Working their way a bit higher but still seriously depressed:With the year over year CPI increase now only 1% the Fed can only wait and see if headline will catch up to core and ‘justify’ their tightening bias. Consumer Price IndexHighlightsThe CPI core is showing pressure for a second month, up a higher-than-expected 0.3 percent in February with the year-on-year rate up 1 tenth to plus 2.3 percent and further above the Federal Reserve’s 2 percent line.Gains are once again led by health care with medical care up 0.5 percent for a second straight month which includes a 0.9 percent gain for prescription drugs. Shelter also shows pressure, up 0.3 percent as does apparel which is up 1.6 percent for a second straight sharp gain. Food rose percent 0.2 percent with the year-on-year rate at plus 0.9 percent.Energy prices, which may be on the climb this month, fell a sharp 6.0 percent in February and pulled down the total CPI which came in at minus 0.2 percent with the year-on-year rate at plus 1.0 percent.But it’s not the total that Fed officials will be watching but the core which — for a second straight month — is signaling what policy makers want, that is upward pressure. This report isn’t dramatic enough to revive much chance for a rate hike at today’s FOMC but it will offer strong arguing point for the hawks.

Topics:

WARREN MOSLER considers the following as important: GDP, housing, inflation

This could be interesting, too:

Nick Falvo writes Subsidized housing for francophone seniors in minority situations

Matias Vernengo writes Serrano, Summa and Marins on Inflation, and Monetary Policy

Angry Bear writes Voters Blame Biden and Harris for Inflation

NewDealdemocrat writes Declining Housing Construction

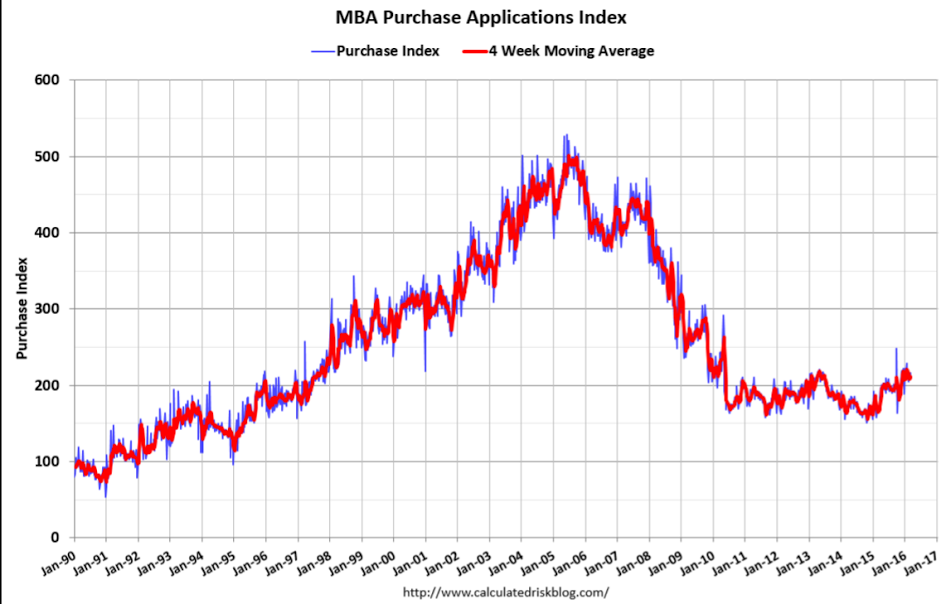

Working their way a bit higher but still seriously depressed:

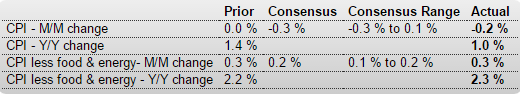

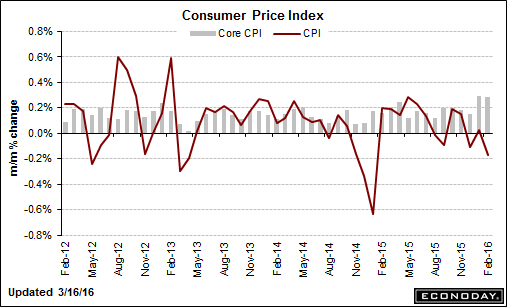

With the year over year CPI increase now only 1% the Fed can only wait and see if headline will catch up to core and ‘justify’ their tightening bias.

Consumer Price Index

Highlights

The CPI core is showing pressure for a second month, up a higher-than-expected 0.3 percent in February with the year-on-year rate up 1 tenth to plus 2.3 percent and further above the Federal Reserve’s 2 percent line.Gains are once again led by health care with medical care up 0.5 percent for a second straight month which includes a 0.9 percent gain for prescription drugs. Shelter also shows pressure, up 0.3 percent as does apparel which is up 1.6 percent for a second straight sharp gain. Food rose percent 0.2 percent with the year-on-year rate at plus 0.9 percent.

Energy prices, which may be on the climb this month, fell a sharp 6.0 percent in February and pulled down the total CPI which came in at minus 0.2 percent with the year-on-year rate at plus 1.0 percent.

But it’s not the total that Fed officials will be watching but the core which — for a second straight month — is signaling what policy makers want, that is upward pressure. This report isn’t dramatic enough to revive much chance for a rate hike at today’s FOMC but it will offer strong arguing point for the hawks.

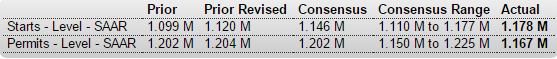

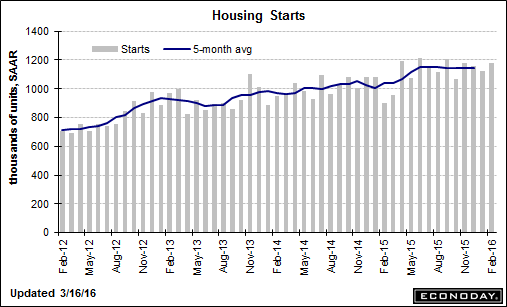

There are no starts without permits, and permits are down:

Housing Starts

Highlights

Housing starts & permits are mixed with starts way up but permits, which are the more important of the two, way down. Starts rose 5.2 percent to a 1.178 million annualized rate while permits, which were expected to show no change, dropped 3.1 percent to 1.167 million.The gain for starts is split between a 7.2 percent surge for single-family homes and a 0.8 percent gain for the multi-family component while the drop for permits is centered in multi-family, down 8.4 percent to a 436,000 rate. But permits for single-family homes, and this is the silver lining in this report, are up 0.4 percent to 731,000. The multi-family component, driven by investment demand, is often very volatile which makes single-family homes the more telling of the two.

Year-on-year, single-family permits are up a very strong 16.8 percent offsetting a 7.6 percent dip on the multi-family side. Regional data for permits show the Northeast out in front with a nearly 36 percent gain and the South in the rear at minus 1.8 percent. The West, which is a key region for new housing, is up 6.5 percent.

The gain for starts will boost ongoing estimates for construction spending while the small gain for single-family permits may help ease concern that housing is losing momentum.

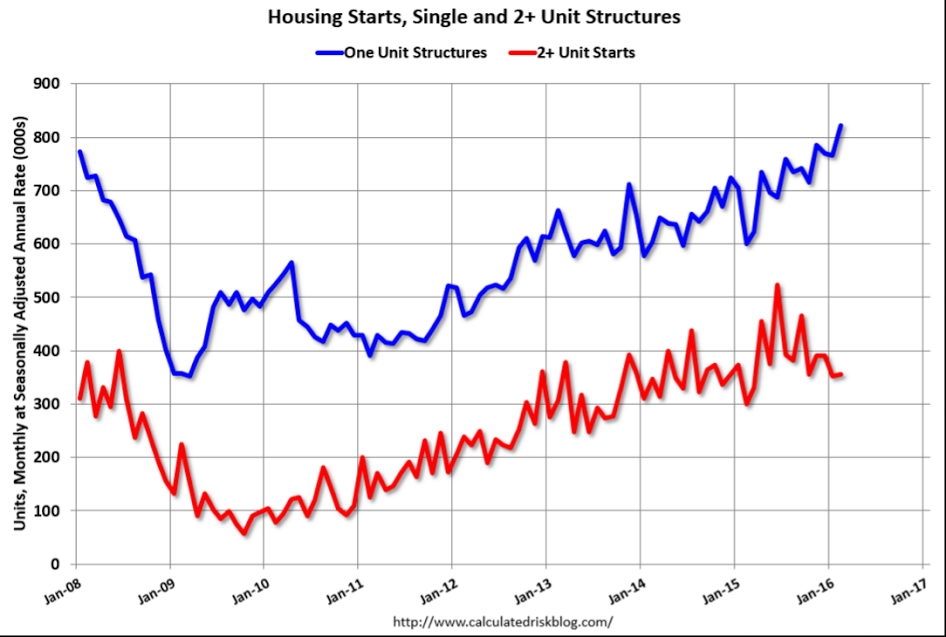

And more confirmation that multifamily peaked last June when the NY tax credits expired:

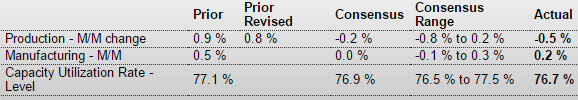

And more bad:

Industrial Production

Highlights

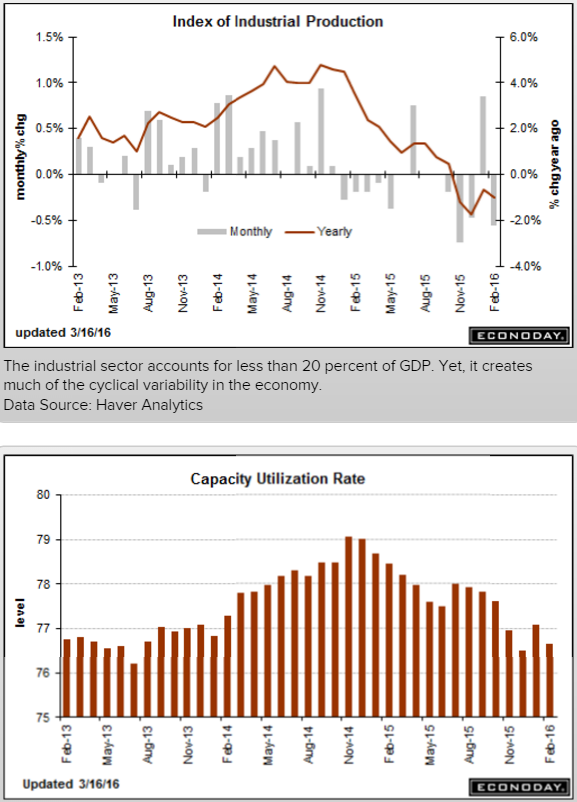

Industrial production fell 0.5 percent in February but includes a respectable and higher-than-expected 0.2 percent gain for manufacturing production which pulls this report to the positive column for the economic outlook. The utility component, down 4.0 percent in February after rising 4.2 percent in January, is very volatile reflecting month-to-month swings this time of year in heating demand. The mining component, down again at minus 1.4 percent, has been weak for the last year reflecting the price collapse for commodities.But the manufacturing component is the telling component with strength belying broad weakness in regional surveys and pointing perhaps to better-than-expected output for the first quarter. Vehicles have been a center of strength for manufacturing, though production here did slip 0.1 percent in the month, while business equipment is suddenly showing life, up 0.6 percent for a second straight month. The gain for this component hints at a revival for business investment.

Capacity utilization overall is down 0.4 percentage points to 76.7 percent though manufacturing capacity, again the reading to focus on, is unchanged at 76.1 percent. The factory sector has been getting pulled back by weak exports and weak demand for energy equipment though this report, together with positive indications in yesterday’s Empire State report, do suggest, or at least offer the hint, that the worst may over.

Note that the traditional non-NAICS numbers for industrial production may differ marginally from the NAICS basis figures.