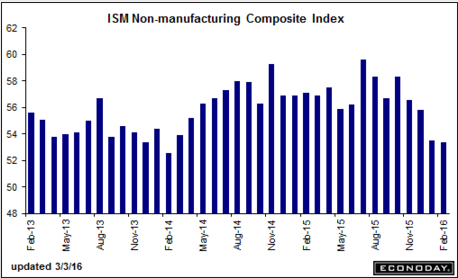

Employment dropped from 52.1 to 49.7- not good:

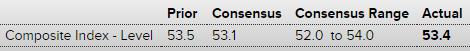

ISM Non-Mfg Index

Highlights

The great bulk of the nation’s economy enjoyed a solid February based on ISM’s non-manufacturing report where the headline index held solidly over breakeven 50, at 53.4 vs January’s 53.5.New orders came in at 55.5, down 1 point from January but still very solid. And backlog orders continue to expand, at 52.0 for a second month in a row. Strength in orders points to future strength in employment which, however, in the report’s only negative dipped 2.5 points to 49.7 for the first sub-50 reading since February 2014.

Other details include a nearly 4 point rise in output (defined as business activity in this report) which is a solid indication for first-quarter growth. Prices for inputs remain in contraction and inventories continue to expand modestly. Export sales are also up though exports for this sample, in contrast to manufacturing, are limited.

The dip in employment is one of the few hints of trouble for tomorrow’s employment report, but it may prove a one-month event. Otherwise, readings in this report are positive, a contrast to this morning’s PMI services report and an indication of extending strength for the domestic economy.

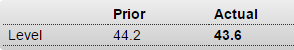

Bloomberg Consumer Comfort Index

Highlights

The consumer comfort index is now below 44 for the first time this year, at 43.6 in the February 28 week. Consumer confidence readings have held mostly steady this year though the decline in this report may hint at an uneasiness perhaps tied in part to uncertainty in the election campaign.

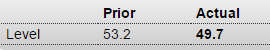

PMI Services Index

Highlights

Markit Economics’ U.S. service sample reported unusually flat activity in February with the final PMI at 49.7 vs 49.8 for the February flash and against 53.7 in January. This is the weakest reading since the government shutdown of 2013.New orders are still growing but, after three months of slowing, are at their weakest pace since January last year. The 12-month outlook, though still positive, is the least positive in 5-1/2 years. Hiring, in an upbeat indication for tomorrow’s employment report, is still solid but how long it can sustain strength is in question. Price data are not favorable with inputs down and selling prices down at a 5-month low.

Slowing in the service sector would leave the economy without a central point of strength. The declines in this report, though possibly reflecting weather factors during the month, do raise the important question whether domestic demand is on the downswing and falling in line with sinking demand overseas.