It was previously noted that Treasury revenue was down, which now is confirmed in this report. This is the beginning of the automatic fiscal stabilizers at work, where weakness translates intoa larger federal deficit, and persists until deficit spending is sufficient to more than offset unspent income, as is necessary for growth. Private sector deficit spending would also restore growth. However I see only private sector credit growth deceleration, which is generally the case as the private sector historically has a strong tendency to instead be pro cyclical: Highlights The Treasury did post a .3 billion surplus in June but 9 months into the government’s fiscal year the deficit is widening sharply, up 27 percent to 0.9 billion vs 6.4 billion this time last year. The year-to-date gain for receipts is at only 0.9 percent with corporate income taxes down sharply and individual income taxes up only slightly. The spending side of the ledger is up 3.9 percent with net interest costs up 11.9 percent and reflecting what are still comparatively high U.S. rates. Medicare costs are up 4.3 percent year-to-date, offset in part by a 1.1 percent decline for defense. Also: The latest US Federal government summary recorded a surplus of .3bn for June compared with a consensus surplus estimate of around .0bn. It followed a .

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

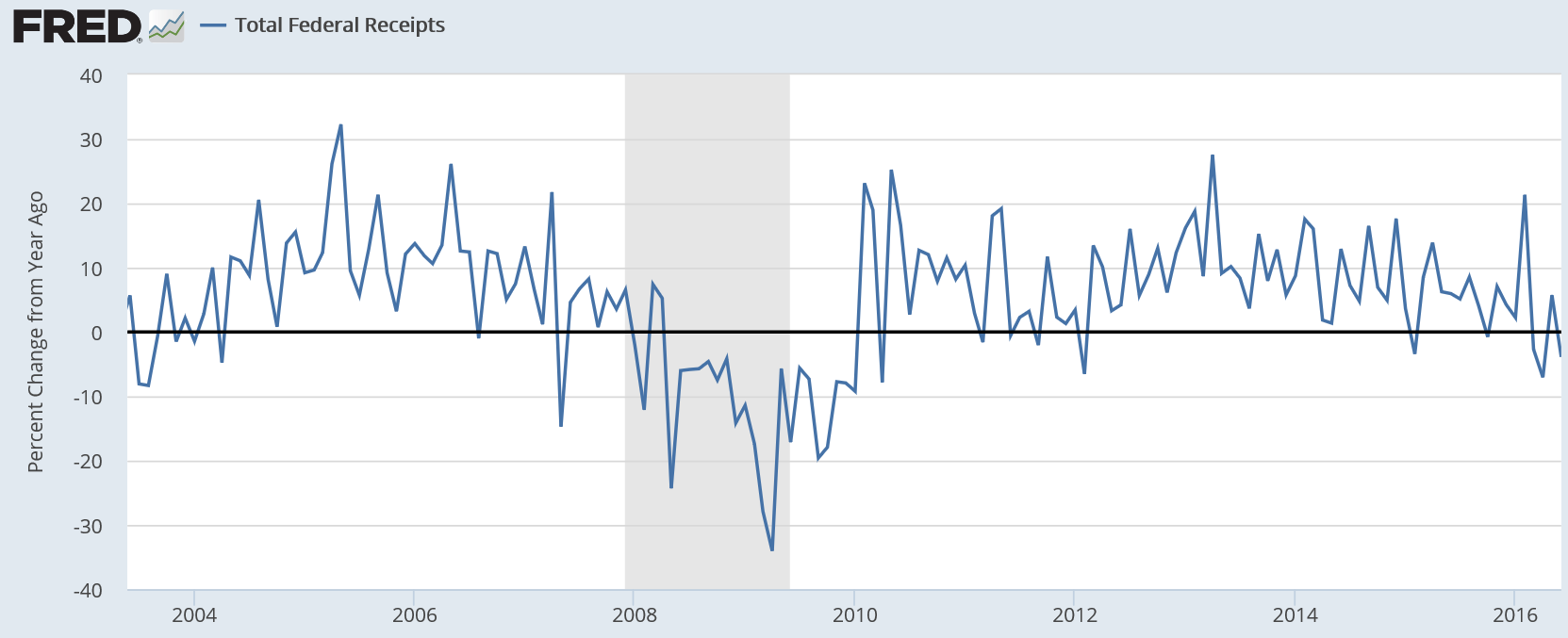

It was previously noted that Treasury revenue was down, which now is confirmed in this report. This is the beginning of the automatic fiscal stabilizers at work, where weakness translates into

a larger federal deficit, and persists until deficit spending is sufficient to more than offset unspent income, as is necessary for growth. Private sector deficit spending would also restore growth. However I see only private sector credit growth deceleration, which is generally the case as the private sector historically has a strong tendency to instead be pro cyclical:

Highlights

The Treasury did post a $6.3 billion surplus in June but 9 months into the government’s fiscal year the deficit is widening sharply, up 27 percent to $400.9 billion vs $316.4 billion this time last year. The year-to-date gain for receipts is at only 0.9 percent with corporate income taxes down sharply and individual income taxes up only slightly. The spending side of the ledger is up 3.9 percent with net interest costs up 11.9 percent and reflecting what are still comparatively high U.S. rates. Medicare costs are up 4.3 percent year-to-date, offset in part by a 1.1 percent decline for defense.

Also:

The latest US Federal government summary recorded a surplus of $6.3bn for June compared with a consensus surplus estimate of around $24.0bn. It followed a $50.5bn surplus in June 2015 and was the weakest June performance for two years. For the first nine months of fiscal 2015/16, the deficit rose significantly to $401bn from $316bn the previous year with sustained deterioration over the past few months.

Over the fiscal year to date, revenue rose 0.9% from the previous year, maintaining the overall slowdown seen over the past few months. Income taxes increased slightly over the year, but growth has weakened and corporate taxes continued to decline with a 16% annual fall.

Spending rose 3.9% over the year and there has been a steady increase in spending over the past 12 months. Over the past 12 months, the deficit amounted to 2.9% of GDP from 2.6% previously. Although there were slight distortions caused by calendar adjustments, there is evidence that the overall deterioration in the budget position is accelerating.

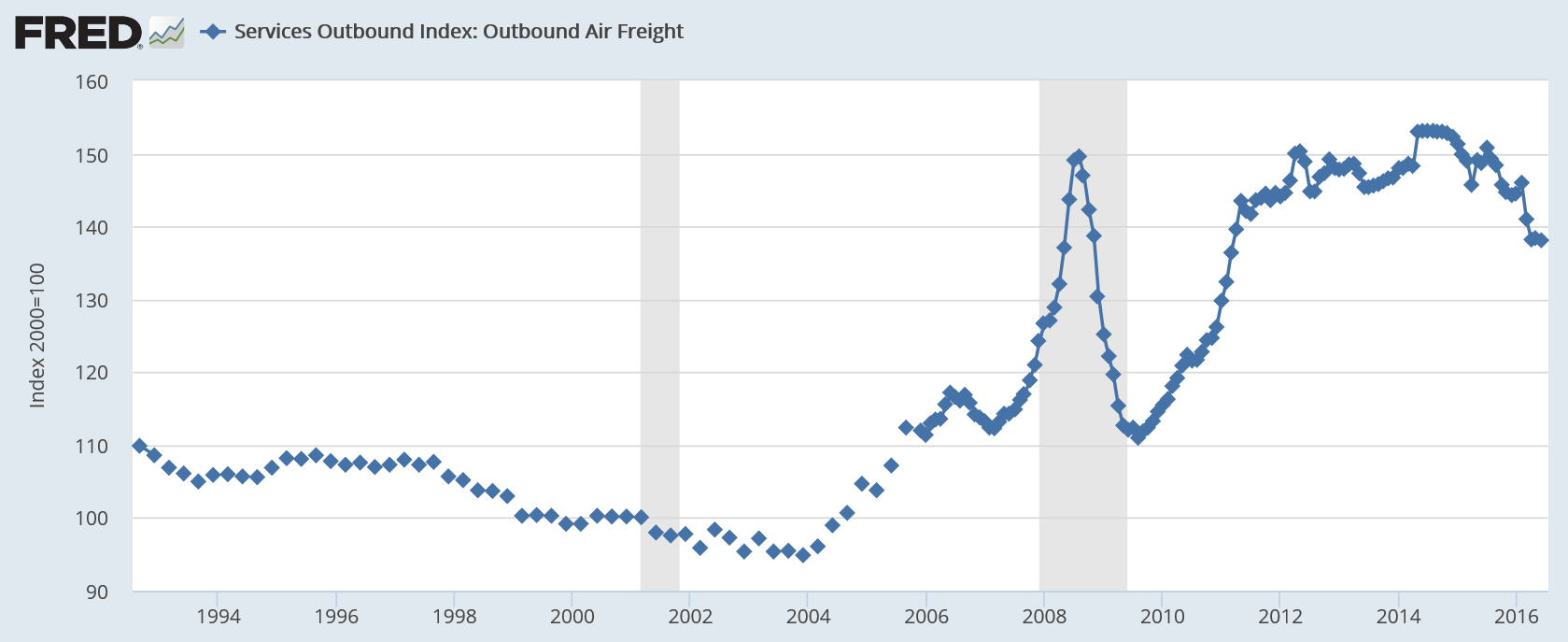

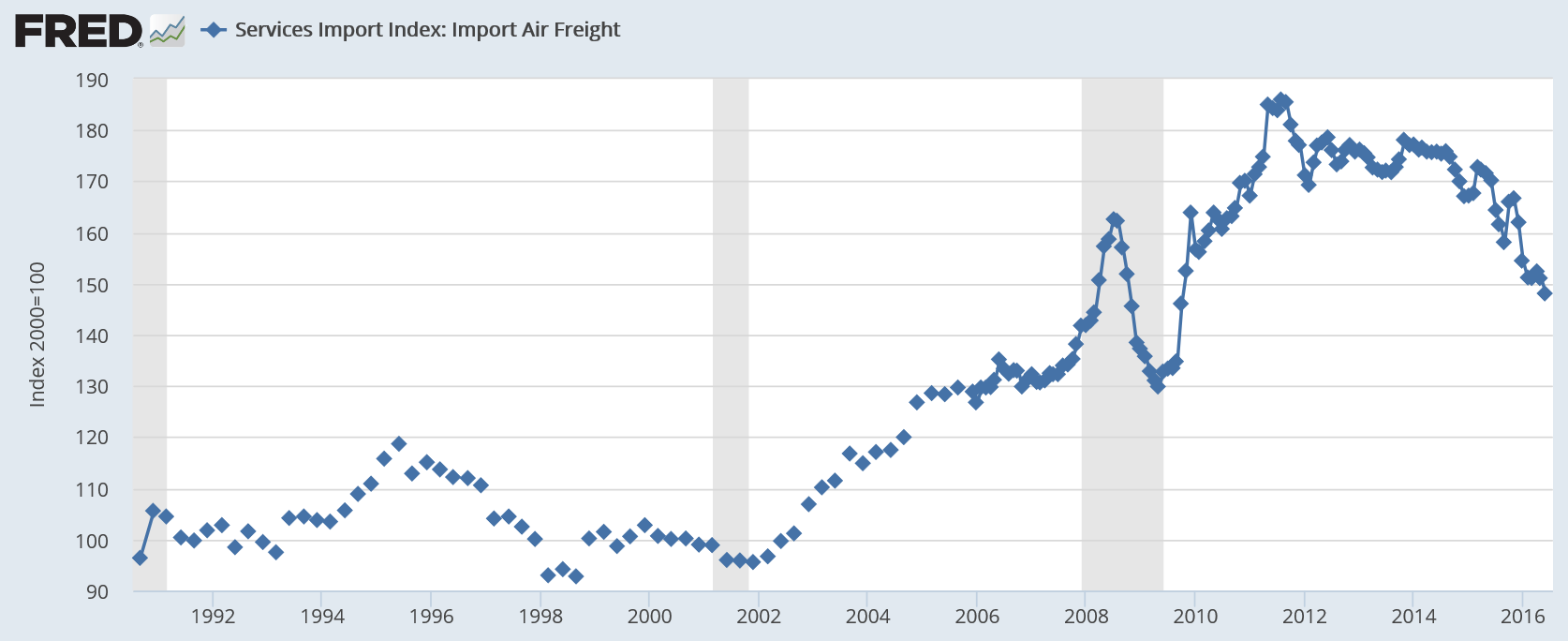

More evidence of trade collapse:

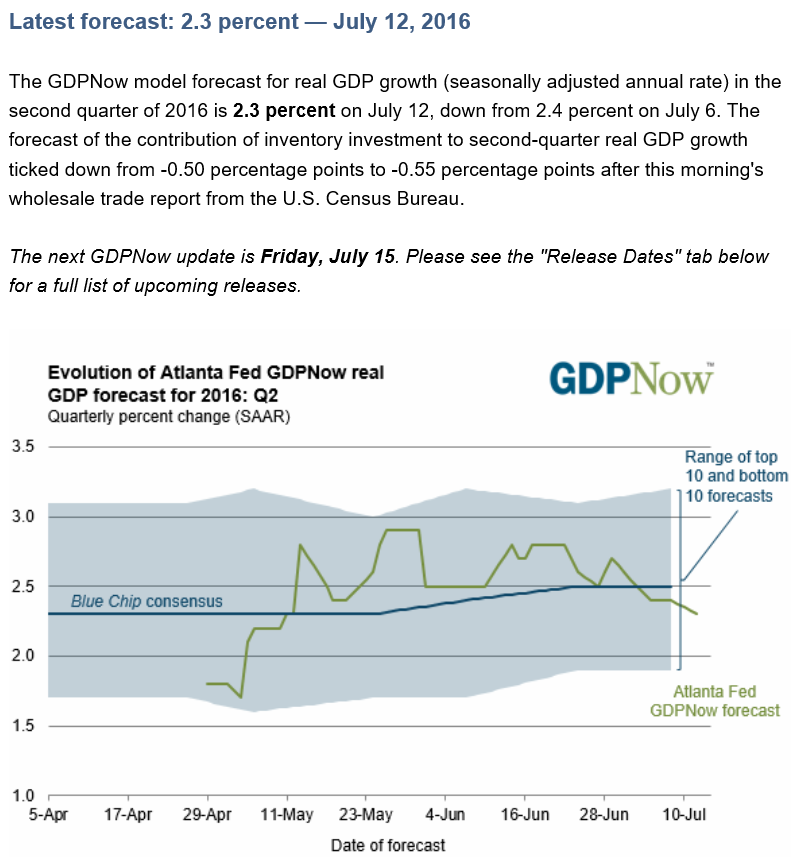

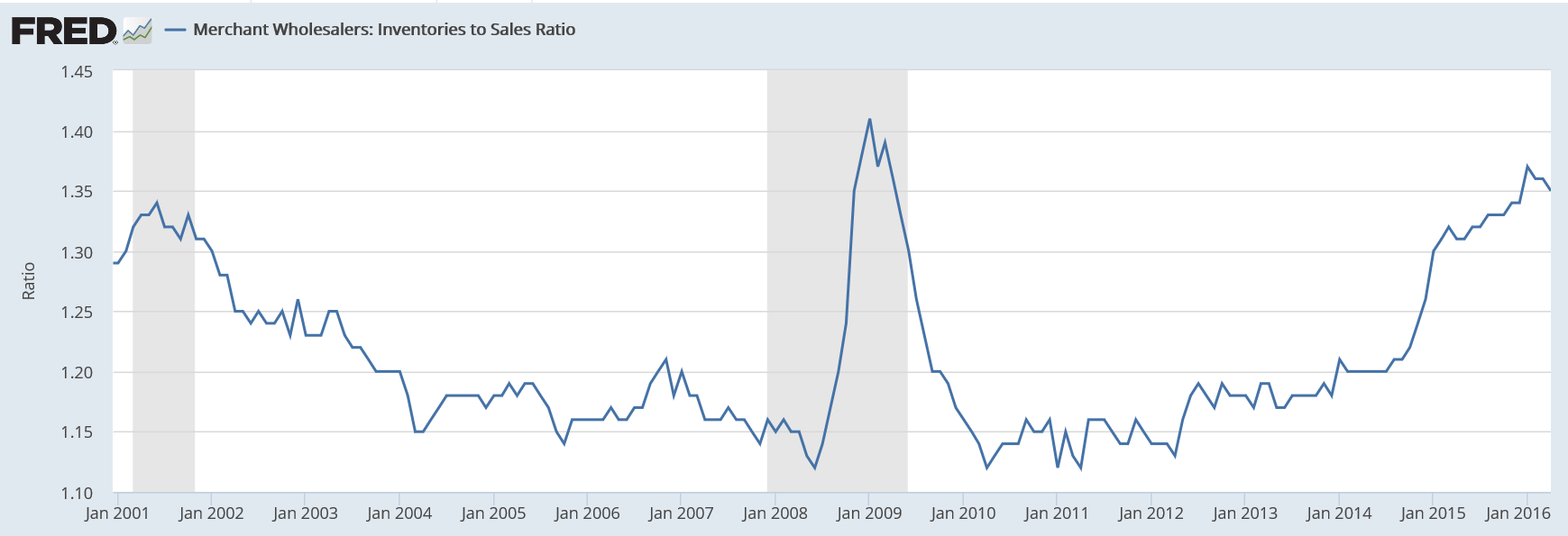

GDP forecast moving down, most recently on a report for May as excessive and still way too high inventories begin to be worked down, as previously discussed. Lots of time for more of same: