As previously discussed, exports are falling and imports climbing, with lots more to go: Highlights Trade looks to be a major negative that will be holding down fourth-quarter GDP. The advance trade deficit in goods widened sharply for a second straight month in November, to .3 billion following a revised .9 billion deficit in October that was nearly billion higher than the last month of the third quarter, September. Exports have been very weak so far this fourth quarter, down 1.0 percent in November following October’s 2.5 percent shortfall. Food exports have been especially soft as have vehicle exports, and capital goods exports fell very sharply in the latest report. Widening the gap have been sharp increases in imports, up 1.2 percent on top of October’s upward revised 1.5 percent increase. Imports of industrial supplies posted a very sharp increase in November as did food imports. Most other readings on the import side are narrowly mixed. Slowing sales growth caused inventories to increase, which leads to production cuts, as per the cuts in automobile production previously discussed: Highlights Wholesale inventories jumped a preliminary 0.9 percent in November following an upward revised 0.1 percent decline in October. Retail inventories also jumped, up 1.0 percent in November following an unrevised 0.4 percent decline in October.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

As previously discussed, exports are falling and imports climbing, with lots more to go:

Highlights

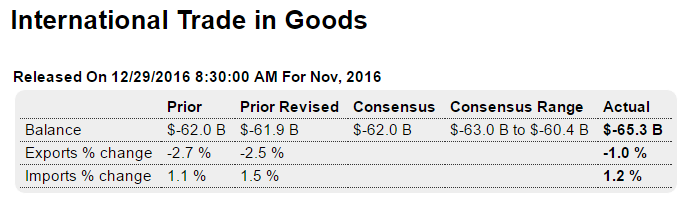

Trade looks to be a major negative that will be holding down fourth-quarter GDP. The advance trade deficit in goods widened sharply for a second straight month in November, to $65.3 billion following a revised $61.9 billion deficit in October that was nearly $5 billion higher than the last month of the third quarter, September.

Exports have been very weak so far this fourth quarter, down 1.0 percent in November following October’s 2.5 percent shortfall. Food exports have been especially soft as have vehicle exports, and capital goods exports fell very sharply in the latest report.

Widening the gap have been sharp increases in imports, up 1.2 percent on top of October’s upward revised 1.5 percent increase. Imports of industrial supplies posted a very sharp increase in November as did food imports. Most other readings on the import side are narrowly mixed.

Slowing sales growth caused inventories to increase, which leads to production cuts, as per the cuts in automobile production previously discussed:

Highlights

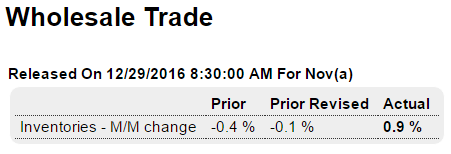

Wholesale inventories jumped a preliminary 0.9 percent in November following an upward revised 0.1 percent decline in October. Retail inventories also jumped, up 1.0 percent in November following an unrevised 0.4 percent decline in October. The build in wholesale inventories is split evenly between durable and nondurable goods with the build on the retail side concentrated in vehicles. The increases in this report are a surprise and, though a positive for the fourth-quarter GDP calculation and an offset to this morning’s widening in the goods trade gap, will revive talk of unwanted inventories.

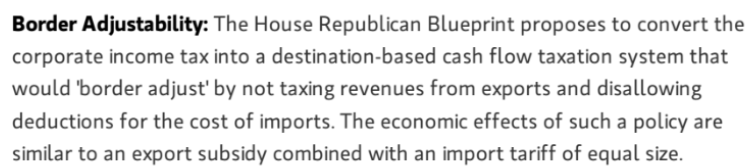

All of this ties into proposed trade policies designed to reduce imports and increase exports, for the further purpose of increasing domestic output and employment:

The questions begin with what this would do to the value of the $US. Mainstream theory concludes that, all else equal, the $ would appreciate to offset the price effects of the ‘border adjustments’. While I agree $ appreciation would offset the price effects, given the forces currently at work I don’t see them pushing things in that direction.

First, mainstream theory would say the current trade balances should ‘fundamentally’ be driving the dollar lower. The US has a large and growing trade deficit, while the euro zone has a large and growing trade surplus, with China also in surplus and Japan working its way back to surplus, etc.

However, while trade has been ‘fundamentally’ working against the $, portfolio shifting, a ‘technical’ force, has been going the other way. (Personally I often use the term ‘savings desires’ to indicate the various desires to hold financial assets of a particular currency.) As previously discussed, for example, the euro area had ‘capital outflows’ of over 500 billion euro over the last year or so, which means portfolio managers of all types with euro financial assets sold them and switched to financial assets denominated in other currencies, such as $US, yen, and Swiss francs (with the Swiss National Bank then selling maybe half of the euros they bought and buying $US). This would be analogous to a crop failure such as the corn crop being reduced by drought, for example. The drop in supply would be a force that would put upward pressure on the price of corn. However, is a company with a very large warehouse full of corn decided to sell it, that selling could dominate and drive the price lower, until the warehouse was empty. Only at that point would the effects of the crop failure dominate, and then drive the price higher.

So technicals (portfolio shifting) can overwhelm fundamentals (trade balances) for long periods of time until the technical force has run its course, and the warehouse is either empty or as low as the portfolio manager wants it to be. In fact, this time around, while the trade flows were presumed to reduce the US trade deficit via lower prices for imported oil, and therefore be supportive of the $, it didn’t work out that way, however, as lower oil prices were partially ‘offset’ by reductions of global income from the lower oil prices, which reduced US exports, and increasing US consumer related imports.

Second, I’m not comfortable with the idea that US export prices will go down if the revenues are no longer taxed. Prices in this case are ‘world prices’ and to the extent the US exporters are ‘price takers’ I don’t see how a lower cost of goods will necessarily result in a drop in global prices any more than, for example, reducing income taxes on oil would cause the price of oil to fall. Yes, longer term, lower costs might bring out more supply, but that’s a different and much longer term story.

Nor do I see the quantities of US exports going up even if the proposed border tax policy results in a reduction in the price of US exports, given the general weakness of global demand. And more specifically, who would buy more US exports if prices were maybe 15% lower, for example? China? Japan? India? I don’t see it.

Third, I do see US imports softening with the proposed import tax, which means an equal reduction of $ revenues to the rest of the world, which means they are likely to buy fewer US exports. This is similar to what happened when the price of oil fell, and the US spent less buying oil from the rest of the world, and that reduction of $ income reduced the demand for US exports.

This is also a strong channel for a general reduction in global aggregate demand.

Now back to the value of the $. Yes, the border tax policy could over time reduce the US trade deficit and thereby be a fundamental force that works towards $ appreciation. However, current fundamentals- the growing US trade deficits- have been and are currently working in the other direction. So what I happening would be a moderation of the fundamental trade flows that have been and are currently working to weaken the $, even as the portfolio managers- the technical forces- continue to deplete their non $ currencies and buy $. And when those currency warehouses are depleted, current trade flows will take over and drive the $ down until they reverse, with the proposed border tax policy perhaps slowing the $’s fall.

To sum up, the way I see it is the current fundamentals overwhelmingly negative for the $, with the proposed border adjustment tax policy at best a much smaller force in the other direction.

Not to mention I’m categorically against it all for more macro reasons. Imports are real benefits and exports real costs, the difference being real terms of trade, which are optimized by running as large a trade deficit as possible. And any lack of aggregate demand for domestic goods and services that results in undesired unemployment if instead best addressed by a fiscal adjustment- lower taxes or more public spending. But in a world where that understanding doesn’t exist, we get these types of highly counterproductive proposals that ultimately and necessarily make things worse.

Post script:

Seems to me it’s just a matter of time before Trump proposes the US start buying and building foreign exchange reserves to counter the strong $, which he has said many time is about ‘currency manipulation’. With the general notion that his other proposals, such as repatriation, will also have strong $ biases, seems to me it’s just a matter of time until we see fx purchases proposed?