Reads like we are already in recession… Recession Warnings May Not Come to Pass Jan 24 (WSJ) — Every U.S. recession since World War II has been foretold by sharp declines in industrial production, corporate profits and the stock market. Industrial production has declined in 10 of the past 12 months, and is now off nearly 2% from its peak in December 2014. Corporate profits peaked around the summer of 2014 and were off by nearly 5% as of the third quarter of last year. The Dow Jones Industrial Average is down 7.6% so far this year. A Goldman Sachs analysis found that profit margins among the companies in the S&P 500 stock index—if energy companies are excluded—have been little changed over the past year. So does this: Dallas Fed Mfg SurveyHighlightsManufacturing data from the Dallas Fed, along with that of the Kansas City Fed, have been offering the most striking evidence of oil-related contraction. Dallas’ general activity index came in at an extremely negative score of minus 34.6 for the January report which is the lowest reading since the beginning of the recovery in 2009.New orders are falling deeper into contraction as are unfilled orders. Hours worked are now in the negative column as is employment.

Topics:

WARREN MOSLER considers the following as important: FED, GDP

This could be interesting, too:

Angry Bear writes GDP Grows 2.3 Percent

NewDealdemocrat writes Real GDP for Q3 nicely positive, but long leading components mediocre to negative for the second quarter in a row

Mike Norman writes Atlanta Fed reduces Q2 GDP forecast once again, as I said they would

Frances Coppola writes Why the Tories’ “put people to work” growth strategy has failed

Reads like we are already in recession…

Recession Warnings May Not Come to Pass

Jan 24 (WSJ) — Every U.S. recession since World War II has been foretold by sharp declines in industrial production, corporate profits and the stock market. Industrial production has declined in 10 of the past 12 months, and is now off nearly 2% from its peak in December 2014. Corporate profits peaked around the summer of 2014 and were off by nearly 5% as of the third quarter of last year. The Dow Jones Industrial Average is down 7.6% so far this year. A Goldman Sachs analysis found that profit margins among the companies in the S&P 500 stock index—if energy companies are excluded—have been little changed over the past year.

So does this:

Dallas Fed Mfg Survey

Highlights

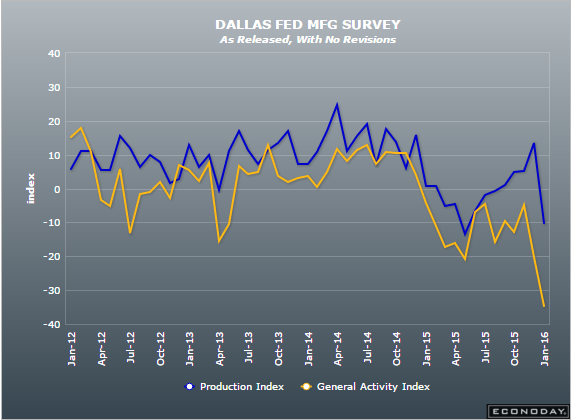

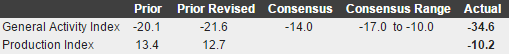

Manufacturing data from the Dallas Fed, along with that of the Kansas City Fed, have been offering the most striking evidence of oil-related contraction. Dallas’ general activity index came in at an extremely negative score of minus 34.6 for the January report which is the lowest reading since the beginning of the recovery in 2009.New orders are falling deeper into contraction as are unfilled orders. Hours worked are now in the negative column as is employment. And finally falling into contraction — and in a big way — is the production index which had through last year, despite long weakness in orders, held in positive ground, but not anymore with the reading at minus 10.2 for a nearly 23 point monthly plunge. Price data in this report remain well into the minus column, at nearly double-digit monthly declines.

Manufacturing reports this month have been mixed, with this and Empire State pointing to another buckling but not the most closely followed report, the Philly Fed which is pointing to stability for the sector. Watch for the Richmond Fed report tomorrow and the Kansas City report on Thursday.

Recent History Of This Indicator

The Dallas Fed general activity index has been buried in deep contraction and, along with the Kansas City Fed report, have been suffering the greatest effects from the collapse in oil. The Econoday median is calling for a 13th straight month of contraction, at a steep minus 14.0 for January vs December’s minus 20.1. Production has held in the plus column for this report but the outlook for continued strength is not supported by new orders which have been in contraction for 14 months.