The consumer isn’t ‘coming back’ until after deficit spending, public or private, increases to offset unspent income, and ‘putting money into savings’ (below) is better described as ‘increasing borrowing less’. Also, consumption spending includes health care premiums and utility bills, and when they go up it tends to later take away from spending on other things: Highlights August was a soft month for the consumer, both for income and especially for spending. Income rose only 0.2 percent in the month as wages & salaries, which had been on a 4-month surge, could inch only 1 tenth higher in August. Consumer spending, which had also been on a 4-month winning streak, came in unchanged as durable goods declined, largely reflecting monthly weakness in vehicle sales, as did non-durable goods, in part reflecting low fuel prices. Service spending advanced, at plus 0.3 percent, but at a slower rate than prior months. Despite the weakness in income, the consumer put money into savings which are at a 5.7 percent rate for a 1 tenth gain and a special factor that held down spending. Inflation readings do show more life with the PCE price index up 0.1 percent and the core up 0.2 percent, both 1 tenth better than the prior month. Year-on-year, the overall measure rose 2 tenths to 1.0 percent with the core up 1 tenth to 1.7 percent and inching toward the Fed’s 2 percent goal.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

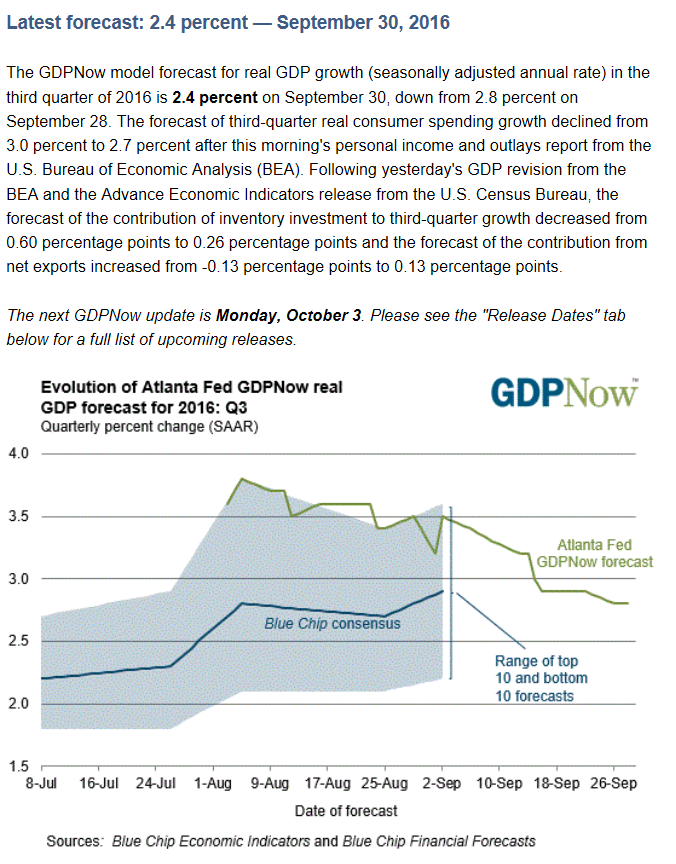

The consumer isn’t ‘coming back’ until after deficit spending, public or private, increases to offset unspent income, and ‘putting money into savings’ (below) is better described as ‘increasing borrowing less’. Also, consumption spending includes health care premiums and utility bills, and when they go up it tends to later take away from spending on other things:

Highlights

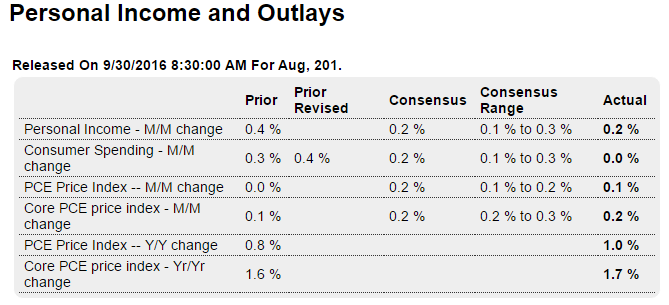

August was a soft month for the consumer, both for income and especially for spending. Income rose only 0.2 percent in the month as wages & salaries, which had been on a 4-month surge, could inch only 1 tenth higher in August. Consumer spending, which had also been on a 4-month winning streak, came in unchanged as durable goods declined, largely reflecting monthly weakness in vehicle sales, as did non-durable goods, in part reflecting low fuel prices. Service spending advanced, at plus 0.3 percent, but at a slower rate than prior months. Despite the weakness in income, the consumer put money into savings which are at a 5.7 percent rate for a 1 tenth gain and a special factor that held down spending.

Inflation readings do show more life with the PCE price index up 0.1 percent and the core up 0.2 percent, both 1 tenth better than the prior month. Year-on-year, the overall measure rose 2 tenths to 1.0 percent with the core up 1 tenth to 1.7 percent and inching toward the Fed’s 2 percent goal.

For policy makers, what strength there is in prices is probably offset by the softness in income and spending. But the results of this report are no surprise, ultimately reflecting what was only a moderate gain for payrolls in August.

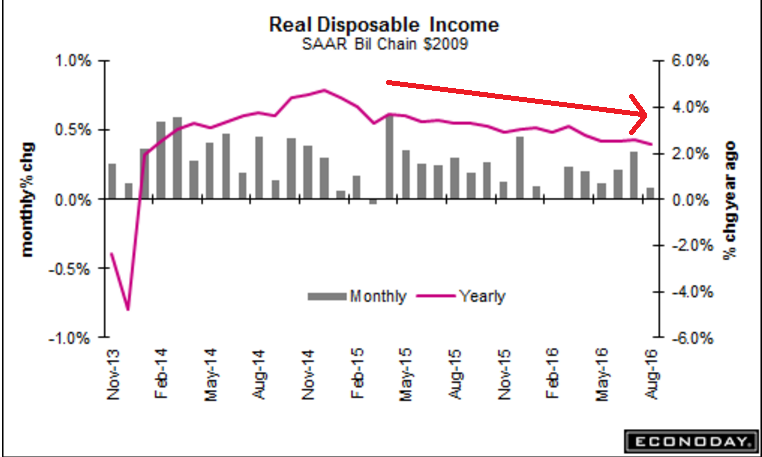

The shale boom reversed the slide into recession, the shale bust reversed the shale boom and it’s back down again:

Both up a bit more than expected:

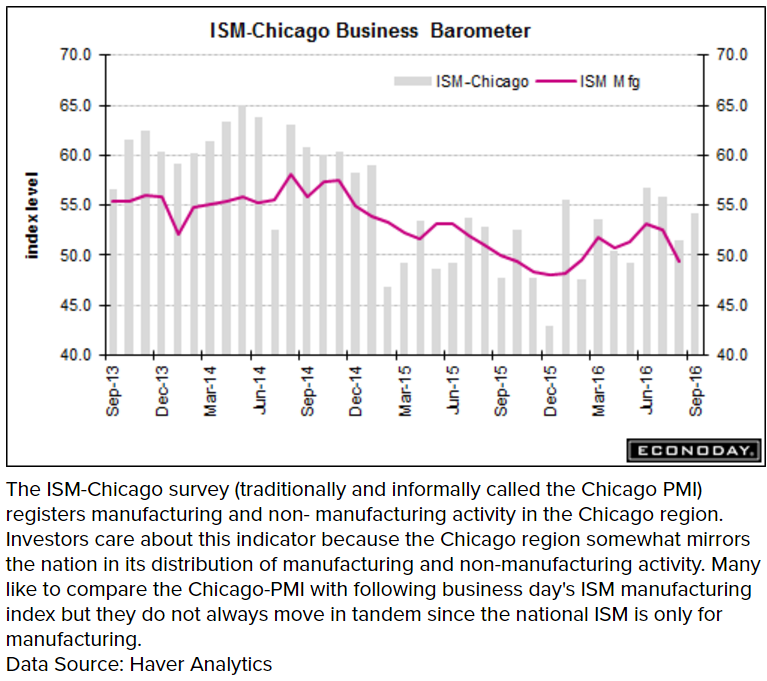

Down again, for reasons previously discussed, likely more to come for same reasons: