A bit higher than expected now been going sideways for almost a year: Existing Home Sales Euro Area current account surplus continues to zig zag it’s way higher: Euro Area Current AccountEurozone current account surplus came in at €32.3 billion in March of 2016 compared to an upwardly revised €11.2 billion surplus in the previous month. The surpluses in balances of goods (to €36.1 billion from €25.2 billion in February) and services (to €4.5 billion from €3.2 billion) widened while the one in primary income (to €6.5 billion from €6.8 billion) narrowed slightly. In addition, the secondary income deficit decreased (to €-14.8 billion from €-24 billion). This is ‘borrowing to spend’ that’s gone away:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

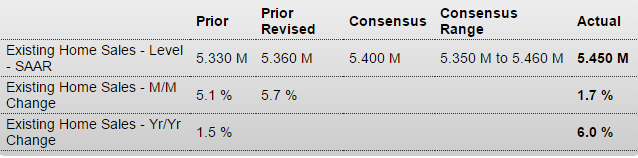

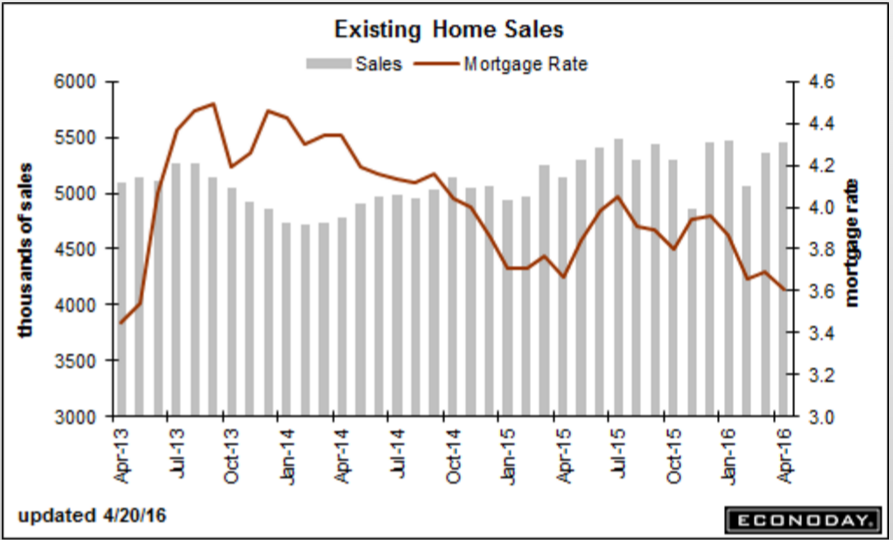

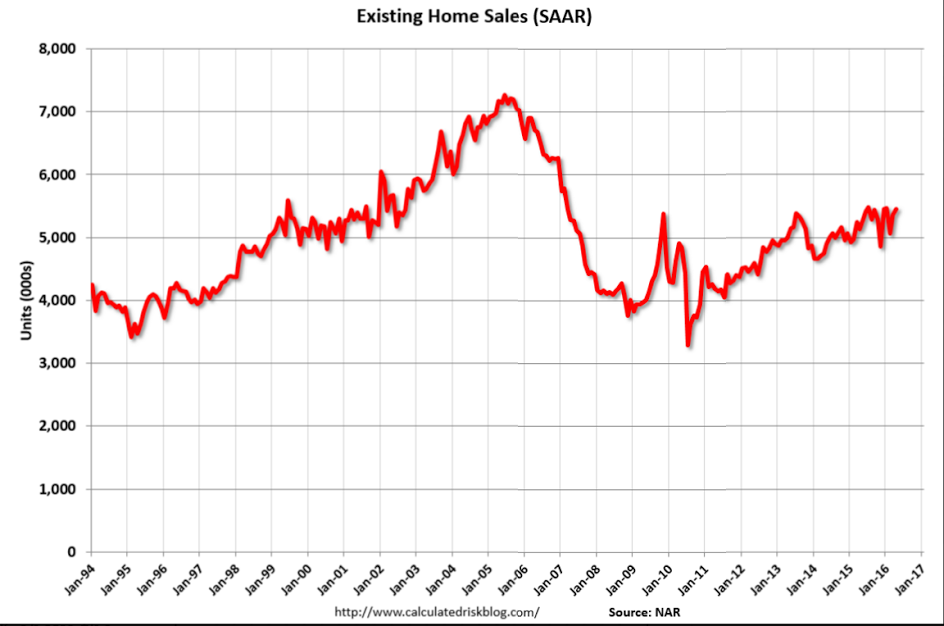

A bit higher than expected now been going sideways for almost a year:

Existing Home Sales

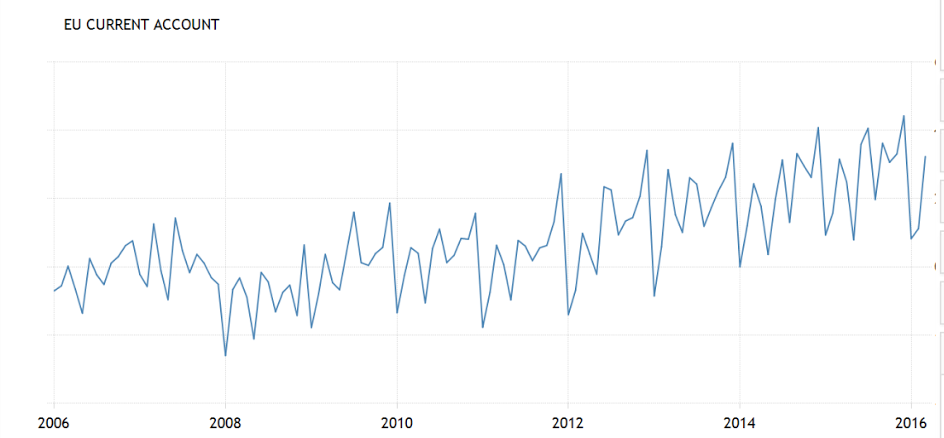

Euro Area current account surplus continues to zig zag it’s way higher:

Euro Area Current Account

Eurozone current account surplus came in at €32.3 billion in March of 2016 compared to an upwardly revised €11.2 billion surplus in the previous month. The surpluses in balances of goods (to €36.1 billion from €25.2 billion in February) and services (to €4.5 billion from €3.2 billion) widened while the one in primary income (to €6.5 billion from €6.8 billion) narrowed slightly. In addition, the secondary income deficit decreased (to €-14.8 billion from €-24 billion).

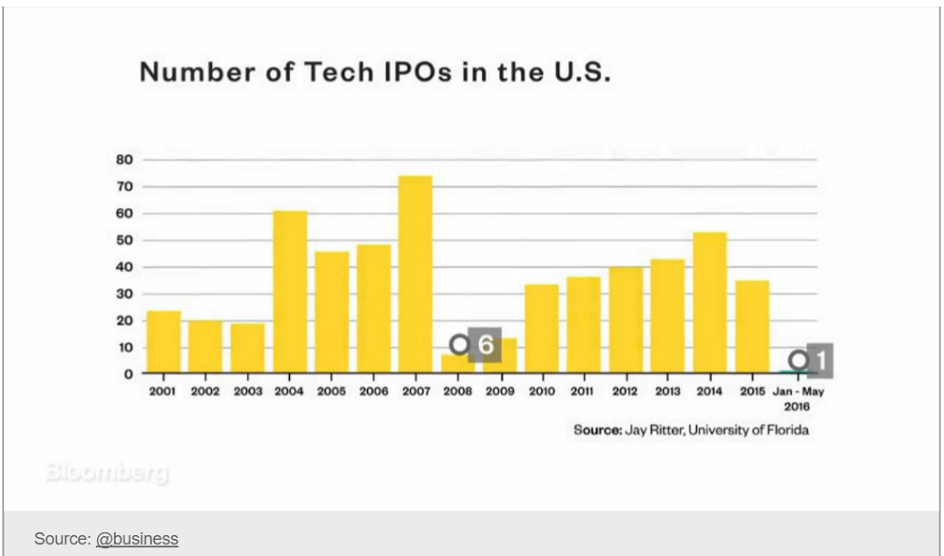

This is ‘borrowing to spend’ that’s gone away: