A few weeks ago I posted the announcement of Saudi price cuts, suggesting this could be meant to bring down prices, which now seems to be happening: Again, with no loan demand, they are calling for higher rates, presumably to slow down lending: Six Fed banks called for discount rate hike: minutes By Lindsay Dunsmuir July 12 (Reuters) — The number of regional Federal Reserve banks pushing the central bank to raise the rate it charges commercial banks for emergency loans rose to six in June, minutes from the Fed’s discount rate meeting released on Tuesday showed. The Federal Reserve banks of Kansas City, Richmond, Cleveland and San Francisco continued to push for an increase and were joined this time around by Boston and St. Louis. Those that wanted an increase cited “expected strengthening in economic activity and their expectations for inflation to gradually move toward the 2 percent objective.” At the macro level the only financial problem from Federal deficit spending per se would be some kind of inflation problem. Therefore the burden of proof is on anyone claiming there is a long term deficit problem to show there is a long term inflation problem.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

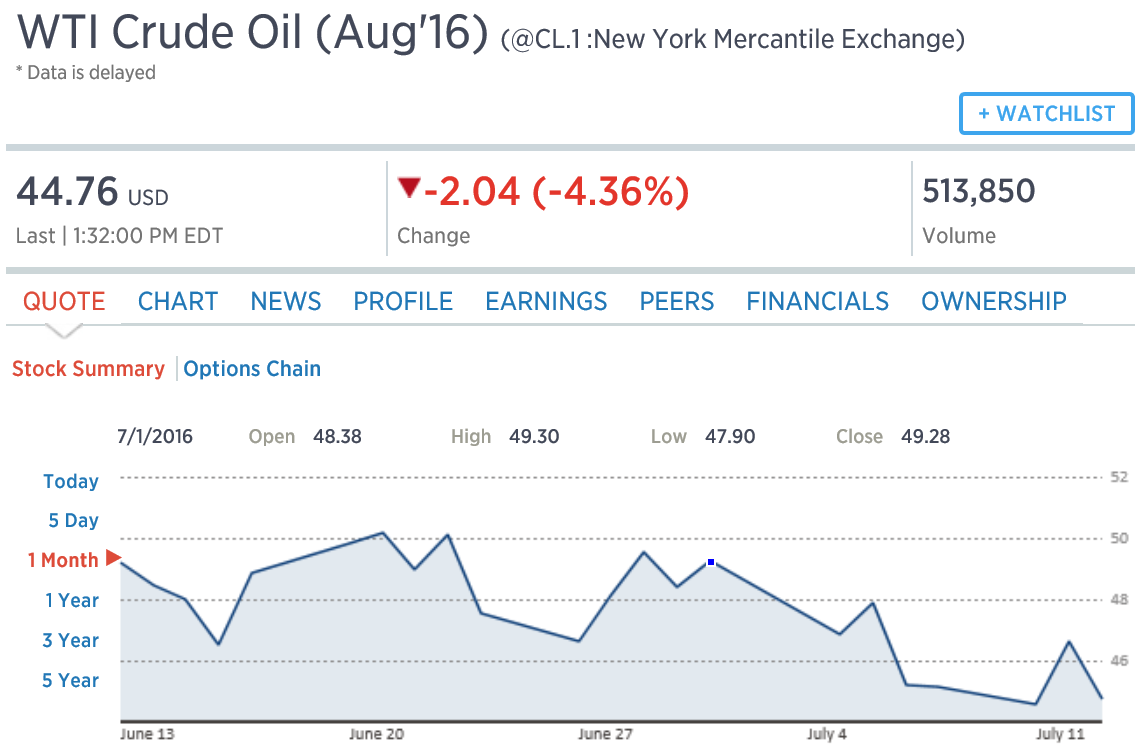

A few weeks ago I posted the announcement of Saudi price cuts, suggesting this could be meant to bring down prices, which now seems to be happening:

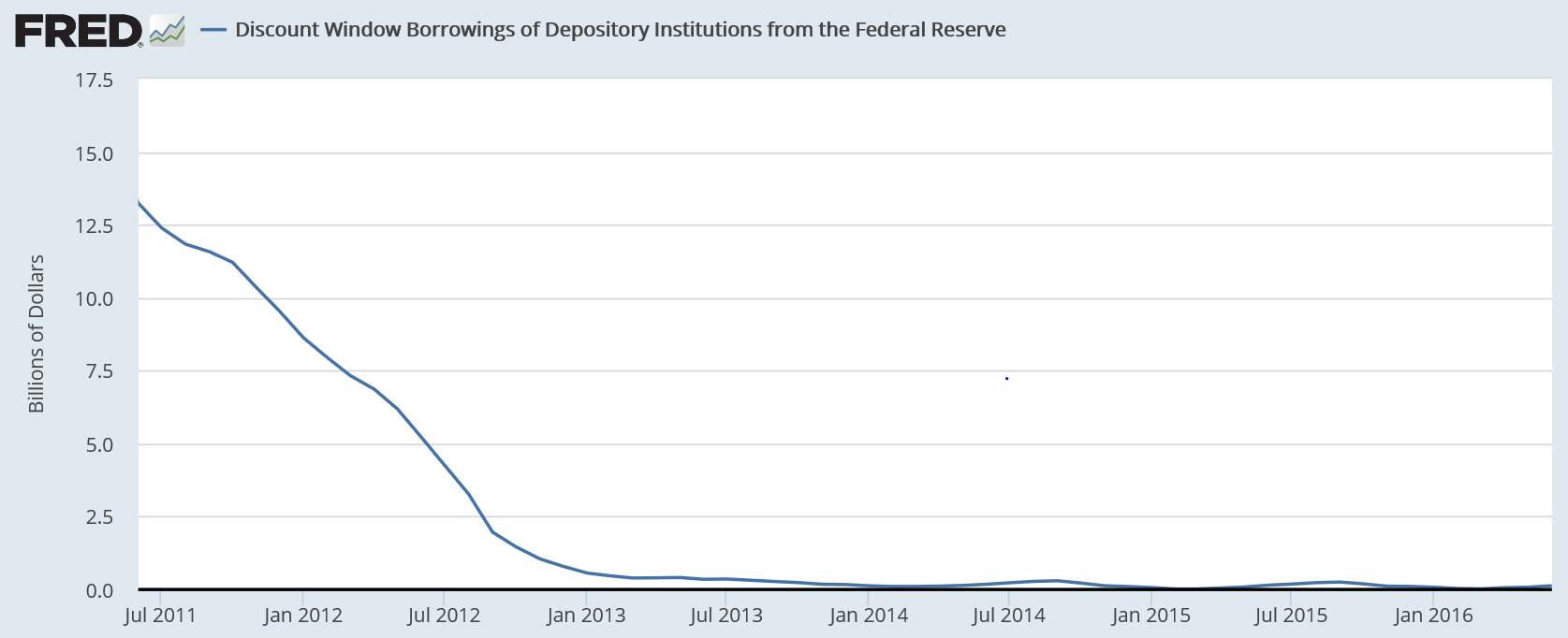

Again, with no loan demand, they are calling for higher rates, presumably to slow down lending:

Six Fed banks called for discount rate hike: minutes

By Lindsay Dunsmuir

July 12 (Reuters) — The number of regional Federal Reserve banks pushing the central bank to raise the rate it charges commercial banks for emergency loans rose to six in June, minutes from the Fed’s discount rate meeting released on Tuesday showed. The Federal Reserve banks of Kansas City, Richmond, Cleveland and San Francisco continued to push for an increase and were joined this time around by Boston and St. Louis. Those that wanted an increase cited “expected strengthening in economic activity and their expectations for inflation to gradually move toward the 2 percent objective.”

At the macro level the only financial problem from Federal deficit spending per se would be some kind of inflation problem. Therefore the burden of proof is on anyone claiming there is a long term deficit problem to show there is a long term inflation problem. So with the Fed’s and CBO’s forecasts at 2%, and with the Treasury TIPS markets showing something less than that, the burden of proof is on those claiming a long term deficit problem to show those forecasts are sufficiently wrong. Yet the ‘headline left’ unquestioningly concedes that there is a long term deficit problem, and the rest is history… :(

CBO Expects Higher Long-Term Deficits and Lower Interest Rates

By Nick Timiraos

July 12 (WSJ) — Federal debt, which has doubled since 2008 to about 75% of gross domestic product, will rise to 122% in 2040, up from an estimate of 107% last year. On the latest forecasts, the national debt would exceed GDP by 2033. Last year’s projections had the U.S. reaching that threshold in 2039. The CBO projects that the debt will reach 141% of GDP in 2046, down from an earlier estimate of 155% made this past January. The latest CBO estimates envision the 10-year Treasury rate, after inflation, reaching just 1.9% over the long term, down from estimates of 2.2% last year and 3% in 2013.

The drop in imports and exports tells the story of the collapse of global trade. Not good:

China’s June exports, imports fall more than expected

July 13 (CNBC) — China’s June exports and imports fell more than expected. In June, exports fell 4.8 percent year-on-year percent, while imports declined 8.4 percent, percent, in U.S. dollar terms. In yuan terms, exports rose 1.3 percent from a year ago while imports declined 2.3 percent. That compared with May exports in dollar-denominated terms tanking 4.1 percent on-year, more than double April’s 1.8 percent fall, while imports edged down 0.4 percent, compared with April’s 10.9 percent drop. In yuan terms, May trade data had painted a different picture, with exports up 1.2 percent on-year and imports 5.1 percent higher.