This is the time of year when year over year growth tends to increase, pulling up the rest of the year’s growth. But note how that increase has declined along with the general increases: Along with what looks to me like Trumped up expectations actual sales remain depressed: Any expected Trump bump in home sales didn’t materialize in contracts for homes signed in November. Higher mortgage rates hit home sales, driving the National Association of Realtors Pending Home Sales Index down 2.5 percent in November from October, the NAR reported Wednesday. Analysts had forecast a 0.4 percent gain in the index, which is now 0.4 percent lower than a year ago and at its lowest level since January. Stock buy backs are an alternative to paying dividends. On difference is that $ paid as dividends constitute income taxable at the going dividend tax rate, while the $ spent to buy back shares are only taxable to the sellers of the shares to the extent there are capital gains. So, just as an educated guess, with buy backs taxable income is reduced by perhaps 90%. Also, repatriation may or may not happen, and it may or may not result in any change in investment, or even stock buy backs.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

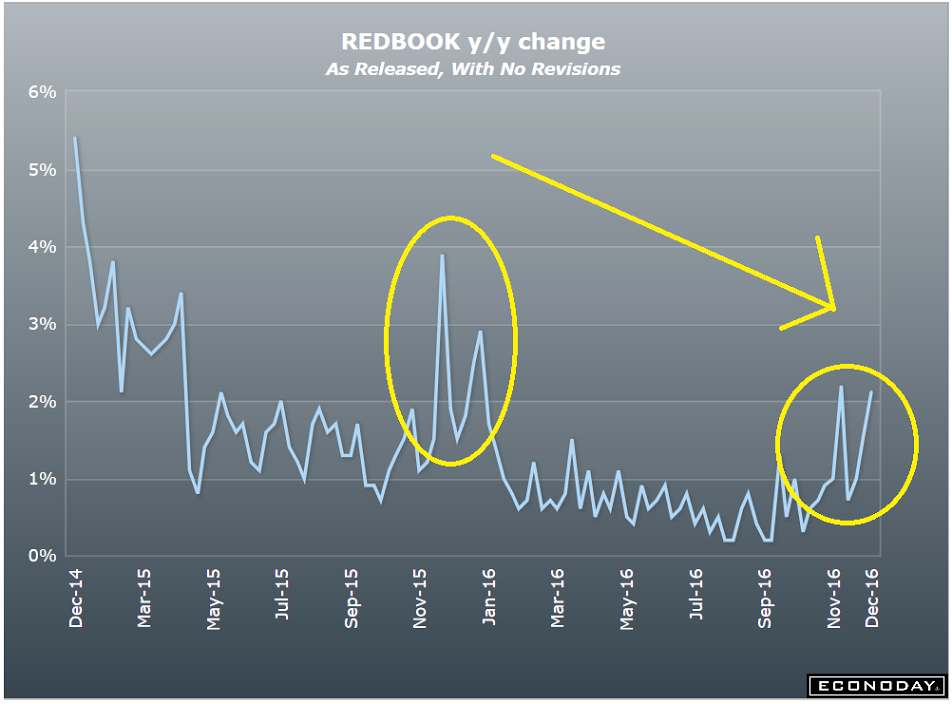

This is the time of year when year over year growth tends to increase, pulling up the rest of the year’s growth. But note how that increase has declined along with the general increases:

Along with what looks to me like Trumped up expectations actual sales remain depressed:

Any expected Trump bump in home sales didn’t materialize in contracts for homes signed in November.

Higher mortgage rates hit home sales, driving the National Association of Realtors Pending Home Sales Index down 2.5 percent in November from October, the NAR reported Wednesday. Analysts had forecast a 0.4 percent gain in the index, which is now 0.4 percent lower than a year ago and at its lowest level since January.

Stock buy backs are an alternative to paying dividends. On difference is that $ paid as dividends constitute income taxable at the going dividend tax rate, while the $ spent to buy back shares are only taxable to the sellers of the shares to the extent there are capital gains. So, just as an educated guess, with buy backs taxable income is reduced by perhaps 90%.

Also, repatriation may or may not happen, and it may or may not result in any change in investment, or even stock buy backs. All it does is reclassify income as domestic rather than foreign, which may or may not lead to further consequent actions by those corporations:

Surging Buybacks Say Stock Boom Isn’t Over

By Corrie Driebusch and Aaron Kuriloff

Dec 26 (WSJ) — Through Dec. 16, companies this month have stepped up their buybacks by nearly two-thirds over the same period last year, according to Goldman Sachs. Goldman forecast that S&P 500 companies will repatriate $200 billion of their $1 trillion in cash held overseas in 2017 and that $150 billion of those funds will be spent on share repurchases. From the start of 2009 to the end of September 2016, companies in the S&P 500 spent more than $3.24 trillion repurchasing shares, according to S&P Dow Jones Indices. In the first three quarters of the year, companies in the S&P 500 spent just over $400 billion on stock buybacks, down from the $426 billion in the same period last year, according to S&P Dow Jones Indices. For all of 2015, $572 billion went to buybacks.

Sales estimates have been revised a bit higher:

Last-minute spending surge lifts U.S. holiday shopping season

By Nandita Bose

Dec 28 (Reuters) — Brick-and-mortar sales in the week ending Dec. 24 rose 6.5 percent year-over-year after having fallen for the rest of the month, according to data from analytics firm RetailNext. Strong demand for furniture, home furnishings and men’s apparel from the start of November through Christmas Eve pushed U.S. retail sales up 4 percent, higher than the previously expected 3.8 percent, according to data from MasterCard’s holiday spending report. Craig Johnson, president of consultancy Customer Growth Partners, now estimates sales growth of 4.9 percent in November and December, up from his initial estimate of 4.1 percent.

The theory is something like “higher stock prices will help the economy”:

BOJ the top buyer of Japanese equities

Dec 25 (Nikkei) — According to data through Thursday, the value of the BOJ’s ETF purchases this year has topped 4.3 trillion yen, up 40% from 2015. Last year, the central bank bought more than 3 trillion yen worth of ETFs. While foreign investors sold more than a net 3.5 trillion yen worth of Japanese shares through Dec. 16, trust banks, including those commissioned by the Government Pension Investment Fund, bought a net 3.5 or so trillion yen worth of shares. This year, the BOJ increased its buying after doubling its annual ETF goal to purchase 3 trillion yen worth of the instruments. The value of the bank’s ETF holdings, based on purchase prices, is 11 trillion yen. Unrealized gains send the market value to 14 trillion yen.

Interesting but backwards, in my humble opinion. That is, if a foreign bank wants to give us $ we can’t pay back, and then the foreign bank fails, and we aren’t insuring their deposits, seems it’s their problem, not ours? In fact, it’s our gain?

Protectionist Walls Are Popping Up…Around Banks

By John Carey

Dec 26 (WSJ) — Financial regulators around the world have increasingly shied away from developing globe-spanning rules in favor of shoring up the financial system in their local purviews. Last month, the European Union proposed rules that would require big foreign banks to hold extra capital within EU borders, a step that echoes a recent U.S. rule for some large, non-U.S. banks. Rules with similar aims also have been rolled out in Switzerland and the U.K. The proliferation of the new rules demonstrate an increasing willingness of banking regulators to act independently of each other to protect the strength of their own financial systems.

Another view on the latest UN resolution the US didn’t veto:

The consequences of not vetoing the Israel resolution