A nice positive print that hopefully signals a turn around, but I need to see at least one more before taking it seriously, as volatility is common with this series:More negative than expected means a downward adjustment for GDP, as do downward revisions of prior prints: Current AccountHighlightsThe nation’s current account deficit narrowed in the fourth quarter to 5.3 billion from a revised third-quarter deficit of 9.9 billion. The improvement reflects a smaller trade deficit for goods and a larger trade surplus for services. Balances on income were neutral.The current account as a percentage of GDP slipped 1 tenth from the third quarter to a very respectable 2.8 percent. For 2015 as a whole, the current account deficit totaled 4.1 billion, equal to 2.7 percent of GDP and up from 9.5 billion and an even lower 2.2 percent of GDP in full-year 2014. Big downward revision to last month makes current month prints suspect at least until the first revision. And the chart looks like it may have crested: JOLTSHighlightsIn a mixed report, job openings surged in January to 5.541 million from, however, a sharply downward revised 5.281 million in December (5.607 million initially reported). The quits rate, which jumped in December, fell back a sharp 2 tenths to 2.0 percent and points to less confidence among workers to shift jobs.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

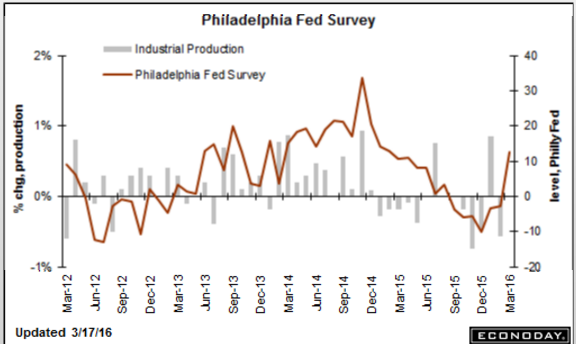

A nice positive print that hopefully signals a turn around, but I need to see at least one more before taking it seriously, as volatility is common with this series:

More negative than expected means a downward adjustment for GDP, as do downward revisions of prior prints:

Current Account

Highlights

The nation’s current account deficit narrowed in the fourth quarter to $125.3 billion from a revised third-quarter deficit of $129.9 billion. The improvement reflects a smaller trade deficit for goods and a larger trade surplus for services. Balances on income were neutral.The current account as a percentage of GDP slipped 1 tenth from the third quarter to a very respectable 2.8 percent. For 2015 as a whole, the current account deficit totaled $484.1 billion, equal to 2.7 percent of GDP and up from $389.5 billion and an even lower 2.2 percent of GDP in full-year 2014.

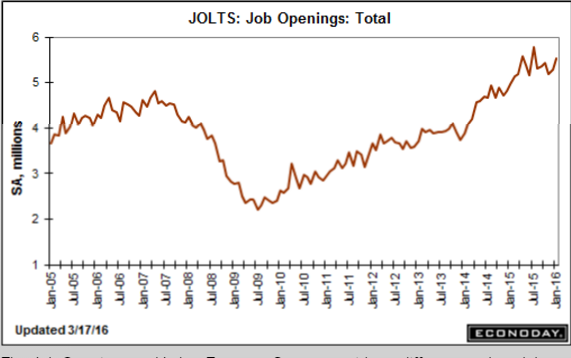

Big downward revision to last month makes current month prints suspect at least until the first revision.

And the chart looks like it may have crested:

JOLTS

Highlights

In a mixed report, job openings surged in January to 5.541 million from, however, a sharply downward revised 5.281 million in December (5.607 million initially reported). The quits rate, which jumped in December, fell back a sharp 2 tenths to 2.0 percent and points to less confidence among workers to shift jobs. Despite the downward revision and despite the drop in the quits rate, the reading for January job openings, which in percentage terms is at 3.7 percent for a 1 tenth gain, is a positive for the jobs outlook.

Norway’s central bank on Thursday cut its key interest rate to an all-time low of 0.5 percent from 0.75 percent, and raised the prospect of a move into negative territory.

The bank warned that should the Norwegian economy be exposed to further shocks, the possibility of negative rates could not be excluded.

“We have experience from other countries that it’s possible to go beyond the zero lower bound…if necessary, we have extended room for maneuver,” central bank governor Øystein Olsen told CNBC.

So if the euro area current account surplus trade flows have finally overtaken CB and other portfolio selling and the euro keeps going up and cuts into net exports, things could get highly problematic very quickly: