Some commentary on the latest Saudi price changes: Saudi raises crude price to Europe, Asia, cuts it for US Saudi Arabia, the world’s largest crude exporter, Wednesday raised the April prices of its oil to Asia and Europe but cut it slightly for shipments to the United States. My quick WRKO radio interview Down some more, as previously discussed:He’s going the right way, but it’s relatively small and he’s unfortunately still out of paradigm which puts it all at risk of ‘losing the debate’ with critics: Trudeau’s Message to World: Let Government Spending Do the Work By Josh WingroveMarch 3 (Bloomberg) — Canadian Prime Minister Justin Trudeau is urging global leaders to rely more on government spending and less on monetary policy to spur growth as he prepares a budget that will push his country into deficit.In a wide-ranging interview Wednesday in Vancouver, Trudeau highlighted the importance of infrastructure spending and measures to bolster incomes of middle classes he says are critical to driving growth. He also defended his plan to go willingly into the red.“My message to other government leaders is don’t fall into the trap that thinking that balancing the books” is an end in itself, he said. “It’s a means to an end.”Trudeau’s arrival on the global scene and his endorsement of deficits marks a sharp about face from his predecessor, Stephen Harper.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Some commentary on the latest Saudi price changes:

Saudi raises crude price to Europe, Asia, cuts it for US

Saudi Arabia, the world’s largest crude exporter, Wednesday raised the April prices of its oil to Asia and Europe but cut it slightly for shipments to the United States.

My quick WRKO radio interview

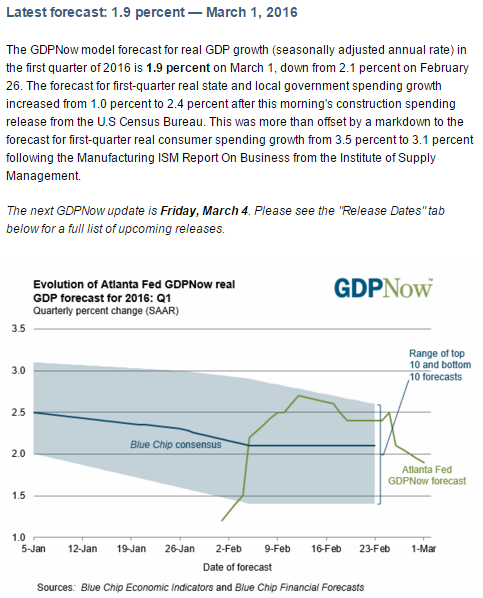

Down some more, as previously discussed:

He’s going the right way, but it’s relatively small and he’s unfortunately still out of paradigm which puts it all at risk of ‘losing the debate’ with critics:

Trudeau’s Message to World: Let Government Spending Do the Work

By Josh Wingrove

March 3 (Bloomberg) — Canadian Prime Minister Justin Trudeau is urging global leaders to rely more on government spending and less on monetary policy to spur growth as he prepares a budget that will push his country into deficit.

In a wide-ranging interview Wednesday in Vancouver, Trudeau highlighted the importance of infrastructure spending and measures to bolster incomes of middle classes he says are critical to driving growth. He also defended his plan to go willingly into the red.

“My message to other government leaders is don’t fall into the trap that thinking that balancing the books” is an end in itself, he said. “It’s a means to an end.”

Trudeau’s arrival on the global scene and his endorsement of deficits marks a sharp about face from his predecessor, Stephen Harper. Along with German Chancellor Angela Merkel and U.K. Prime Minister David Cameron, Harper championed the budget austerity alliance within the Group of Seven that often clashed with the U.S. on fiscal policy.

President Barack Obama will hear a new message next week when he hosts a state dinner for Trudeau at the White House. The Canadian leader’s debut also coincides with an increasing sense in global circles that monetary policy is reaching its limit, fueled in part by Japan’s surprise move to adopt negative interest rates that caused turmoil in currency markets.

“Making sure monetary policy and fiscal policy are aligned and complementary is obviously a benefit to any economy. But at the same time I don’t want to be overly preachy,” Trudeau said. Other countries should consider balanced budgets when feasible “but don’t make it the be-all and end-all because you may be missing out on opportunities to grow your economy — to help citizens prosper — that too much rigidity would actually interfere with.”

G-20 Consensus

At a Group of 20 meeting in Shanghai last week attended by Trudeau’s finance minister, Bill Morneau, officials from the world’s top economies committed their governments to doing more to boost growth amid mounting concerns over the potency of monetary policy.

Trudeau, 44, hinted he is considering expanding on pledges that have his country on pace for a deficit of nearly C$30 billion ($22.3 billion) in the fiscal year that begins April 1. Having promised C$10.5 billion in new spending during the campaign, Morneau delivered a fiscal update last month showing the government is starting from a deficit of C$18.4 billion as Canada grapples with the oil-price shock.

“It’s to me even more of a reason why we need to be investing intelligently in infrastructure, in money in the pockets of the middle class, to grow the economy,” Trudeau said of the fiscal situation he inherited after his majority win in the Oct. 19 election.

Debut Budget

He offered no detail on what new spending may be included in the budget, due March 22, but ruled out big-ticket surprises. “I don’t think we need massive stimulus,” he said. “There’s a limit on how much you can flow infrastructure dollars in a short time frame from a standing start.”

A C$30 billion deficit would be 1.5 percent of gross domestic product. That’s a swing of 1.4 percentage points, from an expected deficit of 0.1 percent of GDP in the current year. Since the end of World War II, there have been only four one-year expansionary fiscal swings of more than 1.4 percentage points of GDP.

Even with C$30 billion in red ink, Canada’s debt-to-GDP ratio would remain among the lowest in the G-7. “That leaves us with more flexibility,” Trudeau said. “If we were sitting at 90 percent debt to GDP, we probably wouldn’t be contemplating the kinds of things we know we’re able to do. If interest rates were radically different — much higher, to take money to invest in our economy — we’d be looking at different kinds of investments.”