Still on the downward glide path since the collapse in oil capex: Highlights Existing home sales, in sharp contrast to new home sales, haven’t been able to build any strength this year and today’s pending home sales report points to outright weakness in the coming months. The pending index fell a very steep 2.4 percent in August with 3 of 4 regions positing monthly declines. The exception is the Northeast which rose 1.3 percent in the month and is the only region in the plus column for the year-on-year rate, at 5.9 percent. But this report is not about strength but weakness, weakness that persists despite very low mortgage rates and strength in the labor market. Housing and autos are the two main sources of consumer credit growth and neither looking so good: Kelley Blue Book sees September U.S. auto sales down 2 percent By Bernie Woodall Sept 28 (Reuters) — Auto industry consultancy Kelley Blue Book said on Wednesday that it expected that September U.S. auto sales fell 2 percent from a year ago, at 1.41 million vehicles, for a seasonally adjusted annualized rate of 17.4 million vehicles. Major auto manufacturers will report U.S. sales for September on Monday. Inventories still coming down, with no sign yet of the reversal most have forecast for q3: Highlights Wholesale inventories fell a preliminary 0.1 percent in August with nondurables down 0.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Still on the downward glide path since the collapse in oil capex:

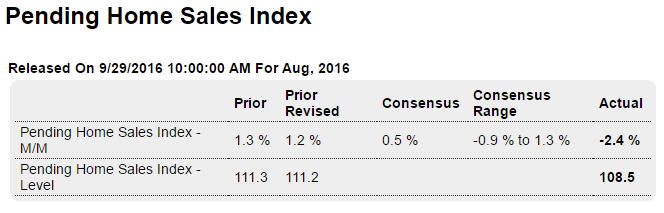

Highlights

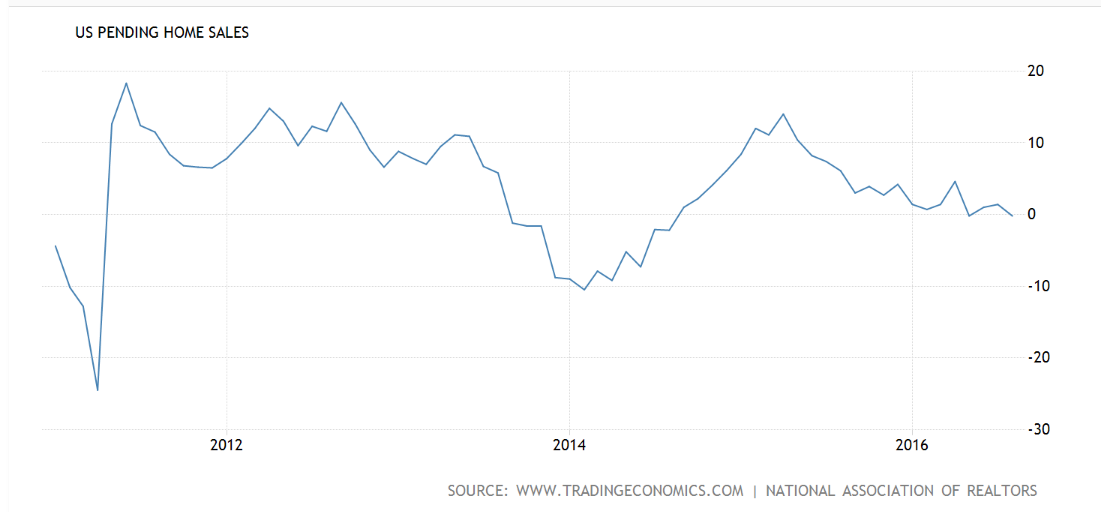

Existing home sales, in sharp contrast to new home sales, haven’t been able to build any strength this year and today’s pending home sales report points to outright weakness in the coming months. The pending index fell a very steep 2.4 percent in August with 3 of 4 regions positing monthly declines. The exception is the Northeast which rose 1.3 percent in the month and is the only region in the plus column for the year-on-year rate, at 5.9 percent. But this report is not about strength but weakness, weakness that persists despite very low mortgage rates and strength in the labor market.

Housing and autos are the two main sources of consumer credit growth and neither looking so good:

Kelley Blue Book sees September U.S. auto sales down 2 percent

By Bernie Woodall

Sept 28 (Reuters) — Auto industry consultancy Kelley Blue Book said on Wednesday that it expected that September U.S. auto sales fell 2 percent from a year ago, at 1.41 million vehicles, for a seasonally adjusted annualized rate of 17.4 million vehicles. Major auto manufacturers will report U.S. sales for September on Monday.

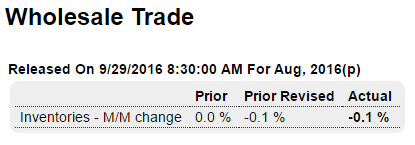

Inventories still coming down, with no sign yet of the reversal most have forecast for q3:

Highlights

Wholesale inventories fell a preliminary 0.1 percent in August with nondurables down 0.6 percent in what likely reflects price weakness for energy products. Inventories of durables in the wholesale sector rose 0.1 percent in the month. This report also includes preliminary data on retail inventories which rose 0.5 percent in the month and reflecting a 1.0 percent jump in vehicles.